Netflix Erupts To All Time High On Blowout Earnings, Record New Subs, Price Hike And New $15 Billion Buyback

Image Source: Pexels

As we wrote in our preview note, it would take a lot to "wow" NFLX bulls according to Goldman while UBS chimed in that the company would have to announce a price hike, and... well, the company heard the two banks, not only reporting Q4 results that blew away expectations but also hiked prices in the US... and also announced a $15 billion buyback to boot!

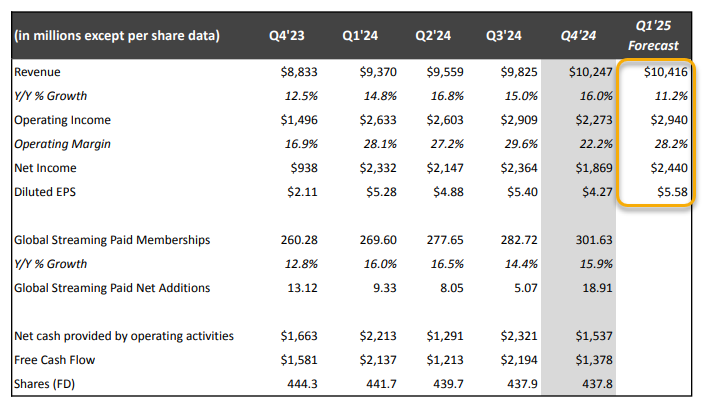

Here is what the company reported moments ago for Q4:

- Revenue $10.25 billion, +16% y/y, beating estimate $10.11 billion

- EPS $4.27 vs. $2.11 y/y, beating estimate $4.18

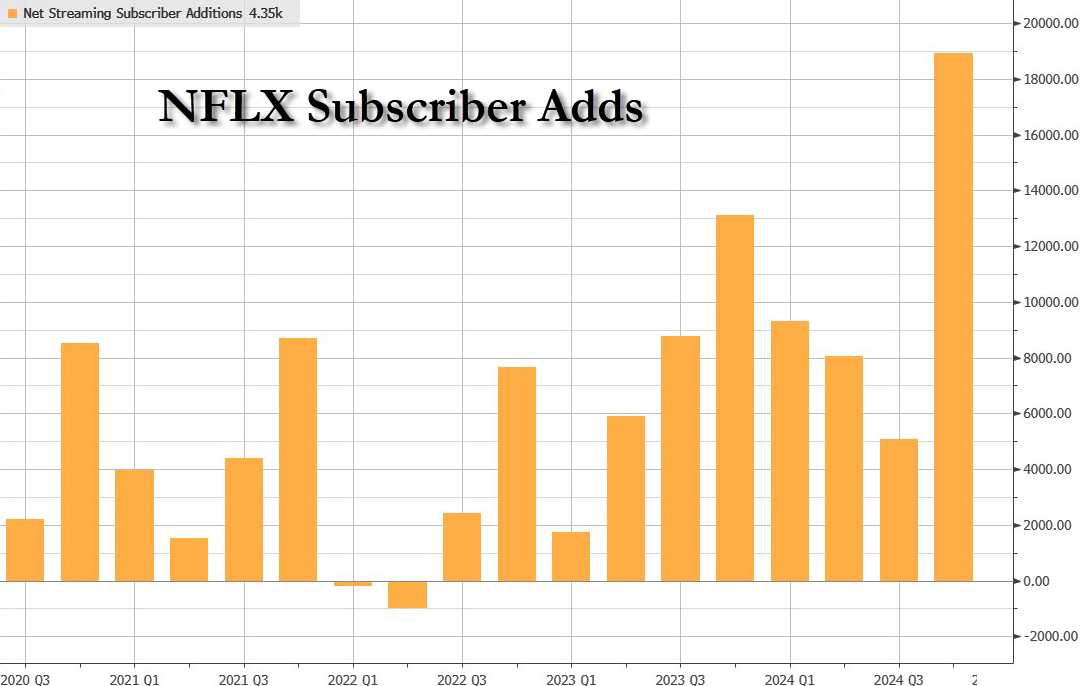

- Streaming paid net change +18.91 million, +44% y/y, more than double the estimate of +9.18 million and above the highest bogey of about 15 million.

