Netflix's Glory Days Are Past

Netflix's (NFLX) days of easy growth and a price supported in large part by hype for the future are longer over. The company's recent quarterly results have demonstrated that competitive pressures are making the company's hopes for perpetual and accelerating membership expansion a pipe dream.

Rather, the future more looks like Netflix continuing to settle down as one of many streaming content providers. This consequently means a reduction in its price to earnings ratio as expectations are reduced due to decelerating membership expansion, increasing content costs to keep a unique draw, reduced price-raising ability, and thus downgraded earnings and revenue growth.

Membership Growth Slows As Competition Fires Up

Netflix's saw not just a significant growth slowdown in paid memberships in Q2 2019 but even an actual decline in U.S. domestic paid memberships.

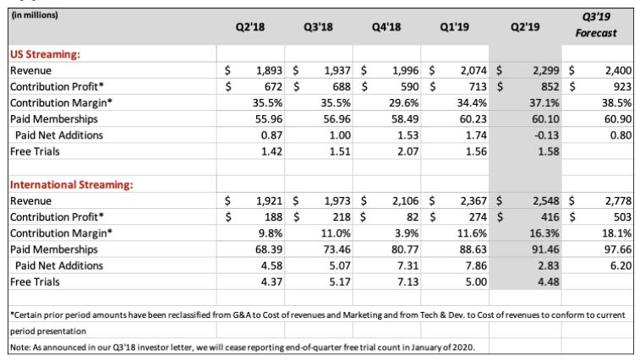

As compared with the prior quarter, domestic paid memberships were down 130,000 from 60.23 million to 60.10 million. International paid memberships still grew but at an enormously reduced rate of 2.83 million as compared to 7.86 million the quarter prior.

What is most notable and worrying however is that Netflix forecast in Q1 2019 for Q2 2019 were domestic growth of 300,000 paid net subscription additions and 4.70 international additions. That Netflix's actual results broke so dramatically with guidance and expectations is part of what led to its roughly 10% drop in the immediate aftermath of the earnings report.

(Source: Q2 2019 Netflix Letter to Shareholders)

However on a broader scale such a break from guidance also demonstrates the uncertainty that now faces Netflix's future trajectory and even current membership and revenue retention.

Netflix's competitors are brewing and carving out their own distinct spaces in the content streaming, subscription, and provider world. Disney+ (DIS) is launching in just under 3-months with a starting price point of $6.99 a month that is below Netflix's current $8.99 a month for its lowest plan price. Not only does that reduce prior expectations built into Netflix's growth trajectory of Netflix being able to raise prices in the future as it builds out its membership and content network but also puts in fact negative price pressure on the company's subscription services. Furthermore, Disney+'s proposed combination of Disney+, Hulu, and ESPN+ for a mere $12.99 a month is equal to Netflix's current standard plan price.

This does not even include all the other corporate giants either creating or modernizing their content streaming services.

With Netflix's Boom Times Over, Investors Feel The Pain

No wonder Netflix stock has been stalling so much recently, as what were only recently 50%+ or even triple-digit (as recently as 2018) return rates now have declined to Netflix being down -8.98% year-on-year and -14.31% the past 3-months. This past year for the company has undoubtedly been dramatically different compared to what Netflix investors have been used to - and in my opinion is only likely to continue as the competition heats up.

Data by YCharts

Netflix's trailing twelve months earnings per share is currently $2.55 a share. At a price of $297 a share its price to earnings ratio is currently about 116x and giving it a market capitalization of about $130 billion (no longer larger than, or even close to, Disney (DIS) and Comcast (CMCSA) which have now ballooned to $244 billion and $200 billion respectively).

I believe we will see EPS growth decline further as competition increases and thus membership growth continues to slow, content spending increases to retain distinctiveness, and revenue growth and margins experience either slowing or even contraction.

Consequently the company's justifiable P/E ratio would reduce as growth expectations - buoyed by now clearly unrealistic membership growth expectations and price-raising hopes - sinks too.

Come this point next year we could imagine Netflix EPS to have grown perhaps 10% to $2.81 a share. However with a P/E reduction to say 85, more reflective of a still growth-oriented - and hype-supported - company, that means Netflix's 12-month price target would be $238.85 a share. That is about a 19.8% price drop from its current $297.81 a share - and is still generally a mild growth thesis.

Conclusion

Netflix is a company which capitalized on the Internet-services based content streaming market early on and nearly gained an inertia effect similar to that of Facebook (FB). Indeed, many investors bet on Netflix's growth story by believing consumers would stick with and trust Netflix as their content provider in perpetuity.

(Source: Inc.com)

However Netflix lacks the same network effects as other social platforms despite the company's half-hearted attempts to build such, such as through the now shut-down video reviews.

With competition to Netflix now on a fever pitch and consumers demonstrating they are willing to bypass or flee the service for the now large variety of other content streaming services and connected tech eco-systems out there, Netflix's only methods of remaining competitive will be costly, earnings/margin reducing, and without guarantee of success.

Netflix will persist - just not at the current price.

Disclaimer: These are only my opinions and do not constitute investment advice.

I've read that for #Disney, the move into streaming is more about the data it can collect on viewers than the revenue it will generate from subscription fees. Disney can make billions off a single movie (Avengers Endgame, Star Wars, Frozen, etc.). A fortune off related licensing, etc. Streaming revenue is a drop in the bucket. $DIS

I've been a loyal #Netflix subscriber and fan since it's early days. I believe that like Apple, Netflix has fiercely loyal customer base which should not be discounted. That being said, if a Disney/Hulu/ESPN giant could offer a library equally as vast, I do think it could start to chip away at that loyal following.

I disagree. While there will always be some churn at both companies, these are not high price points. Many will just subscribe to BOTH services. Doing so is still substantially cheaper than cable and both have some excellent original programming.

I agree. Sure, Disney will have some impact, but it's like saying no one will subscribe to both Showtime and HBO. As long as Netflix continues to have a large library, and pumps out great original content like Stranger Things, House of Cards and more, it will continue to endure.