Netflix Crashes After Musk's "Cancel" Crusade Leads To Top, Bottom Line Miss

Image Source: Pexels

As Goldman wrote in its preview, positioning into today's earnings from Netflix (NFLX) was muted at best, with the stock serving as a "funding short" for various tech-linked pair trades. It is therefore safe to say that expectations were rather muted (with options pricing in 7.5% implied move). Well, for once Wall Street had it spot and whether or not this was due to Elon Musk's aggressive campaign to "Cancel Netflix" due to its tranny-endorsing content, moments ago the company reported results which were catastrophic, with the company missing on both the top and bottom line, and even though it went for the good ole' miss and hike forecasts, the stock - which is plunging after hours - did not buy it.

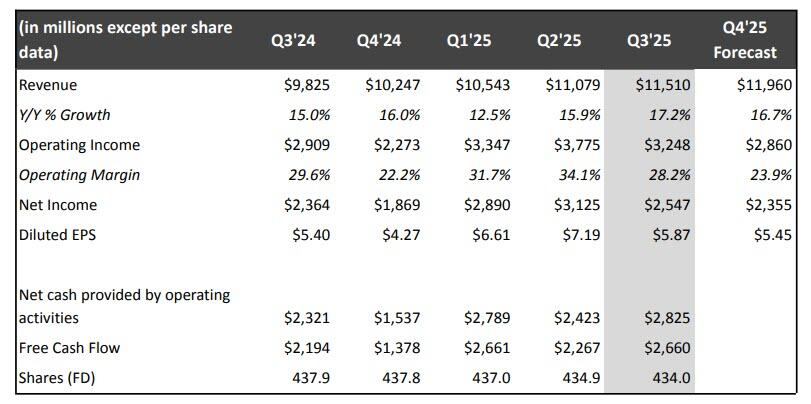

Here are the highlights from Q3:

- EPS $5.87 vs. $5.40 y/y, badly missing estimate $6.94

- Revenue $11.51 billion, missing estimate $11.52 billion

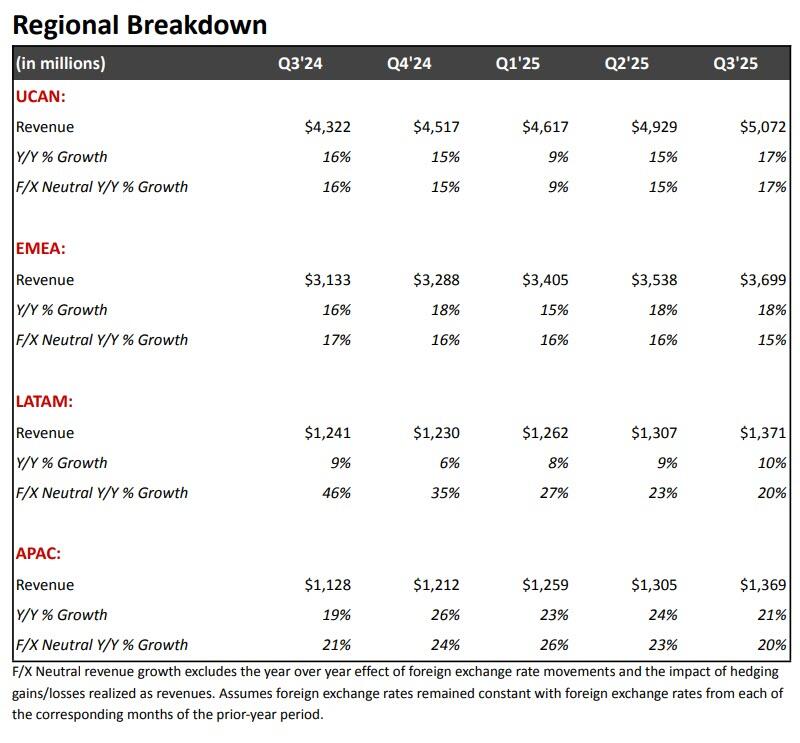

- US & Canada revenue $5.07 billion, +17% y/y, beating estimate $5.04 billion

- EMEA revenue $3.70 billion, +18% y/y, beating estimate $3.68 billion

- Latin America revenue $1.37 billion, +10% y/y, missing estimate $1.4 billion

- APAC revenue $1.37 billion, +21% y/y, missing estimate $1.38 billion

- Operating income $3.25 billion, +12% y/y, missing estimate $3.63 billion

- Operating margin 28.2% vs. 29.6% y/y, missing estimate 31.6%

- Cash flow from operations $2.83 billion, +22% y/y, beating estimate $2.56 billion

- Free cash flow $2.66 billion, beating estimate $2.39 billion

(Click on image to enlarge)

Naturally, Reed Hastings and his woke, pedo-friendly outfit would never admit that Musk was responsible for the stock implosion, so he blamed some Brazilian BS instead:

"Operating margin of 28% was below our guidance of 31.5% due to an expense related to an ongoing dispute with Brazilian tax authorities that was not in our forecast. Absent this expense, we would have exceeded our Q3'25 operating margin forecast. We don’t expect this matter to have a material impact on future results."