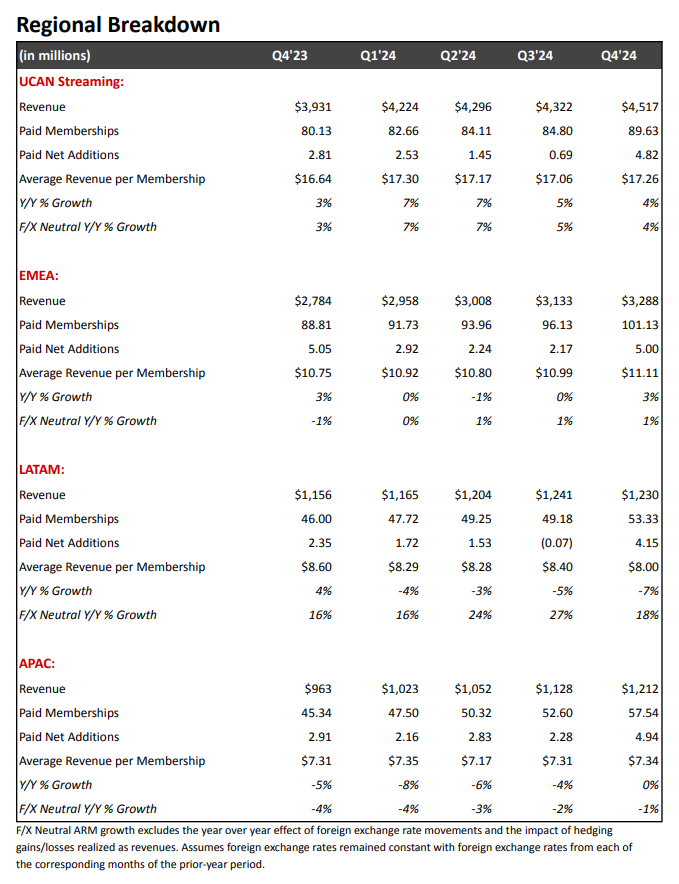

- UCAN streaming paid net change +4.82 million, +72% y/y, beating estimates of +1.75 million

- EMEA streaming paid net change +5 million, -1% y/y, beating estimates of +3.09 million

- LATAM streaming paid net change +4.15 million, +77% y/y, beating estimates of +1.50 million

- APAC streaming paid net change +4.94 million, +70% y/y, beating estimates of +2.70 million

- Streaming paid memberships 301.63 million, +16% y/y, beating estimates of 290.93 million

- Operating income $2.27 billion, +52% y/y, beating estimates of $2.2 billion

- Operating margin 22.2% vs. 16.9% y/y, beating estimates of 21.9%

- Free cash flow $1.38 billion, -13% y/y, beating estimates of $1.06 billion

And yes, it's not a typo: you read that subscriber number right. And no, it makes little sense in the context of the company's historical subscriber additions.

Then again, maybe people just couldn't wait for Squid Game 2. According to NFLX, "Squid Game season 2 is on track to become one of our most watched original series seasons, Carry-On joined our all-time Top 10 films list, the Jake Paul vs. Mike Tyson fight became the most-streamed sporting event ever and on Christmas Day we delivered the two most-streamed NFL games in history."

Commenting on the results, NFLX write that revenue in Q4 increased 16% year over year, or 19% on a foreign exchange (F/X) neutral basis: "This was slightly above our beginning-of-quarter forecast despite the strengthening of the US dollar vs. most currencies as membership growth and ad sales outpaced our forecast." The surge in revenue was thanks to a 15% YoY spike in average paid memberships, while ARM was up 1% year over year, or 3% on a F/X neutral basis.

According to the company, "in Q4, membership growth was driven by broad strength across our content slate, improved product/market fit across all regions and typical Q4 seasonality." And sure enough, in Q4 NFLX generated 19M paid net additions - the biggest quarter of net adds in the company's history - compared with 13M in Q4’23 and 5M in Q3’24.

Operating income totaled $2.3B, up 52% year over year, and operating margin was 22% vs. 17% last year. Both were above the company's previous guidance forecast primarily due to higher-than-forecasted revenue.

EPS amounted to $4.27 vs. $2.11 last year (+102% year over year).

Yet despite the blowout Q4 numbers, the company's guidance was somewhat lukewarm:

- Sees revenue $10.42 billion, below the estimate if $10.48 billion

- Sees EPS $5.58, below the estimate of$6.01

- Sees operating income $2.94 billion, below the estimate $3.13 billion

- Sees operating margin 28.2%, below the estimate 29.8%

For the full year, NFLX now project 2025 revenue of $43.5-$44.5B, $0.5B higher than its prior forecast range. This updated guidance "reflects improved business fundamentals and the expected carryover benefit of our stronger-than-forecasted Q4’24 performance, net of headwinds from the strengthening of the US dollar over the past few months." Since the first 2025 forecast the company published in its Q3’24 results, the appreciation of the US dollar vs. most currencies has negatively impacted the 2025 revenue forecast by ~$1B, net of hedging (this F/X impact is included in our updated guidance).

