"No Rate Cut" Bear Scares S&P 500 Into Retreat

The S&P 500 (SPX) fell again durin ghte third week of April 2024. The index closed out the week at 4,967.23, a little over three percent below the level it closed the second week. The index has dropped 5.5% below its record peak closing value from 28 March 2024.

The main driving force behind the falling level of stock prices are slipping expectations for when and by how much the Federal Reserve will cut interest rates during 2024. The CME Group's FedWatch Tool anticipates the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) when a quarter point reduction is expected, some twelve weeks longer than expected just a week earlier. The tool also projects only one rate cut in 2024, the timing of which is looking uncertain.

As we illustrated in a separate analysis, that slipping timing is reducing the expected level of dividends in future quarters. Right now, we think investors have been scared by the "no rate cut" bear into shifting their forward-looking focus to either 2024-Q3 or 2024-Q4, with their investment time horizon being affected by the sliding expectations for when the Fed might alter the level of short term interest rates in the U.S.

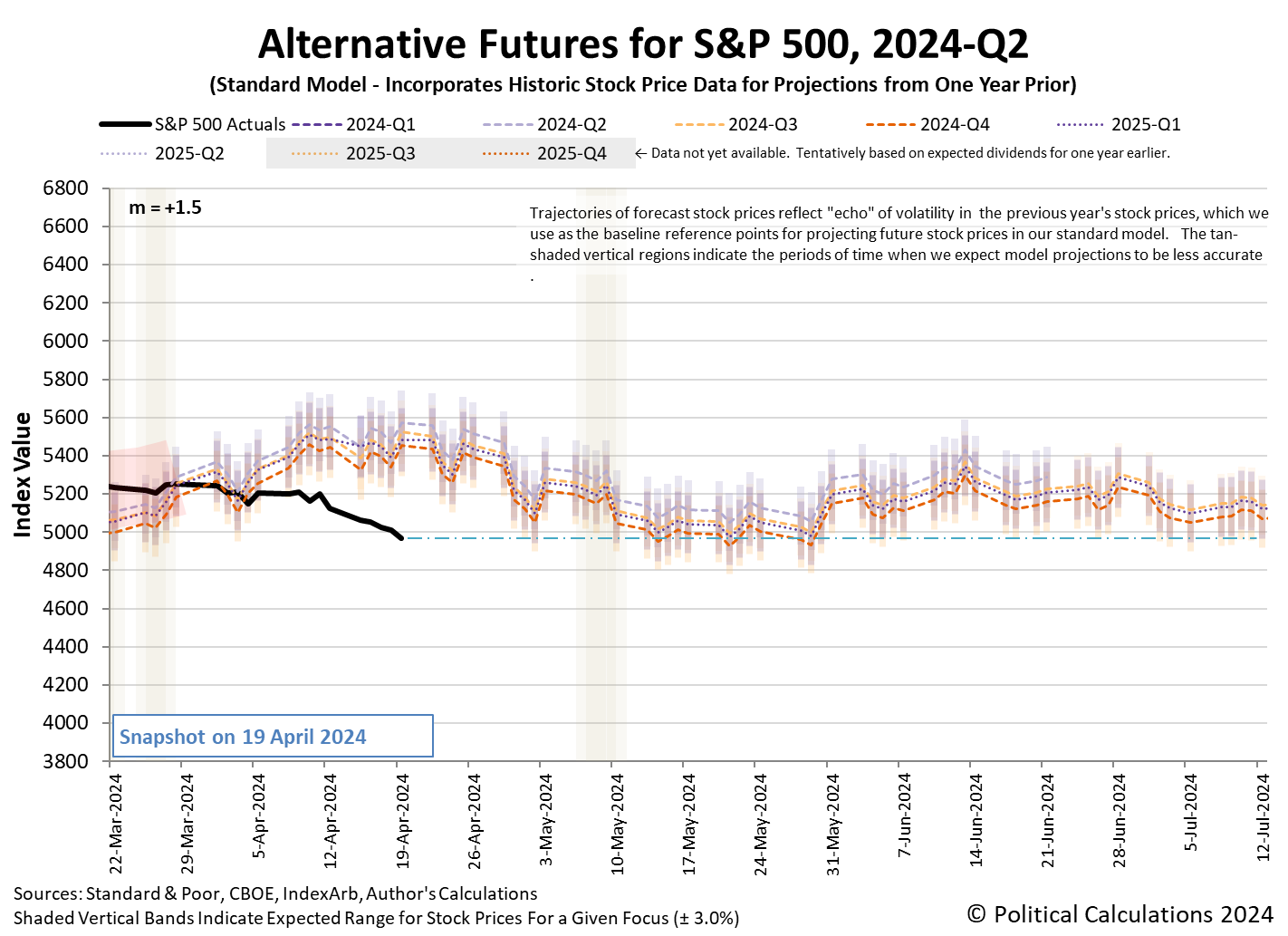

We're basing that hypothesis on the level the dividend futures-based model is projecting the potential level of the S&P 500 will be a month from now as we're within the month-long window in which its projections have "locked in". The latest update for the alternative futures chart shows the current level of the index is consistent with the model's still-dynamic projections outside of the locked-in period:

(Click on image to enlarge)

An alternate explanation is the stock market is experiencing a regime change, in which the dividend futures-based model's basic multiplier has changed, but we would need several more weeks of data to confirm if that is the case. We're weighing these scenarios behind the scenes, where we haven't yet seen sufficient data to determine the established value of the multiplier has definitively broken from the level it has held since 9 March 2023.

