Navigating Fed Policy Amidst Stagnant US CPI: Optimizing Your Tech Portfolio Strategy

The January US consumer price index (CPI) report, which was released recently, has sparked significant concern among investors, primarily due to the core inflation reading. This data, which excludes volatile food and energy prices, has shown a notable uptick in recent months, prompting worries about sustained inflationary pressures.

The sharp increase in the core inflation rate over the past three months is worrisome. The January CPI figures revealed a 0.3% rise for the month and a 3.1% increase over the past year, surpassing economists' expectations of a 0.2% monthly gain and a 2.9% annual rise. However, it was the core CPI that raised the most concern among investors.

The core CPI surged by 0.4% last month and registered a 3.9% increase compared to the previous year, indicating an acceleration in inflationary pressures. This acceleration is particularly worrying given that it exceeded economists' projections, who anticipated respective increases of 0.3% and 3.7%.

It signals the likelihood of elevated inflation persisting in the coming months. Such a scenario has far-reaching implications for financial markets and economic policy, potentially influencing the Federal Reserve's decision-making process.

The release of the CPI data triggered a sharp selloff in stocks, with major indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all experiencing significant declines. The Dow Jones dropped by 500 points, or 1.3%, while the S&P 500 fell by 1.4%, and the Nasdaq Composite slid by 1.7% after the CPI data.

Market reactions to the CPI report also affected expectations regarding future monetary policy actions by the Fed. Prior to the release, there were speculations of a possible rate cut in March. However, following the report, these expectations shifted, with markets now pricing in a lower probability of a rate cut in the near term.

According to the CME FedWatch Tool, there is currently a 6.5% chance of a quarter-percentage-point cut in March and a 35% likelihood in May, down from previous estimates of 16% and 52%, respectively.

We have dismissed the possibility of a rate cut in March, such a move would only be considered if there were significant disruptions within the financial system. As investors brace for potential volatility ahead, all eyes remain on the Fed's response to these evolving economic conditions.

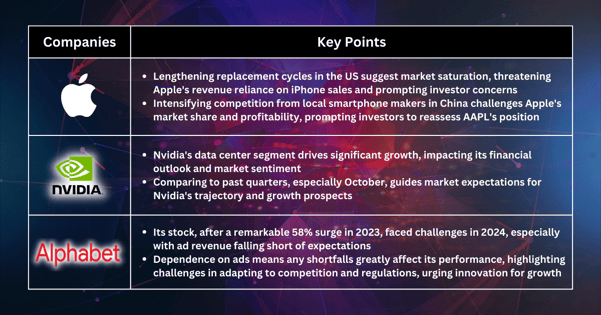

Apple: Challenging Outlook (AAPL)

The prolonged replacement cycle for iPhones in the United States presents a significant hurdle for Apple. This trend indicates a potential saturation in the smartphone market and suggests that consumers may be less compelled to upgrade to newer models due to diminishing incremental improvements.

For AAPL, which heavily relies on iPhone sales for revenue, this poses a threat to future growth and profitability. Investors may interpret this trend as a signal of maturation in the smartphone market and adjust their expectations accordingly, potentially leading to downward pressure on AAPL's stock price.

Also, China represents a critical market for Apple, given its size and growth potential. However, the intensifying competition from domestic smartphone manufacturers poses a challenge to AAPL's market share and profitability in the region.

As Chinese competitors offer comparable products at lower price points, AAPL may struggle to maintain its premium positioning and pricing power. This increased competition not only threatens AAPL's sales volume but also its margins, as the company may be forced to lower prices or increase promotional activities to remain competitive. Investors may view this as a sign of potential erosion in AAPL's competitive moat and react by adjusting their valuations of the company downward.

On the other hand, Legal disputes and patent battles are not uncommon in the tech industry, but they can have significant implications for companies like Apple. The recent ban on certain Apple Watch models due to a patent dispute adds a layer of uncertainty for AAPL, impacting its product portfolio and potentially disrupting sales.

Nvidia: Data centre is a bright spot (NVDA)

Nvidia's data centre segment has been a pivotal driver of growth for the company, particularly amid the increasing demand for cloud computing, artificial intelligence, and high-performance computing solutions. As such, any deviations from anticipated performance in this segment can have significant implications for Nvidia's overall financial outlook and market sentiment.

The comparison to prior earnings setups, particularly the October quarter, underscores the importance of historical performance trends in shaping market expectations. Investors and analysts will likely scrutinize Nvidia's Jan-Q results against these benchmarks to gauge the company's trajectory and potential future growth prospects.

Overall, the commentary provided offers valuable insights into the market's expectations for Nvidia's upcoming earnings report. Attention will be focused not only on overall sales figures but also on the performance of key segments, particularly data centre sales, which are expected to play a critical role in shaping Nvidia's performance in the coming quarters.

Alphabet: Contrasting performance (GOOG)

The contrasting performance of Alphabet's shares between 2023 and 2024 highlights the inherent volatility and unpredictability of the stock market. After experiencing a remarkable 58% surge in 2023, Alphabet's stock has faced headwinds in 2024, failing to maintain its upward momentum. The latest earnings report, which revealed ad revenue figures falling short of analysts' expectations, has likely contributed to the recent underperformance of Alphabet's stock.

As a company heavily reliant on advertising revenue, any discrepancies in this key metric can have a significant impact on Alphabet's financial performance and investor sentiment. The shortfall in ad revenue underscores the challenges faced by Alphabet in an increasingly competitive digital advertising landscape, where factors such as shifting consumer behaviour and regulatory changes can exert pressure on revenue growth.

While Alphabet remains a formidable player in the technology sector with a diverse portfolio of products and services, the recent stumble in ad revenue highlights the importance of adaptability and innovation in sustaining long-term growth. Investors will closely monitor Alphabet's strategies for addressing the challenges in its advertising business and diversifying its revenue streams to mitigate risks associated with overreliance on a single source of income.

More By This Author:

FOMC Minutes This Week Is The Clue To Rate Cut

Gains In US Stocks May Continue After S&P 500 Touched Key 5000 Level

Watch It; US CPI Will Decide The Upcoming Fed’s Policy

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more