Netflix Stock Takes A Hit After Elon Musk’s Comments – Time To Buy The Dip Or Brace For A Bigger Drop?

Image Source: Pexels

With Netflix (NFLX) reaching new highs this year, investors are wondering whether this streaming giant can keep rising or if its impressive run may be slowing down. As the global leader in streaming and digital entertainment, Netflix benefits from its massive subscriber base, expanding ad-tier model, and growing presence in live sports and global partnerships.

Combined with strong profitability, healthy cash flow, and strategic deals with Amazon Ads, AB InBev, and Major League Baseball, the company’s long-term growth story remains compelling.

Still, Netflix faces clear challenges. Optimists see a proven market leader successfully evolving into a diversified entertainment powerhouse with multiple income streams. Skeptics, however, point to high valuation, content fatigue, and intensifying competition from Disney+, Amazon Prime, and Apple TV+.

The stock trades near the top of its range, showing investor confidence but also signaling caution about limited upside at current prices. This balance between Netflix as a mature, cash-generating business and Netflix as a fast-moving innovator makes its next chapter crucial.

Recently, Netflix found itself back in the headlines after Elon Musk publicly criticized the platform for featuring what he described as “woke” content, following the release of a new children’s show with a transgender character. His comments, which spread rapidly on social media, sparked debate and calls for subscription cancellations, briefly pressuring the stock.

While short term reactions were minimal, the episode highlights how Netflix’s creative choices continue to influence both cultural and investor sentiment. The company remains firm in its content strategy, emphasizing creative freedom and global storytelling – but as the industry grows more polarized, public perception may become an even bigger factor in its market performance.

Will Netflix’s bold strategies and global dominance keep it ahead, or could rising controversy and competition mark the start of a cooling phase?

Let’s deep dive into it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Netflix, ask yourself:

Do you want exposure to a global streaming leader expanding into advertising, live content, and digital partnerships?

Are you comfortable paying a premium valuation for a company that still delivers industry-leading profitability?

Do you believe in Netflix’s long-term ability to evolve beyond streaming – into a multi-platform entertainment brand?

For long term investors, Netflix remains a compelling story of global dominance, expanding revenue streams, and consistent profitability. Its evolution from a streaming pioneer into a broader entertainment ecosystem, spanning advertising, live sports, gaming, and global partnerships, highlights a company that continues to adapt and lead. Still, investors should carefully assess their risk tolerance and have a defined strategy before deciding whether Netflix fits into their portfolio.

While Netflix’s fundamentals and cash generation remain strong, it operates in an increasingly competitive arena. Rivals like Disney+, Amazon Prime Video, Apple TV+, and HBO Max are investing heavily in original content, regional expansion, and bundled ecosystems, intensifying the battle for subscribers and viewer attention. This competition could pressure growth and margins over time, making selectivity and timing especially important.

For long term investors, temporary pullbacks could offer attractive entry points into a proven market leader with a global brand and diversified growth engines. For short term investors, however, elevated valuations and near term technical weakness call for patience, discipline, and awareness of the shifting competitive landscape as Netflix enters its next phase of growth.

IDDA Point 3: Fundamental

Core Business Strength & Market Leadership

Netflix remains the dominant force in global streaming, maintaining a substantial lead over rivals with unmatched brand recognition and a massive global subscriber base. Its diversified content portfolio — spanning hit originals, international programming, and now live events — continues to attract strong engagement and viewer loyalty worldwide.

While competition from Disney+, Amazon Prime, and HBO intensifies, Netflix’s first-mover advantage, scale, and deep library of exclusive content have cemented its leadership in the sector. The company’s expansion into emerging regions such as Asia and EMEA has also strengthened its position, helping offset slower growth in mature markets like North America.

Recently, Netflix made headlines after Elon Musk publicly criticized the company for promoting what he described as “woke” content. While his comments briefly stirred social media backlash and minor investor concern, the event underscored Netflix’s unique position in balancing creative freedom with business priorities.

