Nasdaq Composite Holds Critical Support, So Far So Good For Bulls

As we have pointed out several times, tech stocks have lead the bull market since the financial crisis.

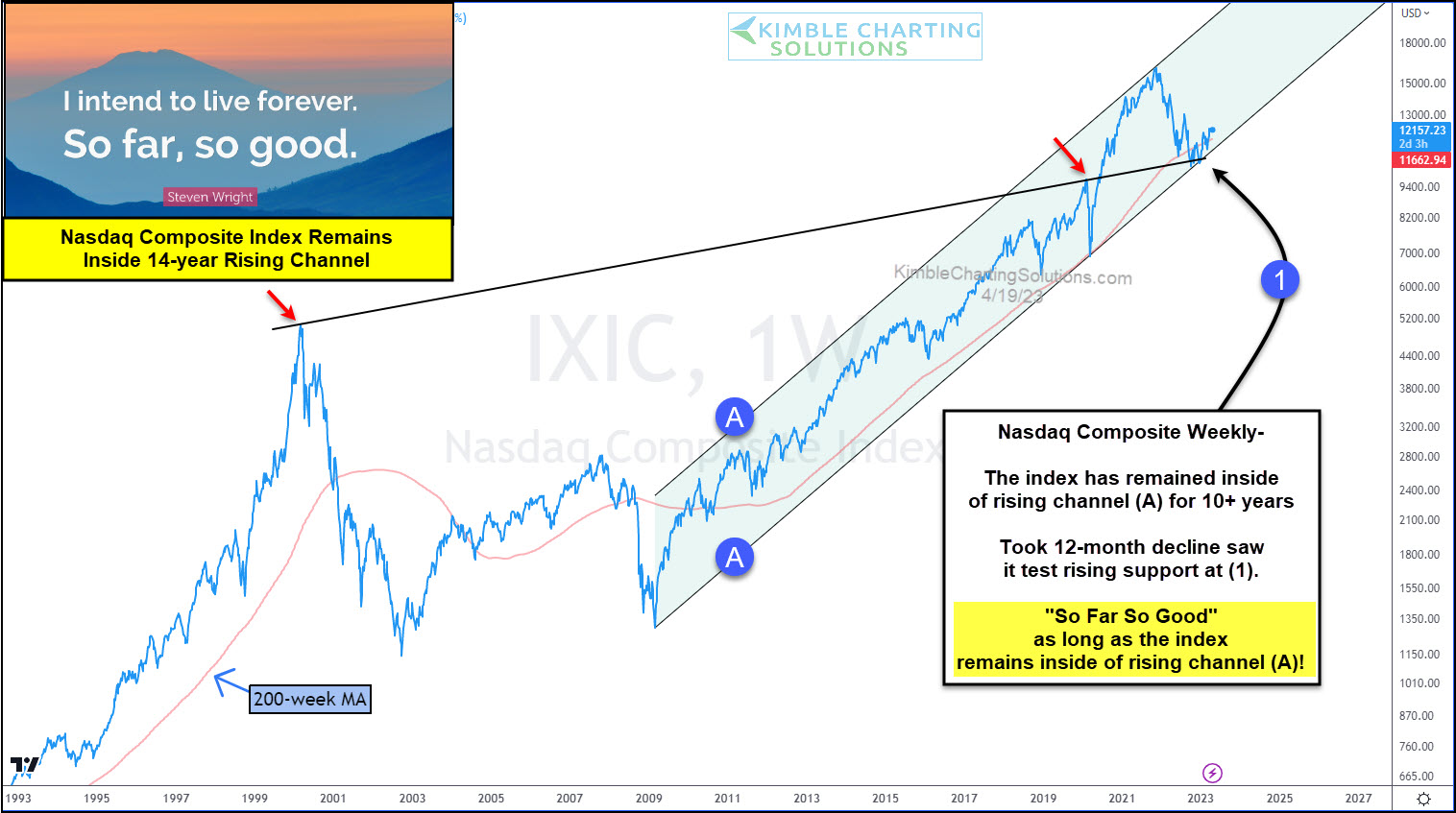

And today’s chart highlights that as well as crucial 14-year bull market support.

Below is a “weekly” chart of the Nasdaq Composite. As you can see, the Nasdaq has remained inside a rising bull market channel for the past 14 years, marked by each (A). But within the past 18 months, it hit the top of the channel (resistance) and turned lower.

That turn lower, saw the Nasdaq test dual trend support at (1), fortified by its 14-year up-trend support line.

So far, so good for tech bulls. The Nasdaq has held support and is attempting to rally. This will be an important support level to watch for investors in the months to come.

(Click on image to enlarge)

More By This Author:

This Indicator Suggests Gold To Outperform Stocks For Years

Semiconductors (SMH) Rally Trades Into Critical Resistance

Gold Bulls Dancing As Prices Close At Monthly / Quarterly Highs

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.