Nine Energy Service Could Fall When Lockup Expires

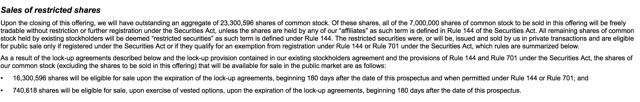

The 180-day lockup period for Nine Energy Service Inc. (NINE) ends on July 18, 2018. When this six-month period ends, the company's pre-IPO shareholders and insiders will have the opportunity to sell more than 17 million currently-restricted shares. The potential for a sudden increase in the volume of shares traded on the secondary market is significant - just 7 million shares of NINE are trading pursuant to the IPO - and could negatively impact the stock price of NINE in the short-term.

(Source: S-1/A)

Currently, NINE trades in the $31 to $32. NINE has a return from IPO of 35.3%. Shares of Nine Energy Service had a first day return of 13.5%.

Business Overview: Operator of Completion and Production Services in Oil and Gas Development

Nine Energy Service is an onshore completion and production service provider in North America. The company focuses on unconventional oil and gas development, and it operates in two primary segments: production solutions and completion solutions.

The production solution segment offers well workover and production enhancement through well servicing equipment and other equipment. The company maintains a fleet of close to 100 rigs. The completion solution segment provides coiled tubing services, wireline services, completion technologies, open-hole float and centralizer equipment, dissolvable and fully-composite frac plugs, stage-one prep tools, frac sleeves, fracture isolation packers, and other cementing services.

Nine Energy Service offers its portfolio to clients in all major onshore basins in the United States and Canada.

The company was originally called NSC-Tripoint and became Nine Energy Service Inc. in 2011. The company maintains headquarters in Houston, Texas and has approximately 1,800 employees.

Company information was sourced from the firm's S-1/A.

Financial Highlights

Nine Energy Service reported the following financial highlights for the first quarter of 2018:

- Revenue totaled $173.8 million.

- Net income totaled $1.7 million with an adjusted EBITDA of $24.1 million.

- Revenue increased approximately 13% as compared to the same quarter in 2017.

- Nine Energy Service reported net income of $1.7 million resulting in $0.08 per diluted share. This is in contrast to a net loss of $(29.8) million resulting in a $(1.89) per diluted share for the same quarter of 2017.

- The Company reported an adjusted EBITDA of $24.1 million, an improvement of approximately 29% in contrast to the same quarter 2017 and an adjusted EBITDA of $18.7 million. This was the fifth sequential quarterly increase.

- For the first quarter of 2018, Nine Energy Service generated a ROIC of 3%.

Financial highlights were sourced from the company's website.

Management Team

President and CEO Ann Fox has served the company in her current position since July 2015. She joined the company in 2013. Her previous experience comes from positions at SCF Partners, Prudential Securities, and Warburg Dillon Read. She served in the United States Marine Corps and served in active duty in Iraq. Ms. Fox earned an MBA from Harvard Business School and graduated from Georgetown University's Walsh School of Foreign Service with a BS in Diplomacy and Security in World Affairs.

EVP David Crombie has served the company since 2015. His previous experience includes positions at Crest Pumping Technologies, and Halliburton Energy Services. He has extensive experience in domestic and international cementing and stimulation operations in Saudi Arabia, the Gulf of Mexico, Oklahoma, the Fort Worth Basin, and the Permian Basin.

Management bios were sourced from the company's website.

Competition: Schlumberger, Weatherford International and Others

Nine Energy Service faces competition from a variety of service providers in the E&P industry, including Superior Energy Services (SPN), Basic Energy Services (BAS), Key Energy Services (KEG), Pioneer Energy Services (PES), C&J Energy Services (CJ), Weatherford International (WFT), Baker Hughes (BHGE), and Schlumberger (SLB).

Early Market Performance

The underwriters for Nine Energy Service priced its IPO at $23 per share, at the high end of its expected price range of $20 to $23. Its six-month performance on the NYSE has been a steady climb. The stock closed on its first day of trading at $23 and then rose to a high of $38.36 on May 17.

Conclusion

When the 180-day IPO lockup period for NINE expires on July 18, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted stock for the first time. We believe that they will be motivated to do so - NINE has a return from IPO of more than 35%. Significant sales of stock could flood the secondary market for NINE and cause a sharp, short-term drop in share price.

Aggressive, risk-tolerant investors should consider shorting shares of NINE ahead of the July 18 IPO lockup expiration. Interested investors should cover these short positions during the July 19 trading session.

Disclosure: I am/we are short NINE.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more