From a fundamental perspective, this incident highlights the power – and risk – of Netflix’s global influence: its content decisions can shape not only audience perception but also short term investor sentiment. Despite the noise, Netflix’s ability to weather such controversies reaffirms the strength of its brand and the stickiness of its subscriber base.

Profitability, Margins & Financial Health

Financially, Netflix continues to show strong performance with steady revenue growth and improving profitability. Its earnings have increased thanks to the success of its ad-supported plans, efficient cost management, and a growing global subscriber base.

As the platform expands, each new subscriber adds more to profits, showing the benefits of its large scale. The company continues to generate healthy cash flow, which allows it to fund new projects and create original content without relying heavily on loans.

Overall, Netflix maintains a solid financial foundation, giving it the flexibility to keep investing in growth while staying disciplined with its spending and debt.

Strategic Initiatives & New Revenue Streams

The company is no longer just a subscription business, meaning it’s building multiple income streams to reinforce its growth trajectory. Advertising is emerging as a key driver, aided by partnerships with Amazon Ads, AB InBev, and Major League Baseball (MLB). These deals not only expand Netflix’s monetization channels but also increase brand reach through co-marketing, live sports, and cross-platform integration.

The entry into live programming and gaming, as well as collaborations with creators on TikTok and YouTube, reflects a deliberate strategy to diversify beyond films and series. This broadens Netflix’s ecosystem, improves engagement, and reduces reliance on a few blockbuster titles.

Valuation, Efficiency & Growth Outlook

Despite its strong financial performance, Netflix’s share price has become a major talking point. The stock is valued much higher than competitors like Disney and Amazon, which makes some investors question whether it’s worth the premium.

Supporters believe the higher price is justified because Netflix has stronger profits, a larger global reach, and better returns than most of its rivals. They also expect its revenue and earnings to keep growing as advertising plans expand and average user spending increases.

Skeptics, however, warn that Netflix has already used many of its big growth drivers, such as price increases and password-sharing crackdowns, which could limit how much higher the stock can go in already crowded markets.

Long-Term Fundamentals & Global Opportunity

Over the long term, Netflix’s fundamentals remain solid. It operates with financial stability, an improving cost structure, and an expanding global footprint. Its heavy investment in original and localized content ensures continued cultural relevance and subscriber engagement.

The company’s ability to adapt its model through advertising, live sports, and partnerships signals resilience and innovation. Still, long-term success will depend on maintaining profitability amid rising content costs, competitive pressure, and public scrutiny over its creative direction.

Overall, Netflix exhibits the hallmarks of a mature yet adaptable enterprise: strong cash flow, steady margins, and multiple avenues for sustainable growth – even in the face of controversy or competition.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Strong Profitability & Cash Flow:

Netflix continues to post robust revenue growth, expanding margins and strong free cash flow, proving its business model is both scalable and sustainable.

New Growth Catalysts:

The company’s ad-supported tier, live sports ventures, and partnerships with Amazon Ads, AB InBev, and MLB open up new, high-margin revenue streams and reinforce its ecosystem.

Global Dominance & Brand Power:

With over 300 million subscribers and cultural reach through global hits like

Squid Game and Wednesday, Netflix maintains unmatched brand loyalty and international presence, helping cushion competition risks.

Risks

Rising Content Costs:

As competition intensifies, Netflix must keep producing fresh, high-quality shows and films to maintain viewer interest. This constant demand for new content pushes production costs higher, which could squeeze profits and make it harder to sustain its current growth pace over time.

Saturated Markets & Slower Growth:

Key regions like North America are reaching subscription limits, and growth levers like password-sharing crackdowns and price hikes have already played out.

Rising Competition & Content Fatigue:

With Disney+, Amazon, and Apple pouring billions into original programming, Netflix faces mounting pressure to continuously produce hits – a costly and unpredictable challenge that may erode margins over time.

Investor sentiment toward Netflix is positive but cautious. Many recognize its strong profits, global reach, and ability to adapt through new ventures like advertising, live sports, and partnerships with major brands.

