New Report: Oshkosh Corporation

Oshkosh Corp (OSK) operates in the industrials business sector in Wisconsin. The company manufactures some of the industry's toughest specialty trucks and access equipment. This is my first report on Oshkosh Corp for this Viital portfolio or any of my previous six dog of the week portfolios.

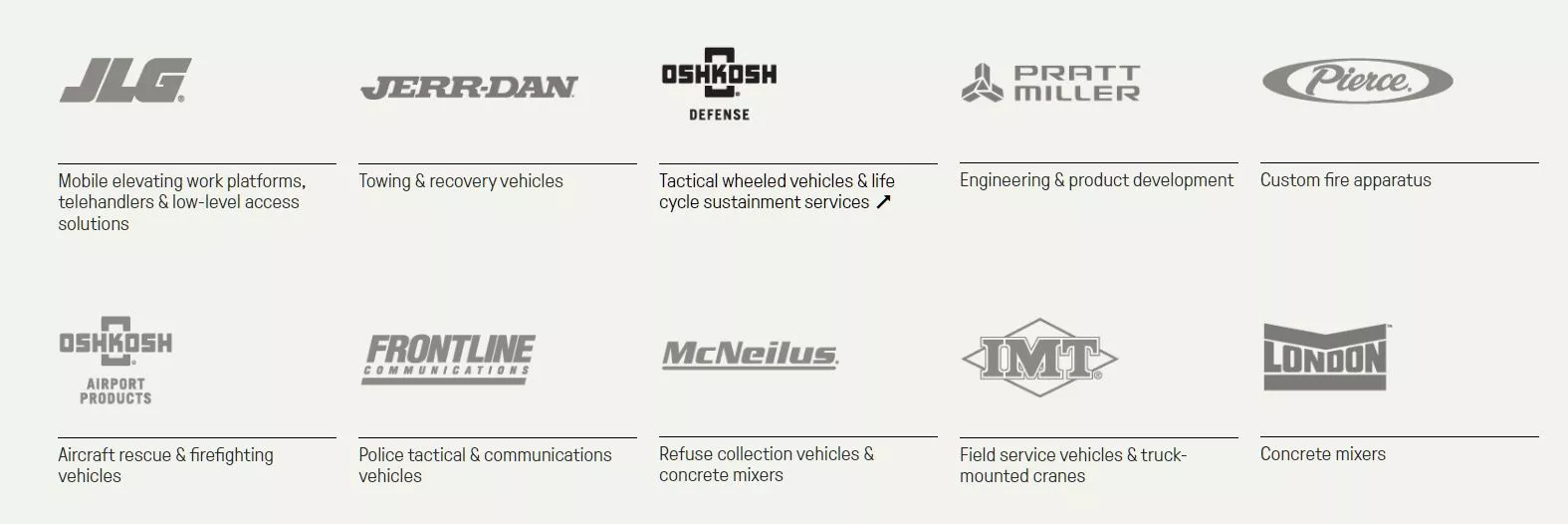

Oshkosh is the top producer of access equipment, specialty vehicles, and military trucks.

It serves diverse end markets, where it is typically the market share leader in North America, or, in the case of JLG aerial work platforms, a global leader.

After winning the contract in 2015 to make the Humvee replacement, the JLTV, Oshkosh became the largest supplier of light defense trucks to the U.S. military.

The company reports four segments—access equipment (42% of revenue), defense (32%), fire and emergency (15%), commercial (12%)—and it generated $7.9 billion in revenue in 2021. Hence, OSK is a mid-cap stock.

Images: Oshkosh Corp.

Oshkosh Corporation provides its products through direct sales representatives, dealers, and distributors.

The company was formerly known as Oshkosh Truck Corporation and changed its name to Oshkosh Corporation in February 2008.

Oshkosh Corporation was founded in 1917 and is headquartered in Oshkosh, Wisconsin.

Three key data points gauge any dividend equity or fund such as Oshkosh Corp:

|

OSK Returns

Adding the $1.48 OSK annual dividend to the estimated one-year price upside of $17.56 shows a $19.04 potential gross gain, per share, to be reduced by any costs to trade OSK shares.

At Friday's $92.44 closing price per share, a little over $1000 would buy 11 shares.

A $10 broker fee (if charged) would be paid half at purchase and half at sale and might cost us about $0.91 per share.

Subtract that maybe $0.91 brokerage cost from my estimated $19.04 gross gain estimate per share results in a net gain of $18.12 X 11 shares = $199.43 for a 19.9% net gain on a $1,016.84 investment.

So it is that Oshkosh Corp shows a possible 19.9% net gain including a 1.6% forward looking dividend yield.

Over the next year at this time our $1000 investment in OSK shares could generate $16.00 in cash dividends alone. Note that a single share of UMPQ stock bought at yesterday's $92.44 price is over 17 times greater than the anticipated dividend income from our $1000.00 invested. So, by my dogcatcher ideal, this is no time to buy OSK shares based on their declared dividend for the year 2022. The forthcoming annual dividend from $1K invested is currently 17.3 times less than yesterday's single share price. Consider yourself alerted. It's a sign. Do not buy OSK stock for dividend until the price drops to $30.67 or its Q dividend is increased to $2.13 per share.

All of the estimates above are speculation based on the past history of Oshkosh Corporation. Only time and money invested in this stock will determine its market value.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a ...

more