Nebius Group Vs. Amazon: Which AI Cloud Stock Has More Room To Run?

Image: Bigstock

Key Takeaways

- Nebius Group's AI cloud revenue grew over nine-fold in Q2 2025, reaching $105.1 million on soaring compute demand.

- Nebius Group boosted its ARR outlook to $900 million-$1.1 billion, signaling strong traction and expanding enterprise reach.

- AWS delivered $33 billion in Q3 revenue, up 20.2%, powered by Trainium chips and growing AI workloads.

Nebius Group N.V. (NBIS - Free Report) and Amazon.com, Inc. (AMZN - Free Report) are major players in the rapidly expanding AI cloud infrastructure market.

Amazon, through its Amazon Web Services (“AWS”) division, remains the industry’s most diversified and cash-generating cloud powerhouse. Its strengths lie in vast data center capacity, proprietary chips like Trainium, and deep enterprise penetration. Nebius, by contrast, is an emerging challenger, nimble, fast-growing, and laser-focused on AI compute infrastructure.

According to an IDC report, spending on AI infrastructure is expected to top $200 billion by 2028. This uptrend in spending benefits both Amazon and Nebius, but not equally. They differ sharply in scale and growth trajectory. So, for investors looking to make a smart move in the AI infrastructure space, which stock truly stands out?

Let’s analyze their fundamentals, growth opportunities, market challenges, and recent valuation to assess which one may present a stronger investment opportunity.

The Case for Nebius Group

Nebius, an Amsterdam-based AI infrastructure provider, has grown rapidly in 2025 amid soaring demand for AI cloud services driven by the expansion of generative AI, machine learning, and high-performance computing applications. Strong demand for its copper GPUs and near-peak GPU utilization has benefited results, with Nebius reporting a nine-fold surge in AI cloud revenue in the second quarter of 2025.

The company’s total revenues soared 625%, driven by strong performance in its core business and outstanding execution by the TripleTen team. Nebius’ core business revolves around its AI cloud platform, purpose-built for intensive workloads and powered by proprietary software, and hardware developed through its R&D hubs.

The company stands to gain from its product launches. Recently, Nebius launched Nebius AI Cloud 3.0 “Aether,” a next-generation cloud platform designed for enterprise-scale AI. As AI inference adoption accelerates, traditional cloud systems have struggled with slow deployment, fragmented tools, and limited AI performance and security.

The company has upgraded its cloud software to support growing capacity and large-scale clusters, expanded its customer base with leading tech firms such as Cloudflare, Prosus, and Shopify, and strengthened its position as the go-to cloud provider for AI-native startups.

AI compute demand is growing fast, and the company is expanding capacity to drive growth in 2026 and beyond. Nebius Group has raised its ARR outlook from $750 million-$1 billion to $900 million-$1.1 billion, reflecting solid contract wins and continued sales growth.

However, broader macroeconomic uncertainties and heavy capital spending weigh on Nebius Group’ growth trajectory. Nebius Group has reaffirmed its 2025 capex guidance at $2 billion. Now, $2 billion capex is a huge cash outlay even with a $4 billion capital raised to date. Elevated Capital expenditure levels pose a risk if revenue growth fails to keep pace with the company’s capital intensity, particularly in an environment where AI demand may fluctuate amid competitive pricing pressures and evolving regulatory frameworks.

Moreover, scaling aggressively (multiple data centers in various regions) involves execution risk. Also, Nebius faces tremendous competition in the AI cloud infrastructure space, which boasts behemoths like Amazon, Microsoft, and Alphabet, as well as small players like CoreWeave.

The Case for Amazon

Amazon continues to assert its dominance in the global cloud and AI infrastructure market through AWS. In the third quarter of 2025, AWS achieved $33 billion in revenue, marking 20.2% year-over-year growth. The surge was driven by strong demand for generative AI, inference workloads, and custom silicon solutions. With an annualized revenue run rate of $132 billion, AWS remains the backbone of the AI revolution, enabling enterprises to train, deploy, and scale large language models and AI agents.