However, the recent backlash from Elon Musk’s criticism of Netflix’s content has added a new layer of attention to how public perception and social influence can impact sentiment. While the remarks briefly sparked debate and minor volatility, most investors view it as noise rather than a fundamental threat, noting Netflix’s long history of weathering controversy.

Still, some worry about its high share price, slower subscriber growth in key markets, and rising competition from Disney+, Amazon, and Apple TV+. Overall, investors remain confident in Netflix’s long-term strength but are staying alert to both market dynamics and how cultural debates could influence the company’s brand and future growth in an increasingly crowded entertainment landscape.

Sentimental Risk: High

IDDA Point 5: Technical

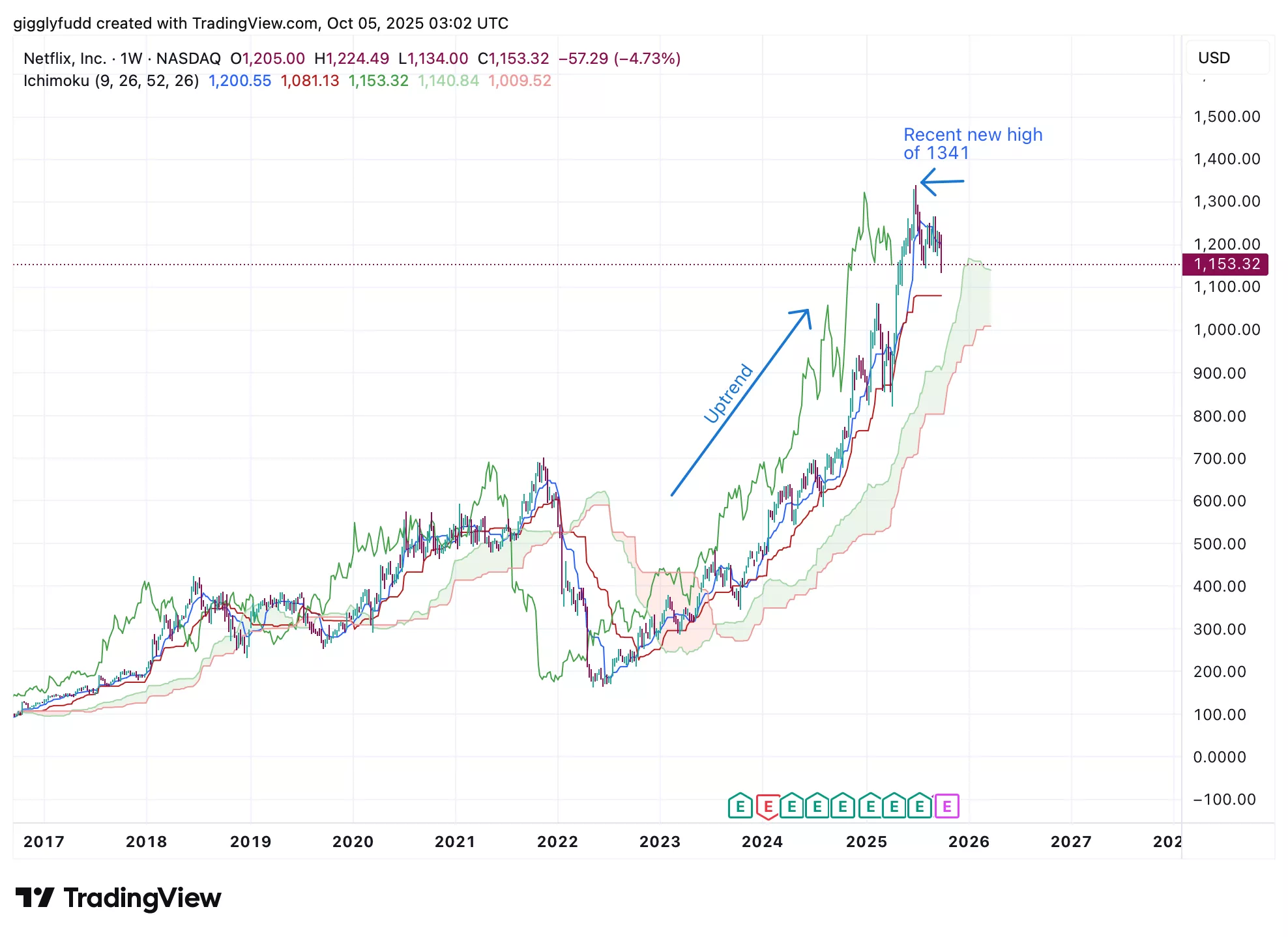

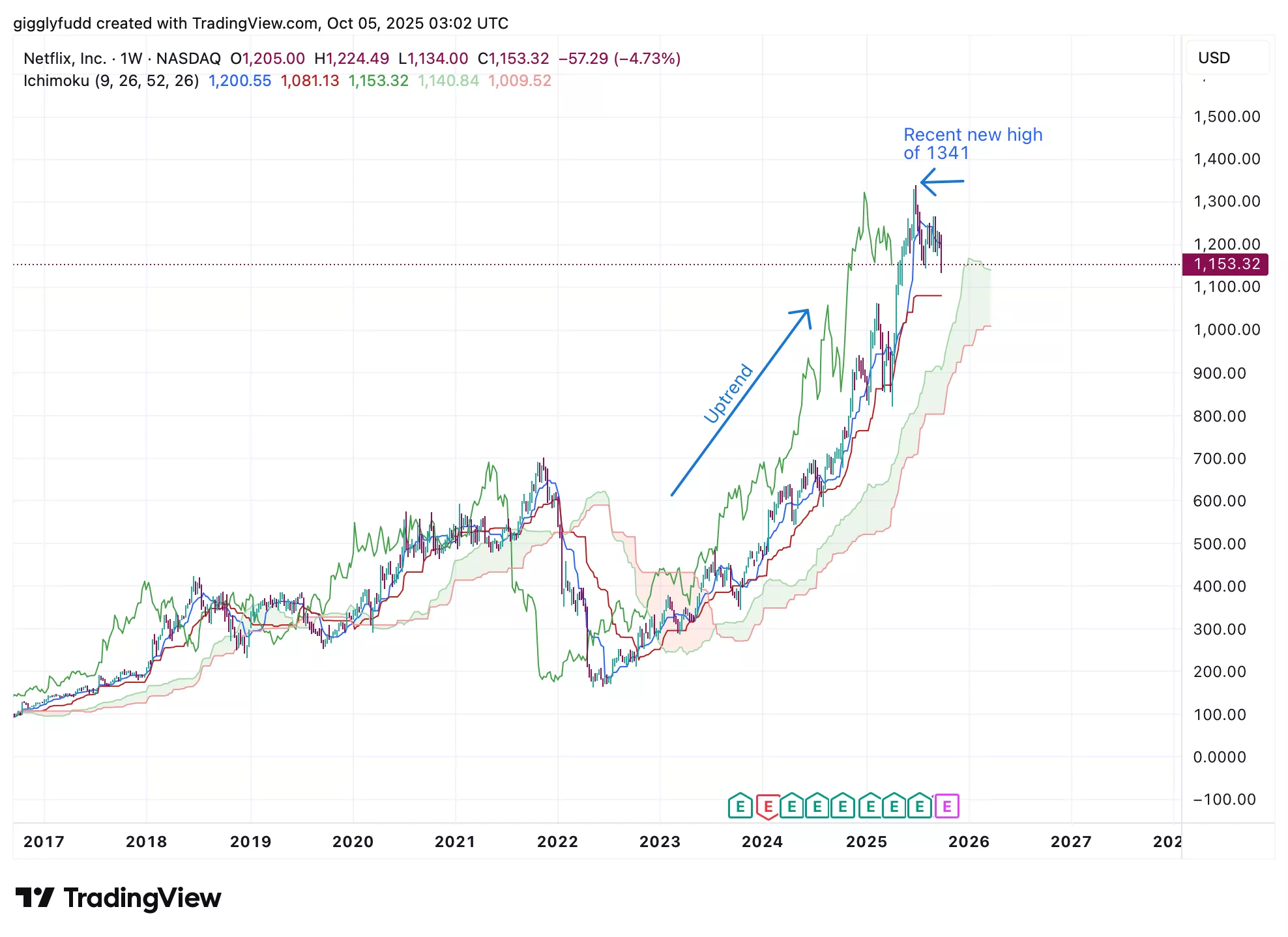

On the weekly Chart

The stock has been in a clear uptrend since May 2022, with each new high surpassing the previous one.

