Nasdaq Sharply Lower As Tech Selloff Weighs

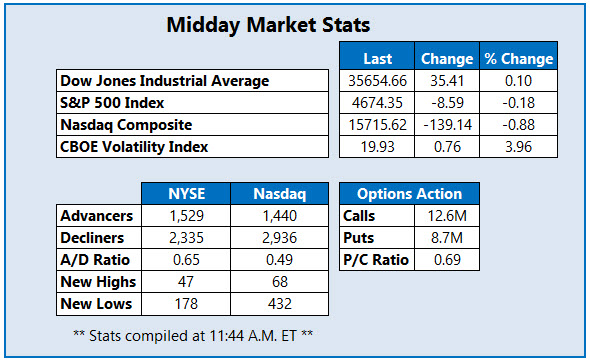

The Nasdaq Composite (IXIC) is sharply lower midday, as the tech selloff weighs on the benchmark, while the Dow Jones Industrial Average (DJI) is up roughly 35 points, and the S&P 500 (SPX) sits modestly in the red. Economic data showed the IHS Markit manufacturing purchasing managers' index (PMI) rising to 59.1 in November from the previous month's 58.4, while the IHS Markit services PMI dropped to 57 in November from 58.7, with both figures holding above 55 despite labor and supply shortages.

Dick's Sporting Goods (NYSE: DKS) is seeing notable options activity today, as the stock falls despite its upbeat third-quarter report and raised outlook -- down 9.4% to trade at $127.10 at last glance. So far, 24,000 calls and 11,000 puts have crossed the tape, with options volume running at eight-time what's typically seen at this point. The weekly 11/26 135-strike call is the most popular, with new positions being opened there.

Near the top of the Nasdaq, today is Pasithea Therapeutics Corp (Nasdaq: KTTA), last seen up 210% to trade at $6.87. The biotech company is skyrocketing after news that its subsidiary, Pasithea Clinics, was granted approval to offer Spravato, its nasal spray for treatment-resistant depression, in the U.K. Already approved in the U.S., the company stated that only three clinics have been accredited to offer this treatment. On the charts, today's pop has the stock, which went public in September, jumping to record highs.

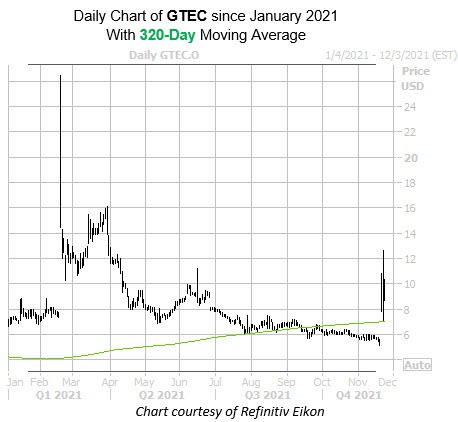

Meanwhile, Greenland Technologies Holding Corp (Nasdaq: GTEC) is on the other end of the spectrum, down 23.7% to trade at $8.91 at last check. The negative price action is likely a correction from the last two session's of impressive gains after the company announced the launch of its second electric industrial vehicle line, the GEL-1800 Electric Wheeled Front Loader. Up roughly 21% year-to-date, the 320-day moving average lingers below as support.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more