In the meantime, the context provided by the market-moving headlines of the week points to that market regime still holding. The week's headlines point to the rapidly slipping expected timing of rate cuts in 2024, which continued in the past week, as the continuing culprit in the decline of stock prices during the last several weeks.

Monday, 15 April 2024

- Signs and portents for the U.S. economy:

- Fed minions say they won't rush to cut rates until they need to see data pointing to wage inflation:

- Bigger trouble, stimulus developing in China:

- Economic growth signs in Japan:

- Nasdaq, S&P, and Dow ended notably lower while yields rallied once again

Tuesday, 16 April 2024

- Signs and portents for the U.S. economy:

- In reversal, Fed minions claim they need more time to combat inflation before they can cut rates:

- Bigger trouble, stimulus developing in China as Q1 growth better than expected:

- Nasdaq, S&P, Dow end mixed after hawkish Powell further clouds rate cut expectations

Wednesday, 17 April 2024

- Signs and portents for the U.S. economy:

- Fed minions say they're in "no hurry" to cut interest rates:

- Bigger trouble, stimulus developing in China:

- ECB minions looking forward to cutting Eurozone interest rates, don't want to review their inflation target anytime soon:

- Nasdaq sheds more than 1%, S&P posts four-day losing streak, Dow slips slightly

Thursday, 18 April 2024

- Signs and portents for the U.S. economy:

- Fed minions now saying they're in no "mad dash hurry" to cut interest rates:

- BOJ minions promise future rate hikes will be slow:

- ECB minions say they're "crystal clear" on cutting Eurozone interest rates in June:

- S&P posts five-day loss for first time since Oct, Nasdaq & Dow end mixed; eyes on Netflix

Friday, 19 April 2024

- Signs and portents for the U.S. economy:

- IMF minions getting mad at Fed minions; Fed minions say they're doing nothing because Bidenflation not going away:

- Bigger trouble, stimulus developing in China:

- BOJ minions say rate hikes are coming:

- ECB minions say inflation could go either way:

- Wall Street's April pullback intensifies as S&P 500 notches worst week in over a year

More By This Author:

Turbulence Signaled By S&P 500 Dividend Futures ArrivesTeen Employment Numbers Improve in March 2024

Campbell's Tomato Soup Price Resumes Inflationary Rise

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more