The Ichimoku Cloud remains bullish and wide, reinforcing long-term upward momentum, with candlesticks positioned firmly above the cloud.

Recently, Netflix reached a new high, signaling strong investor confidence and continued belief in the company’s growth story. While the price has since entered a short term pullback, this is not unusual after an extended rally.

Periodic corrections often allow the stock to consolidate gains and attract new buyers at lower levels. The broader trend still favors the bulls, supported by Netflix’s steady earnings growth, expanding global footprint, and new revenue drivers such as advertising and live sports.

As long as the stock holds above key support zones, the long term outlook remains positive, suggesting the pullback may simply be a pause before the next potential leg higher.

(Click on image to enlarge)

On the daily Chart

The pattern has been in a downtrend since June 2025, following the high of $1,341.

Candlesticks have now fallen below the Ichimoku Cloud, which previously acted as a key support zone.

The Kijun line has crossed above the Tenkan line, forming a death cross – a bearish signal that reinforces short term downside momentum.

After peaking in late June, the stock has steadily declined, recently breaking below the Ichimoku Cloud following market reactions to Elon Musk’s public criticism of Netflix’s content. The move reflected a short term loss of momentum as traders responded to the headlines and a brief dip in investor sentiment.

This break below the cloud confirms near term weakness, and with the future cloud now turning bearish, further downward pressure may persist in the short term until sentiment stabilizes and buying momentum returns.

The current market price has already tested a key support level at $1,142 – if this level holds, a rebound or consolidation could follow. However, a decisive break below it would likely trigger further downside movement in the short term.

(Click on image to enlarge)

Investors looking to get in NFLX can consider these Buy Limit Entries:

1142.11 (High Risk)

1080.89 (Medium Risk)

1018.39 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

1341.09 (Short term)

1460.71 (Medium term)

1537.23 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Netflix (NFLX)

Netflix’s latest pullback has reignited the question at the heart of this analysis – is this a buying opportunity or the start of a bigger drop? The stock’s recent dip followed Elon Musk’s public criticism of the company’s content, which sparked brief market turbulence and renewed debate around valuation and sentiment.

Despite the short-term reaction, confidence in Netflix’s profitability, expanding ad-tier growth, and new partnerships remains strong, but it also underscores the fine balance between optimism and caution. Bulls believe Netflix is entering a new phase of diversified strength and innovation, while bears warn that its premium valuation and growing competition could make the stock vulnerable to further downside.

Ultimately, whether Netflix rebounds or slides deeper will depend on how well it manages growth, controversy, and competitive pressure – a test that will determine if this dip becomes a chance to “buy the drop” or a signal of more weakness ahead.

Key Takeaways:

The debate around Netflix now focuses on whether its recent decline presents long term value or signals exhaustion in its rally. Bulls point to strong fundamentals, expanding revenue streams, and brand dominance as reasons for confidence. Bears counter that high pricing, slowing growth, and rising competition could limit short-term upside.

For long-term investors, Netflix remains a proven compounder with resilient fundamentals. For short-term traders, however, the market’s reaction to Elon Musk’s comments and recent technical weakness call for patience, discipline, and careful timing before reentering.

Overall Stock Risk: Medium

More By This Author:

Could Bitcoin Break $200K This Cycle? What Investors Need To Know After Its $124K Peakishares Silver Trust ETF: Is This The Beginning Of A Mega Trend Or A Temporary Spike?

Viking Therapeutics Stock: A Stumble Or The Setup Of The Decade?