Nike Reacting Perfectly From Elliott Wave Hedging Area

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of Nike ticker symbol: $NKE. We presented to members at the elliottwave-forecast. In which, the decline from 01 October 2024 unfolded as an impulse structure. And showed a lower low favored more downside extension to take place. Therefore, we advised members not to buy the stock & sell the bounce in 3, 7, or 11 swings. Based on Elliott wave hedging area looking to get 3 wave reaction lower at least. We will explain the structure & forecast below:

Nike 4-Hour Elliott Wave Chart From 12.19.2024

(Click on image to enlarge)

Here’s the 4-hour Elliott wave chart from the 12.19.2024 update. In which, the cycle from the 01 October ended in wave (1) as an impulse structure at $72.70 low. Up from there, the stock made a bounce higher in wave (2) to correct that cycle. The internals of that pullback unfolded as Elliott wave zigzag structure where wave A ended at $81.18 high. Wave B pullback ended at $76.31 and wave C managed to reach the elliott wave hedging area at $84.50- $89.75 area. From there, market makers agrees for the minimum reaction lower to take place.

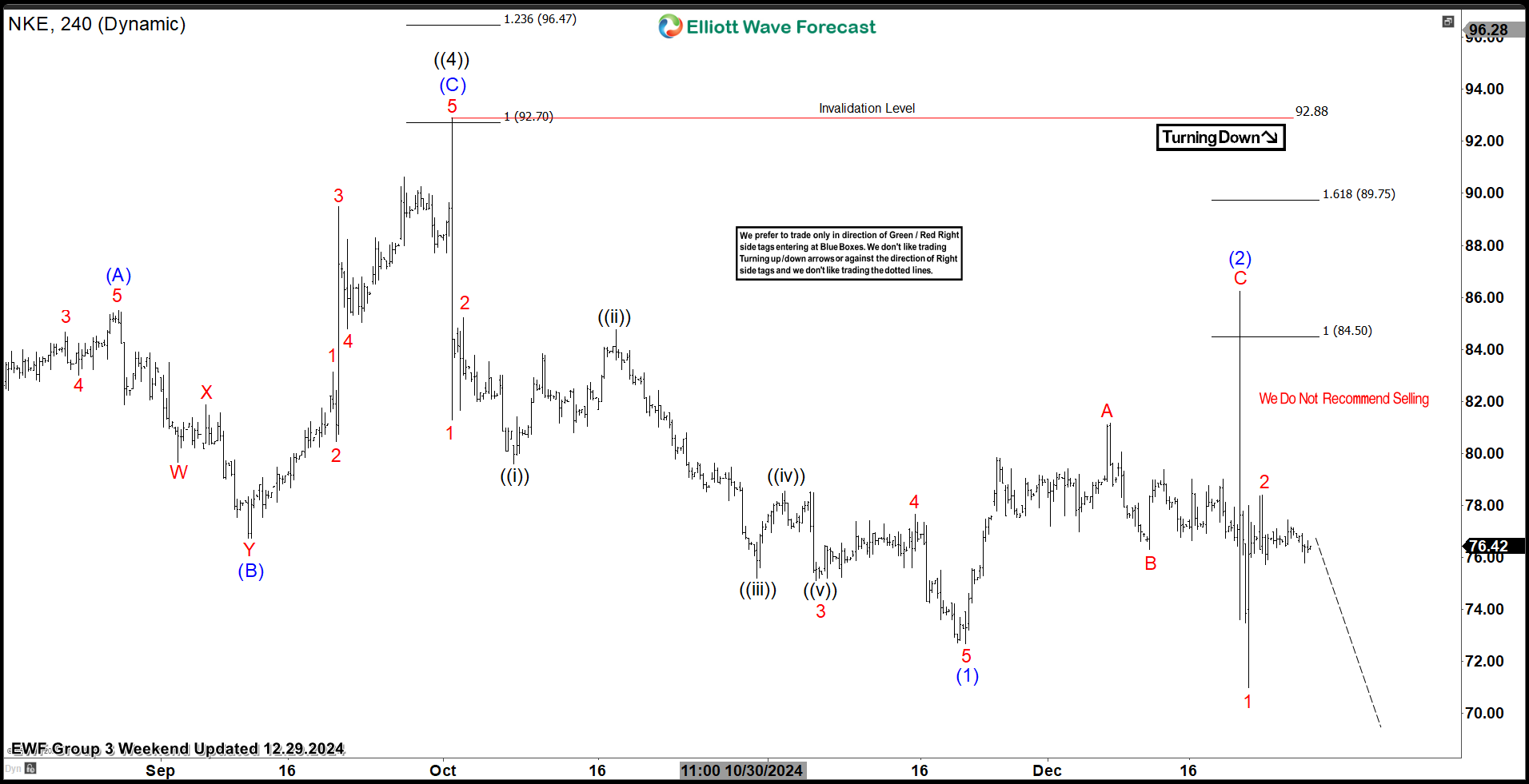

Nike Latest 4-Hour Elliott Wave Chart From 12.29.2024

(Click on image to enlarge)

This is the latest 4-hour Elliott wave Chart update. In which the Nike is showing a strong reaction lower taking place, right after ending the zigzag correction within the equal legs area. Allowed members to create a risk-free position shortly after taking the long position. Since then, the stock has made a new low below $72.70 low confirming the next extension lower towards $66.05- $61.29 area lower before next bounce takes place.

More By This Author:

ETHUSD Buying The Dips After Elliott Wave Double ThreeNetflix Buying The Dips At The Blue Box Area

Netflix Is In Process Of Doing Five Waves Advance

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more