Nasdaq Pacing For Weekly Win Despite Shaky Bond Market

Stocks are modestly higher at midday, as Wall Street kicks off a new month and quarter. The Dow Jones Industrial Average (DJI) is up 31 points, brushing off lackluster jobs data. The S&P 500 Index (SPX) is just above breakeven, while the Nasdaq Composite (IXIC) stands comfortably in the black, despite the shaky bond market. The latter is the only benchmark pacing for a weekly win. Elsewhere, West Texas Intermediate Crude (WTI) is trading around $100 per barrel, after the White House's promise to release strategic oil reserves.

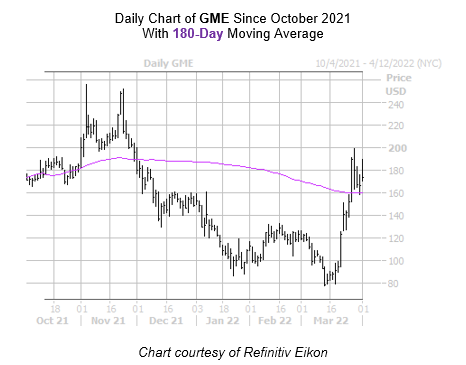

GameStop Corp. (NYSE: GME) is seeing an unusual amount of options activity today after the company announced plans to increase the number of shares outstanding from 300 million to 1 billion in an attempt to trigger a stock split. As a result, 156,000 calls and 62,000 puts have crossed the tape, which is double the intraday average. Most popular by far is the 4/1 200-strike call, followed by the 250-strike call from the same series, with new positions being opened at both. GameStop stock was last seen 4.3% higher at $173.66, with the flattening 180-day moving average catching some dips in recent sessions. Year-to-date, GME is up 16.3%.

The top-performing stock on the New York Stock Exchange (NYSE) today by a wide margin is Manning and Napier Inc (NYSE: MN). Last seen up 41.4% at $12.76, MN is now trading at roughly seven-year highs after the investment company was acquired by asset management firm Callodine Group in $245.7 million deal. Year-over-year, the equity sports a 97.4% lead.

Redwire Corp (NYSE: RDW) is pacing towards the bottom of the NYSE, last seen down 30.5% at $5.90 after Jefferies cut the stock's price target to $13 following the company's 2021 financial report. After going public in February 2021, Redwire stock steadily traded around the $10 mark, until volatility took hold in September. RDW soared to an Oct. 25 record high of $16.98, before careening to a Feb. 24, all-time low of $4.25. Year-over-year, the equity is down 42.2%.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more