Next Comes The Dead Cat Bounce … Then We Revisit The December Lows

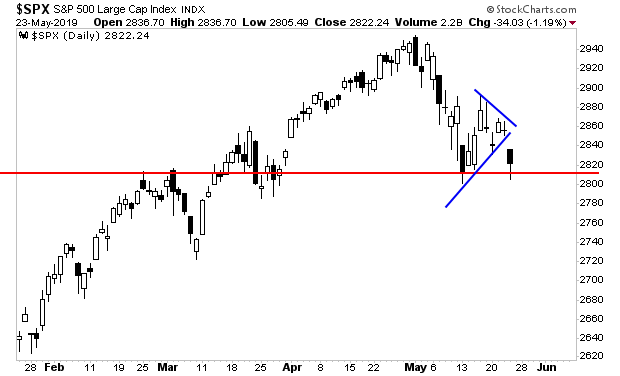

Stocks dropped hard out of their triangle formation (blue lines) yesterday, but the bears couldn’t finish the job… and the S&P 500 held support (red line).

This opens the door to a bounce into early next week… but I wouldn’t count on much other than a dead cat bounce to the 2,880s or so.

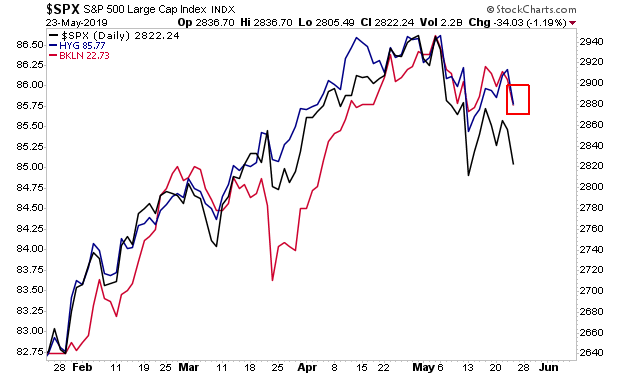

This is where Junk Bonds and Leveraged Loans (two other risk measures that usually lead stocks) are hanging out (red box in chart below).

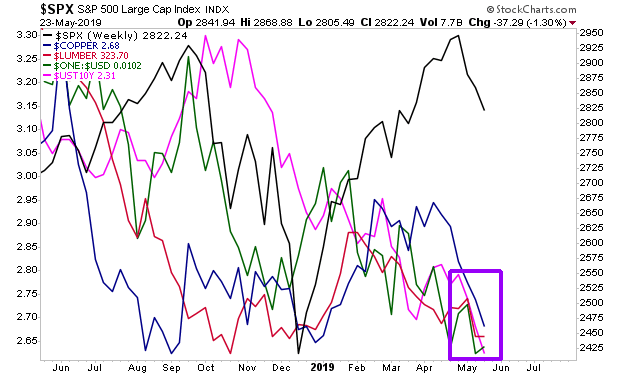

Indeed, Copper, Lumber, the $USD (inverted) and the yield on the 10-Year Treasury, ALL suggest fair value for the S&P 500 is down around the 2,400s.

I’m not saying we’ll get there next week… but that is coming sometime in June.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.