A major growth driver for AWS is its proprietary silicon, particularly its Trainium and Graviton chips. Amazon’s Trainium2 has rapidly evolved into a multibillion-dollar business, growing 150% quarter-over-quarter and powering massive AI clusters such as Project Rainier, which includes nearly 500,000 Trainium2 chips, expected to double by year-end. AWS is already preparing Trainium3, expected to offer another 40% efficiency improvement.

Amazon is rapidly expanding its AI software ecosystem. Its Bedrock platform offers access to multiple foundation models, while SageMaker simplifies AI development and deployment. The new AgentCore framework enables secure, large-scale deployment of AI agents, already adopted by Ericsson, Sony, and Cohere Health to enhance efficiency. Tools like Strands and Quick Suite further integrate AI into enterprise workflows.

To meet surging AI demand, Amazon is undertaking one of the largest infrastructure expansions in tech history, adding 3.8 gigawatts of power in the past year, doubling capacity since 2022, and aiming to double again by 2027. In the final quarter of 2025, the company plans to add at least another 1 gigawatt of capacity.

For fourth-quarter 2025, net sales are projected to range between $206.0 billion and $213.0 billion, indicating year-over-year growth of 10% to 13%.

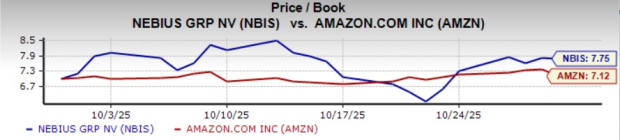

Nebius Group Shares vs. Amazon

Over the past month, Nebius Group shares have gained 11.8% while Amazon stock has increased 11.4%.

Image Source: Zacks Investment Research

Valuation for Nebius Group & Amazon

Valuation-wise, Nebius is overvalued while Amazon is undervalued, as suggested by the Value Score of F and C, respectively. In terms of Price/Book, Nebius Group shares have been trading at 7.75X, which is higher than Amazon’s 7.12X.

Image Source: Zacks Investment Research

How Do Zacks Estimates Compare for Nebius Group & Amazon?

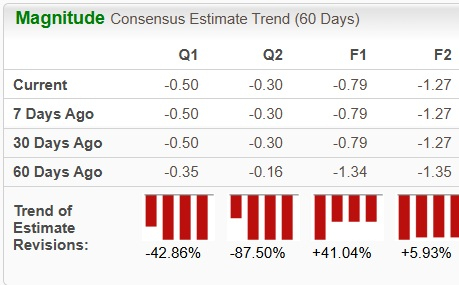

Analysts have significantly revised their earnings estimates for Nebius Group’ bottom line for the current year.

Image Source: Zacks Investment Research

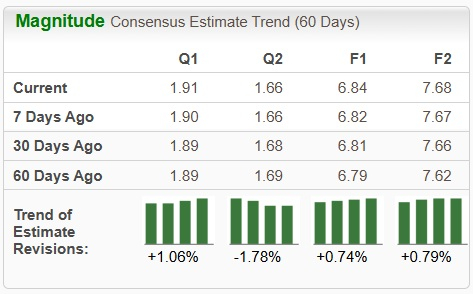

For Amazon, there has been a marginal upward revision.

Image Source: Zacks Investment Research

Nebius Group or Amazon: Which is a Better Pick?

Nebius Group carries a Zacks Rank #4 (Sell) rating at present, while Amazon has a Zacks Rank #2 (Buy) rating. Consequently, in terms of the Zacks Rank, Amazon seems to be a better pick at the moment.

More By This Author:

Mag-7 Earnings: Trick Or Treat For ETF Investors?US-China Signs 1-Year Rare Earth Deal: Will Clean Energy ETFs Gain?

Buy The Spike In Alphabet Stock After Its First $100 Billion Quarter?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more