New Highs In Nasdaq And S&P Don't Help Russell 2000

The indices which have done most of the leg work through 2021 were again grabbing the headlines on Friday, but the Russell 2000 was not an index joining in the fun. Both the Nasdaq and S&P managed new closing highs, both of these indices having successfully defended breakout support in addition to Fiboacci retracements, but really - it's the Russell 2000 we need to see strength from.

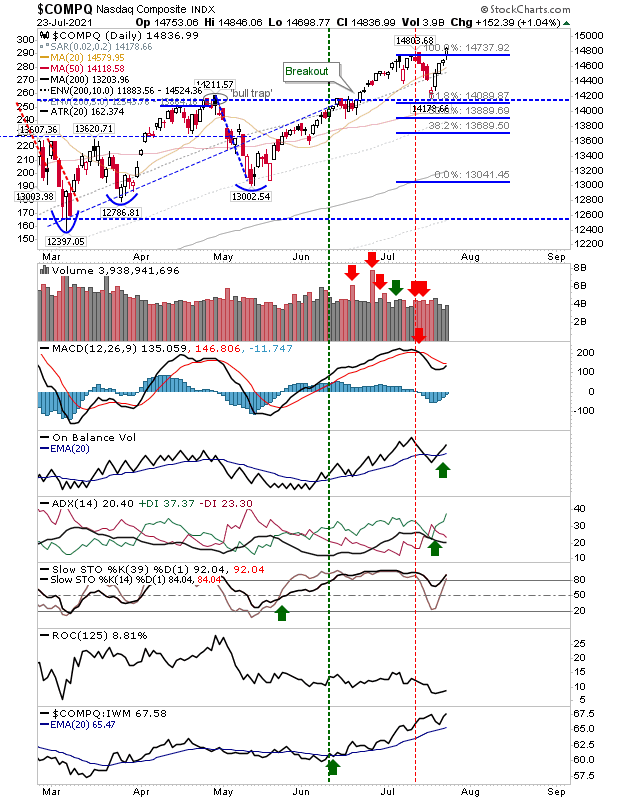

The Nasdaq managed a solid test of breakout support despite the MACD trigger 'sell', although On-Balance-Volume, ADX and Stochastics are bullish, the latter indicator has been firmly on the bull's side.

The S&P also logged a new closing high with bullish technicals for On-Balance-Volume, ADX, and Stochastics. The MACD remains on a MACD trigger 'sell' but there is little of immediate concern for the index.

The Russell 2000 finished with a small doji on light volume. It didn't help the technical picture with all lead indicators in the red, including relative performance against the S&P and Nasdaq where further ground was lost. This trading range is keeping the index limbo, which puts a question mark over strength in the Nasdaq and S&P.

For the coming week, we will want to see the Russell 2000 continue its push towards range resistance. Trading volume has been light, but this is likely to continue through the traditional vacation period of August. We will see what the market brings this week.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more