Furthermore, as it announced last year, beginning with the Q1’25 earnings in April, Netflix will no longer report paid memberships and ARM on a regular quarterly basis; and starting with the Q2’25 results, NFLX will publish its bi-annual engagement report - which accounts for 99% of all viewing on Netflix - in tandem with our Q2 and Q4 earnings results.

Turning to the cash flow statement, NFLX said that cash generated by operating activities in Q4 was $1.5B vs. $1.7B in the prior year period, while Free cash flow (FCF) for the quarter was $1.4B compared to $1.6B in Q4’23. For the full year 2024, net cash provided by operating activities was $7.4B vs $7.3B in 2023, while FCF totaled $6.9B in both 2024 and 2023. At year end, total debt was $15.7B with net debt of $6.1B.

For 2025, NFLX expects to generate FCF of about $8B; the forecast assumes cash content spend of roughly $18B and an estimated $800M in cash outflows related to the timing of certain direct and indirect tax deposits, which is in addition to typical annual tax obligations. During 2025, NFLX expects to pay down $1.8B in bonds that mature during the year using the proceeds from our investment grade debt offering in 2024

Netflix then shares the following perspective on its 2025 year:

We enter 2025 with strong momentum, coming off a year with record net additions (41M) and having re-accelerated growth (16% increase in revenue). Moreover, we’re in a leadership position in terms of engagement (approximately two hours per paid membership per day), revenue ($39B) and profit ($10B in operating income) in a market that is continuing to expand. We estimate there are now 750M+ broadband households (excluding China and Russia) and $650B+ of entertainment revenue in the 4 markets we operate in, of which we only captured ~6% in 2024. Similarly, we believe we account for less than 10% of TV viewing in every country in which we operate, all of which suggests a long runway for growth as streaming continues to expand around the world.

Our business remains intensely competitive with many formidable competitors across traditional entertainment and big tech. We’re fortunate that we don’t have distractions like managing declining linear networks and, with our focus and continued investment, we have good and improving product/market fit around the world. We have to continue to improve all aspects of Netflix - more series and films our members love, a great product experience, increased sophistication in our plans and pricing strategy (including more advertising capabilities) - and grow into new areas like live programming and games. If we do that well, we believe we’ll have an increasingly valuable company - for consumers, creators and shareholders.

The company also discussed its recent foray into live programming:

Our newly established live programming slate has already delivered some must-watch moments. In Q4, we had the Jake Paul-Mike Tyson boxing match, which became the most-streamed sporting event ever, while the Taylor-Serrano undercard became the most-watched professional women’s sports event in US history. We followed that up with the NFL on Christmas Day, which were the two most streamed NFL games in history, and Beyoncé Bowl, which drove peak viewing on Christmas Day. Building on that momentum, we recently announced that we’ve secured the US rights for FIFA’s Women’s World Cup in 2027 and 2031. We're not focusing on acquiring rights to large regular season sports packages; rather, our live strategy is all about delivering can’t-miss, special event programming. This includes not only sports but also exciting comedy specials like Chris Rock: Selective Outrage and The Roast of Tom Brady. Our aim is to deliver big, memorable moments to our members. Although our live programming will likely be a small percentage of our total view hours and content expense, we think the eventized nature will result in outsized value to both our members and our business.

If that wasn't enough, it appears that NFLX continues to draw in new clients capitalizing on its low-priced ad tier:

We provide a range of prices and plans to address an array of consumer needs. For example, our ads plan allows us to offer lower price points for consumers, which continues to be quite popular. In Q4, it accounted for over 55% of sign-ups in our ads countries and membership on our ads plan grew nearly 30% quarter over quarter. Today we are introducing an Extra Member with Ads offering in 10 of the 12 countries where we have an ads plan to give our members additional choice and flexibility.

And while ads fund the low-end, the company is hiking prices on the high end. It announced that it is "adjusting prices today across most plans in the US, Canada, Portugal and Argentina (which was already factored into the 2025 guidance we provided in October 2024)."