Yeah right.

This is what else the company said about Q1:

Revenue in Q3 grew 17%, in-line with our forecast, driven primarily by membership growth, pricing adjustments, and increased ad revenue. Revenue was in-line with our guidance with the slight variance due to unfavorable movements in foreign currencies since we set our forecast.

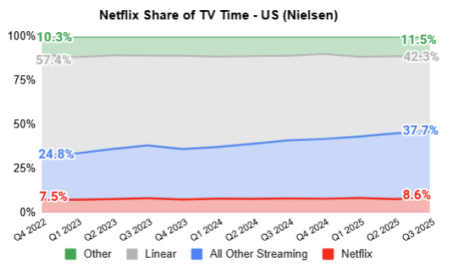

Engagement remains healthy. We hit our highest quarterly view share ever in the US and UK, which has grown 15% and 22%, respectively since Q4’22, according to Nielsen and Barb.

Q3’25 operating income totaled $3.2B, up 12% year over year. Operating margin was 28% vs 30% in Q3’24. This was below our guidance forecast because we incurred an expense in Q3’25 of approximately $619 million related to an ongoing dispute with Brazilian tax authorities regarding certain non-income tax assessments. This expense was not included in our prior guidance forecast but was identified as a potential exposure in our prior 10-Q and 10-K filings. The expense, which covers periods from 2022 through Q3’25, was booked as a cost of revenue. The cumulative impact of this expense (approximately 20% of which is for the year 2025 with the remainder related to 2022-2024) reduced our Q3’25 operating margin by more than five percentage points. Absent this expense, we would have exceeded our Q3'25 operating margin forecast, and we don’t expect this matter to have a material impact on our results in the future. Diluted EPS was $5.87 vs. $5.40 last year (+9% year over year), $1.00 below forecast due to lower than forecasted operating income.

Hoping markets will quickly forget the atrocious Q3 numbers, NFLX was hoping market will just buy the outlook hype with the following Q4 guidance:

- Revenue $11.96 billion, above the estimate $11.9 billion

- EPS $5.45, above estimate $5.42

- Operating income $2.86 billion, above estimate $2.88 billion

- Operating margin 23.9%, above estimate 24.1%

(Click on image to enlarge)

Looking ahead, NFLX said In Q4’25, it expects revenue growth of 17% (16% on a F/X neutral basis) driven by growth in members, pricing, and ad revenue. We project an operating margin of 23.9%, a two percentage point year over year improvement.

This means that for the full year 2025, we expect $45.1B in revenue (16% growth, 17% on an F/X neutral basis), in-line with our prior expectations for 15%-16% revenue growth (16%-17% on a F/X neutral basis). We’re now forecasting a 2025 operating margin of 29% (both reported and based on F/X rates as of 1/1/25), vs. our prior expectations for a 30% reported operating margin (29.5% based on F/X rates as of 1/1/25) due to the impact of the Brazilian tax matter.

NFLX also discussed its content slate, which according to the company "helped drive record TV view share in Q3 in the United States and the United Kingdom , two of our largest markets. Based on Nielsen and Barb data, from Q4’22-Q3’25, our quarterly 4 TV view share has grown 15% and 22% in the US and UK, respectively, as you see in the charts below. Given the still substantial amount of linear viewing globally, we believe there’s plenty of opportunity to expand our share of TV engagement, if we continue to improve."

Turning to the company's cash flow, it reported Q3 cash generated from operating of $2.8B vs. $2.3B in the prior year period. Free cash flow in Q3’25 totaled $2.7B vs. $2.2B in Q3’24. The company now expects 2025 free cash flow of approximately $9B (+/- a few hundred million dollars), up from its prior forecast of $8B-$8.5B. This new forecast

reflects the timing of cash payments and lower content spend.

During the quarter NFLX repurchased 1.5M shares for $1.9B, leaving $10.1B remaining under our existing share repurchase authorization. We ended the quarter with gross debt of $14.5B and cash and cash equivalents of $9.3B

There was a bunch more in the investor letter which readers can peruse at their leisure, but the only thing that mattered was the stock price, which explains why NFLX has been underperforming since June and has become the favorite hedge fund funding short.

(Click on image to enlarge)

More By This Author:

China GDP Grows At Slowest Pace In A Year Amid Crumbling Domestic Demand, Crashing Real Estate Market

Ray Dalio Explains Why Gold & Why Now...

Federal Courts To Scale Back Operations As Shutdown Exhausts Funds

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more