Nokia Holds Strong In Market Weakness: What's Next?

Nokia Oyj (NYSE: NOK) announced on Thursday that Kuka, a Germany-based industrial robots and automation solutions manufacturer, will deploy Nokia's 5G SA technology to support its product development.

The news is the latest of a slew of Nokia press releases centered around various countries and organizations integrating Nokia’s software, broadband, and communication solutions technology. Although the numerous releases seem to hold Nokia’s stock above the $5 level, it hasn’t made a big move north since April 29 when the company printed its first-quarter earnings.

Nokia is also a Reddit favorite and was targeted on Jan. 27 along with GameStop Corporation (NYSE: GME) and AMC Entertainment Holdings Inc (NYSE: AMC) in an epic short squeeze that saw Nokia’s shares rise 107% to $9.79 before crashing.

Nokia doesn’t have the typical underlying statistics of a Reddit darling because of its massive 5.63 billion share float. The company also has a very low percentage of its shares held short, although the number has increased from 33.28 million in May to 37.91 million in June.

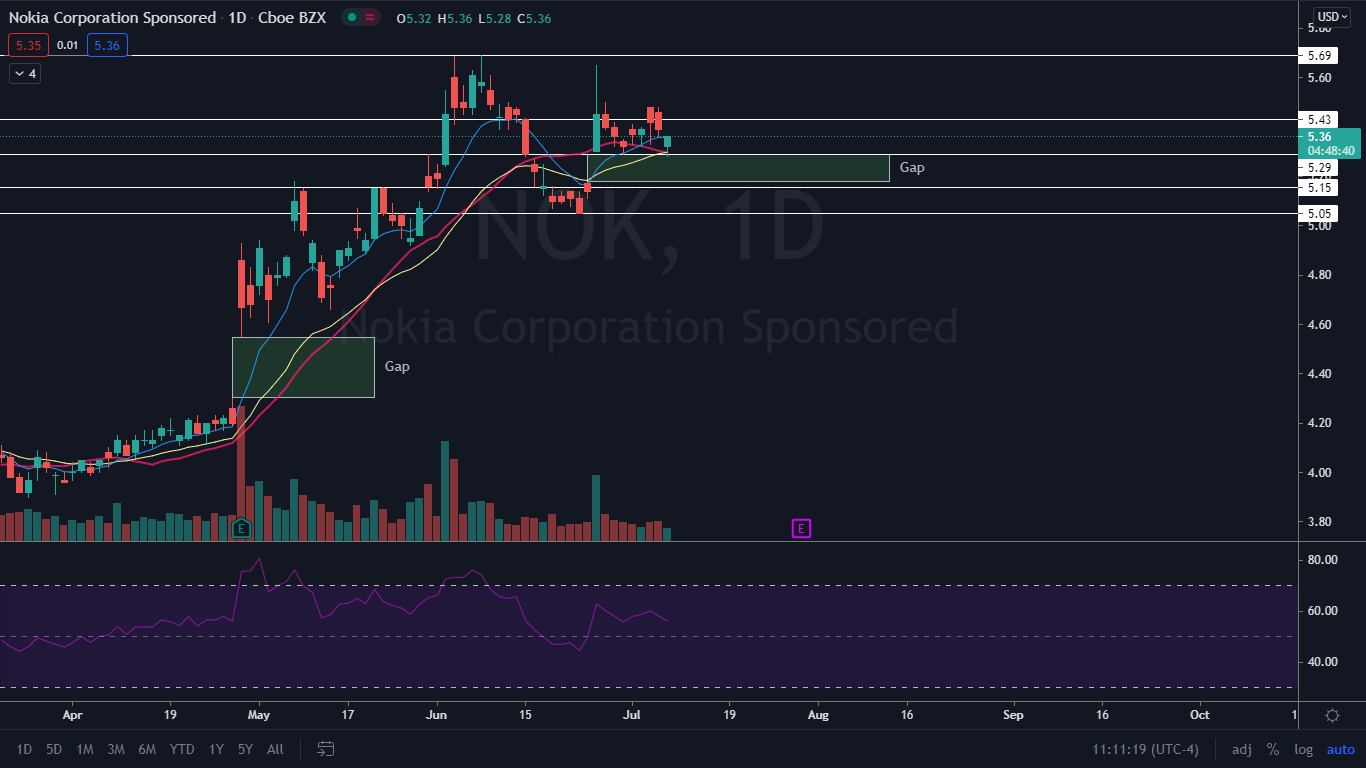

Downward pressure came into the general markets on Thursday, Nokia’s stock held strong above resistance. Although it gapped down when the market opened bulls bought the dip and by mid-day, Nokia was printing a bullish candlestick.

The Nokia Chart: Nokia gapped down 1.3% Thursday but held above a support level at $5.29. Just below the level is a gap although Nokia briefly dipped into it the gap didn’t fill. Gaps fill 90% of the time and bulls could feel more confident in a further move north if Nokia did fill the gap soon.

Nokia is trading above the 21-day exponential moving average (EMA) but is pinned just below the 21-day EMA, which indicates indecision in the short term. Nokia was able to regain support of the 200-day simple moving average on Thursday, which indicates overall sentiment in the stock is bullish.

Nokia was in the process of printing a bullish hammer candlestick on Thursday, which indicates higher prices may come over the next few days. Bulls would like to see the top of the candlestick close the day above the eight-day EMA for confidence.

(Click on image to enlarge)

Bulls would also like to see continued momentum push Nokia back up above a resistance level at $5.43. If it could regain the level as support, it could make a move back up toward $5.69.

Bears want to see Nokia drop down to fill the gap and for sellers to push it down toward the $5.15 level. If Nokia were to lose the level as support it could fall further to the $5.05 mark.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Guys #Nokia will be 5 something for life. $NOK