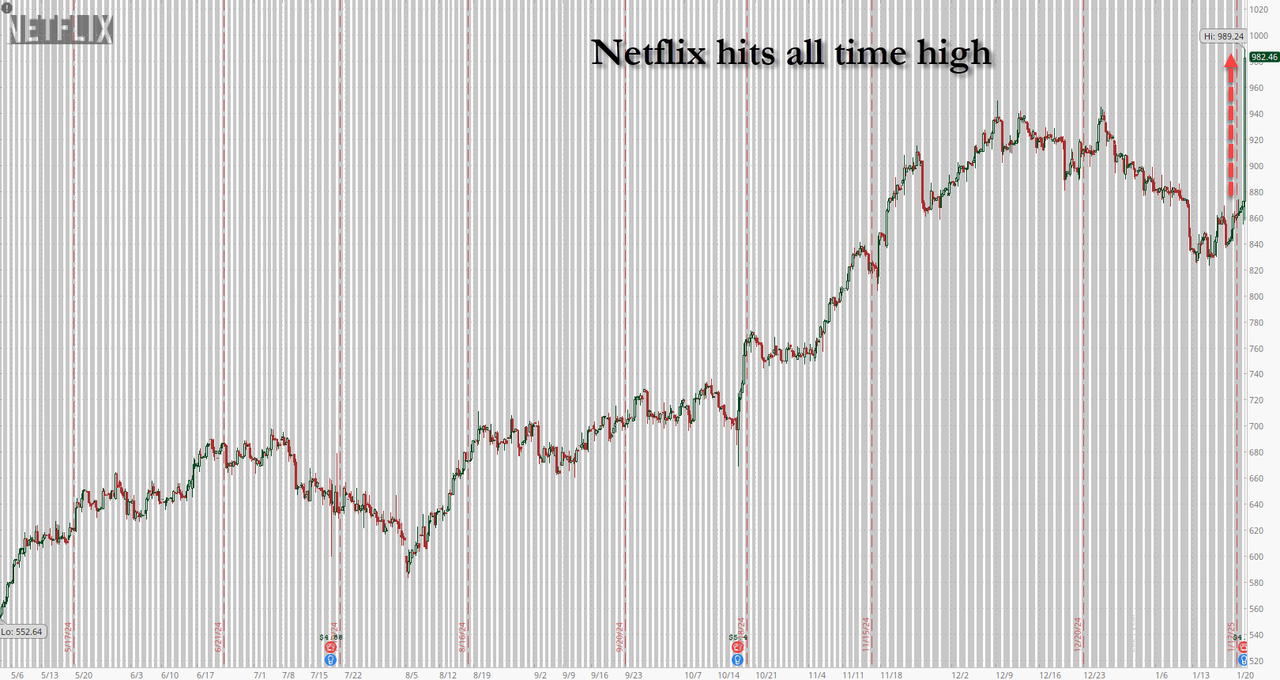

Commenting on the results, UBS writes that Netflix shares are up 11% post close "as the set up had been sell into the print, and buy back once quarterly/2025 guidance was given. This 19 mn net adds in Q4 was the standout number, beating the bogey at 13 mn (and even the highest number I heard at around 15 mn)."

Finally, sealing the nail in the shorts' coffin, NFLX also announced a new $15 billion buyback, which is double anything the company has done before! It follows, repurchases of 9.9M shares in 2024 for $6.2B; the company has used $12.9B to repurchase shares since the existing program’s inception, and means that the company's total buyback authorization is now $17.1B.

According to UBS' Kelsey Perselay, "this flips the script away from subscriber guide, and Q1 looks healthy across the board, especially revenue growth FXN and reported. Revenue and EBIT on the dollar side missed, but investors were already braced for the FX impact. Further, 2025 guidance was raised across the board, with FCF now at $8 bn, slightly lower than the UBS estimate of $10 bn but that was driven by one timers and taxes. Content spend sitting at $18 bn is roughly in line. As well, the company announced they will be adjusting prices for US, Canada, Portugal and Argentina – didn’t give a number, but this price increase was factored into 2025 guidance that they gave in 2024. They also announced a $15 bn buyback, which is almost double what they had previously done. A top priority in 2025 is improving offering for advertisers."

Of course, one didn't need to read any of this as one look at the stock price which is up 13% after hours to a new all time high of $986, is enough to get a sense of what a blowout quarter Netflix just reported, even if its Q1 guidance was a bit soft.

(Click on image to enlarge)

More By This Author:

Trump Vows To Refill SPR "Right To The Top" As China Tanker Rates Soar

Dollar Crashes On Trump Tariff Report

S&P Futures Rise Above 6,000 With Trump Inauguration Looming

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more