New Buyback Tax May Impact Stock Returns

In August of last year Congress passed the so-called Inflation Reduction Act and included within the Act is a 1% excise tax on the fair market value of stock repurchased by companies effective 1/1/2023. On December 27 the IRS released initial guidance on the tax in Notice 2023-2. The excise tax does not apply to repurchases under $1 million, so many companies that repurchase stock will be impacted by this tax. Further detail can be found in a Grant Thorton summary at this link. At issue for investors, in addition to the impact on individual companies, is some investment strategies are constructed around a buyback variable. More specifically, Invesco has constructed an index known as the BuyBack Achievers ETF (PKW.) According to the Invesco site,

"The Invesco BuyBack Achievers™ ETF (Fund) is based on the Nasdaq US BuyBack Achievers™ Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index is designed to track the performance of companies that meet the requirements to be classified as BuyBack Achievers™. The Nasdaq US BuyBack Achievers Index is comprised of US securities issued by corporations that have effected a net reduction in shares outstanding of 5% or more in the trailing 12 month."

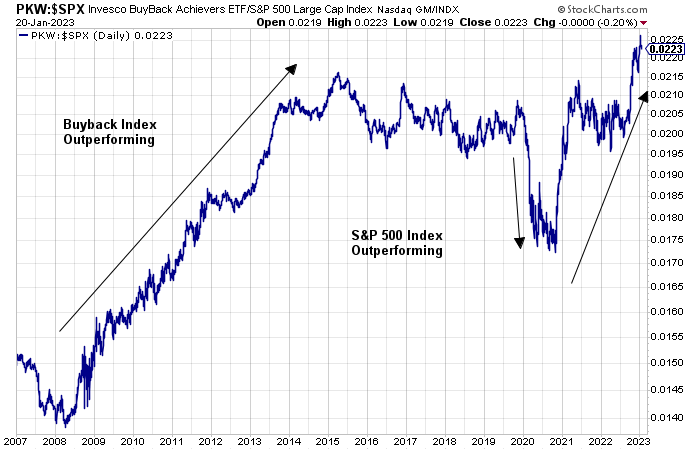

Over the long run, the Invesco BuyBack Index has outperformed the S&P 500 Index as seen in the below chart.

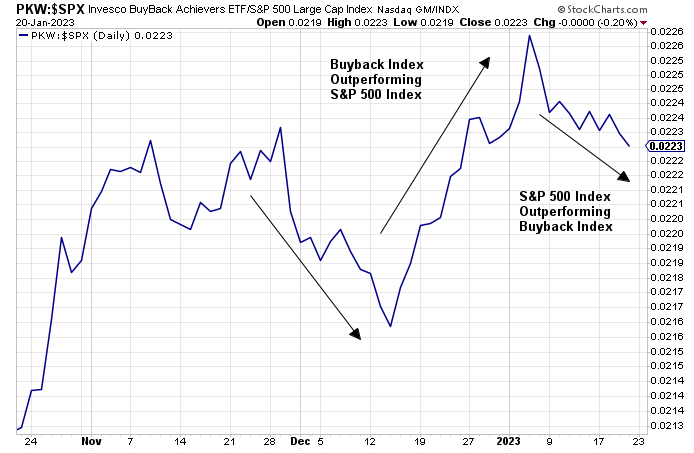

More recently though the BuyBack Index seems to be underperforming, especially since the beginning of 2023.

The short-term underperformance is just that, short-term, and does not necessarily indicate a longer stretch of weakness. However, given the additional tax that will impact companies, the issue is worth incorporating into one's analysis.

More By This Author:

The Stock Market Is Triggering Bullish Technical SignalsThe Dow Stock Dogs Performed In 2022

Equity Put/Call Ratio Above 2.0!

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more