Nasdaq Tanks As "Gamma Unclench" Arrives - Here Are The Levels To Sell (Or Buy)

US equity markets are under pressure this morning with Nasdaq leading the charge lower (having been dumped at the Asia open, the European open, and the US open)...

(Click on image to enlarge)

The Dow, S&P, and Russell 2000 all reversed at their 200DMAs and look set to test the 100DMA (Nasdaq never made it back to its 200DMA)...

(Click on image to enlarge)

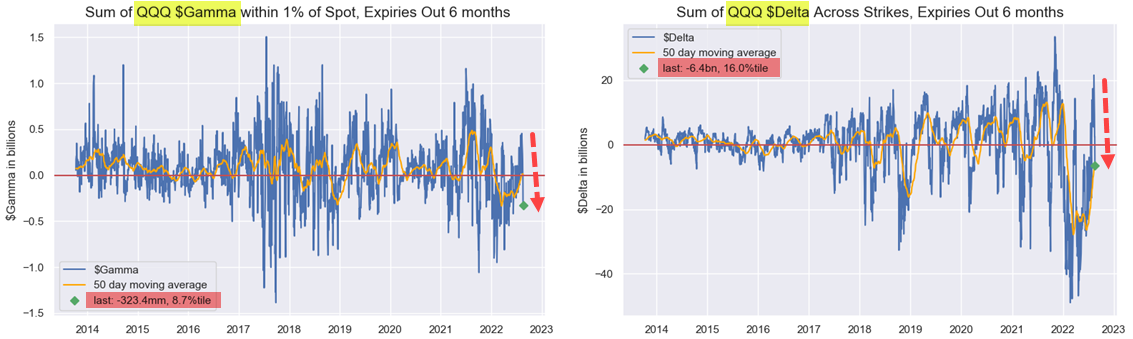

As Nomura's Charlie McElligott notes, one major reason for this sudden volatility is the anticipated post-Op-Ex “Gamma Unchlench” arrives and is allowing US Equities a larger trading distribution, with several key technical levels in play(or broken):

- Most critically after Friday’s heavy expiration activity, we now see Dealers in “Negative Gamma vs Spot” location below 4219 flip-line for SPX / SPY consolidated options (Note: QQQ, IWM and HYG all now in “Negative Gamma vs Spot” territory as well)

- ES1 through the 4215 “50% high / low” retrace

- Through 4202 sees a break below the bottom of the mid-July bull channel

Nasdaq stands out as the most obvious pivot back into "negative gamma" territory, with the ensuing 'delta purge'...

(Click on image to enlarge)

So what happens next?

As McElligott notes, from a “flows” perspective on the now two month Equities rally, we have focused on:

- 1) Systematic strategy buying-to-cover from CTA Trend (+$78.6B of Global Equities buying off the June net exposure low / peak of aggregated “Short” positioning);

- ...as well as 2) Vol Control re-allocation to add back exposure (+$35B off the May exposure lows), which only then accelerated the destruction of downside hedges AND forced grabbing into upside...

- ...hence 3) massive Mechanical “Positive $Delta” flows from the Options space, which at one-point were > +$900B of implied $Delta off the June low

NOW, however, we see those Systematic and Mechanical “buy” flows either largely spent, or at risk of actually becoming supply a few weeks out, IF Vol was to reset higher here for a sustained period of time

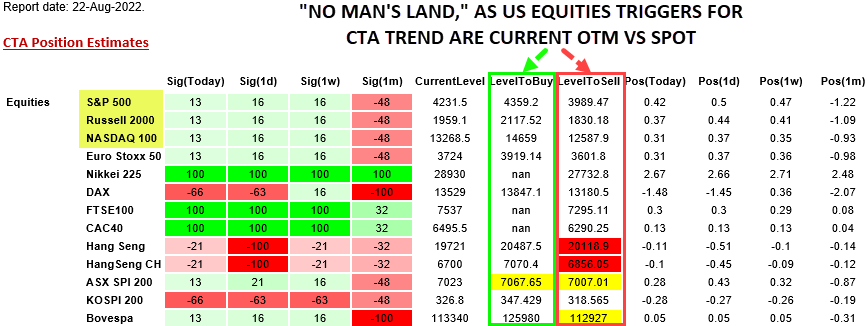

1. CTA Trend now sits in “no man’s land."

Well-below releveraging buy-triggers overhead in US Equities futures... but

Above de-leveraging / flip back “Short” sell-triggers...

(Click on image to enlarge)

For the S&P, 3989 is key for a big purge (with 4094 the next support to watch at 100DMA), but for the Nasdaq 100 the 'level to sell' is close at 12,587.

2. Vol Control is the local tie-breaker, and it’s nuanced as-ever

Vol Control in the NEAR-TERM (next two weeks) would require sustained 2.0% daily chg type days in-order to see a pivot back towards de-allocation (2% daily chg = -$4.7B over the next two weeks)—or, as an alternative, larger 1d absolute Vol shocks (e.g. a 3.0% SPX change today would see -$2.3B of VC de-allocation selling)

3. From a Vol mkt perspective, Spot lower / Vol higher and resumption of downside hedging demand

(Skew actually performed on Friday) will see NEGATIVE $Delta flows picking back-up.

For the Nomura strategist, the key for this nascent selloff to hold is going to be the willingness then of ACTIVE / DISCRETIONARY traders to again “lean into” the market and resume “Shorting” HERE AND NOW while the post-Op-Ex “window for Vol expansion” is open, and / or take down “Nets” again ahead of a rough seasonal for Equities, coming after what’s been a vicious two-month covering explosion across previously “grossed-UP” Shorts in “worst of” themes...

...so there is some scar tissue to sort out.

More By This Author:

The World's Second Largest Cinema Chain Is Preparing For Bankruptcy

NYC Rental Market Sets A "Record Number Of Records"

Private Mortgage Lender Bust Begins As Loan Applications Crash

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more