NJR: A Higher-Yielding Nat Gas Utility

Photo by Timothy Newman on Unsplash

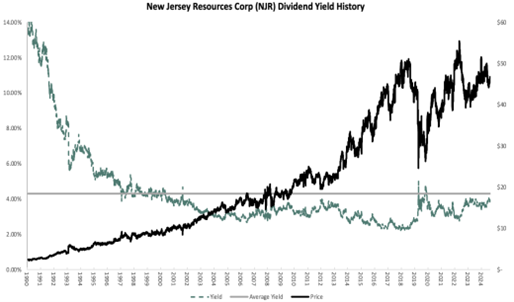

New Jersey Resources Corp. (NJR) provides natural gas and clean energy services, transportation, distribution, asset management, and home services through its five main subsidiaries. The stock trades at 14.1x our EPS estimate, below our fair value P/E of 17.5.

The company owns both regulated and nonregulated operations. Its principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates natural gas transportation and distribution infrastructure serving over half a million customers. NJR Clean Energy Ventures (NJRCEV) invests in and operates solar projects to provide customers with low-carbon solutions.

The company has raised its annual dividend for 28 consecutive years and has a market capitalization of $4.6 billion. On May 5, it said fiscal Q2 earnings per share grew 26% over the prior year’s quarter, from $1.41 to $1.78, topping analyst estimates by $0.16.

The strong performance resulted primarily from volatile prices for natural gas, which benefited the Energy Services business. As results exceeded management’s expectations, they raised EPS guidance for the full year from $3.05-$3.20 to $3.15-$3.30.

New Jersey Resources has exhibited a more volatile performance record than a typical utility due to the volatility of its natural gas business. Nevertheless, it has grown its EPS in seven of the last nine years, at a 5.8% average annual rate. Management has provided guidance for 7%-9% annual growth of EPS over the long run. We assume 6% growth to be on the safe side.

If the stock converges to its fair valuation over the next five years, it will enjoy a 4.6% annualized valuation tailwind. Also, given 6% expected EPS growth and a 4% dividend, total return during this period could reach 13.8% annually.

Recommended Action: Buy NJR.

More By This Author:

MGK And IGM: Two QQQ Alternatives For Tech Investors To ConsiderL3Harris Technologies: A "Triple Beat" Earnings Play In The Defense Sector

AES: A Global Utility Worth Targeting Despite Tougher Market Conditions

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more