New Age Beverages Is About To Take A Spill After Parabolic Rise With Many Upcoming Negative Catalysts

Summary

- NBEV is a $500M market cap struggling US beverage roll-up attempting to reinvent itself by marketing CBD-infused drinks

- The Company’s recent ‘key’ licensing deal to sell Marley branded CBD drinks comes with unfavorable economics as NBEV will pay a high 50% of gross margin for the license.

- Insiders lock-up agreement expires on 2/6/19, which will allow over 6 million shares to be sold.

- NBEV has run up 100% since its November financing at $3.50 per share without significant fundamental news in our view.

- NBEV has burned through most of its recent cash raise from a non-core acquisition, we expect more near-term equity financings.

Situation Overview

New Age Beverages (NBEV) is a Colorado-based beverage company that has accumulated a portfolio of C-tier beverage brands primarily by acquiring other struggling beverage companies. The company has generated annual losses since inception, but the share price is up >300% since September 2018 when the company announced its foray into the CBD (Cannabidiol) beverage space. Its market cap has increased from $75 million to $500 million during that period largely driven by intense speculation. We don’t believe the company has accomplished anything significant in the past five months to merit this parabolic rally.

Looking beyond the hype, we believe NBEV is in actuality a highly promotional company that has never been profitable in the highly competitive beverage space. The unfavorable economics of its key CBD deal with Marley underscore how mediocre its business model really is. This report highlights the business challenges facing NBEV, its regulatory hurdles, and the unfavorable stock dynamics. We see ~50% near-term downside in the share price back to its November offering price of $3.50 per share as the stock’s parabolic rally fades.

We Believe New Age Beverage Will Have A Hard Time Making A Profit On Its Marley Brand With Its Bad Licensing Deal

In April 2017, NBEV acquired the license rights for the Marley brand for ready-to-drink non-alcoholic beverages. In order to brand their new CBD-infused drinks with the Marley logo, NBEV needed to license the rights from private equity-owned company Docklight, which owns the Marley brand for cannabis-related products.

In their January 16th press release, NBEV conveniently decided to omit any economic details about the licensing deal with Docklight. In the conference call that morning, Brent Willis provided a bit more detail, but in a statement that didn't tell the whole story. He said:

“Financially, after covering the costs for producing and commercializing the brand, ingredients, et cetera, we are sharing in the profits 50/50”

At first glance, one might think this statement implies a 50/50 split of net profits, which in itself is an aggressive split for a mere branding agreement.

However, in an 8-K released after market close that day, we see that the terms are even worse than Willis seems to imply. It states:

“As consideration for the license, the Company agreed to pay Licensor a fee equal to fifty percent of the gross margin, as defined in the Agreement…

That’s not sharing the net profits 50/50, but the gross profits. We also find it suspicious that the terms of the "Agreement" weren't filed with the SEC.

The 50% licensing fee is certainly not typical. This report by KPMG from 2012 says that a 25% royalty rate of the product's profits is standard across industries. This article from upcounsel.com also confirms the 25% standard licensing fee. It states:

Generally, the income approach uses the 25 percent rule, which specifies that the inventor is eligible for 25 percent of the licensee's long-term pre-tax operating profit made from the sale of the licensed product.

The above statement suggests 25% of net profits is a normal licensing fee.

Insider Lock-Up Agreement Ends On February 6, 2019

What could cause a strong sell-off in the stock, is insiders signed a lock-up agreement in conjunction with their November financing which expires on Feb 6, 2019. If management was willing to dilute shareholders at $3.50/sh, we think it is highly probable they look to dump their own stakes at the current nosebleed prices of around $7 per share.

As stated in the prospectus supplement for the offering:

“Lock-Up Agreements. Our directors and executive officers have entered into lock-up agreements with the underwriters. Under these agreements, these individuals have agreed, subject to specified exceptions, not to sell or transfer any common stock or securities convertible into, or exchangeable or exercisable for, our common stock during a period ending 90 days after the date of this prospectus supplement.”

The date of the prospectus supplement is 11/8/18, which makes the 90th day 2/6/19. This allows insiders to sell their shares starting on 2/7/19.

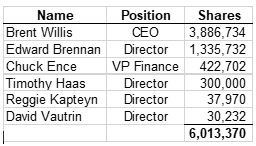

Here is a table of publicly reported directors and executives who own the most amount of shares and are subject to the lock-up agreement:

Source: SEC filings

Once insiders start filing that they are selling shares, we believe that will fuel a selloff. What we find even more alarming are the names no longer on this list. As we delved deeper into our diligence on NBEV, we discovered a notable list of insider departures in key positions. The amount of shares we totaled insiders to have above is about 6M. But that doesn’t include the shares that the insiders who have left NBEV have reported who could sell or have already sold.

Thanks for the comments. Yes, Bart that info will be shown in our Seeking Alpha article that will be off embargo tomorrow at 10am:

seekingalpha.com/.../4238331-new-age-beverages-take-spill-parabolic-rise-upcoming-negative-catalysts

That embargo crap is one of the many reasons I've stopped reading Seeking Alpha. They've really gone downhill the last few years.

Nice article.

You forgot Neil Fallon's 5.3 million shares.