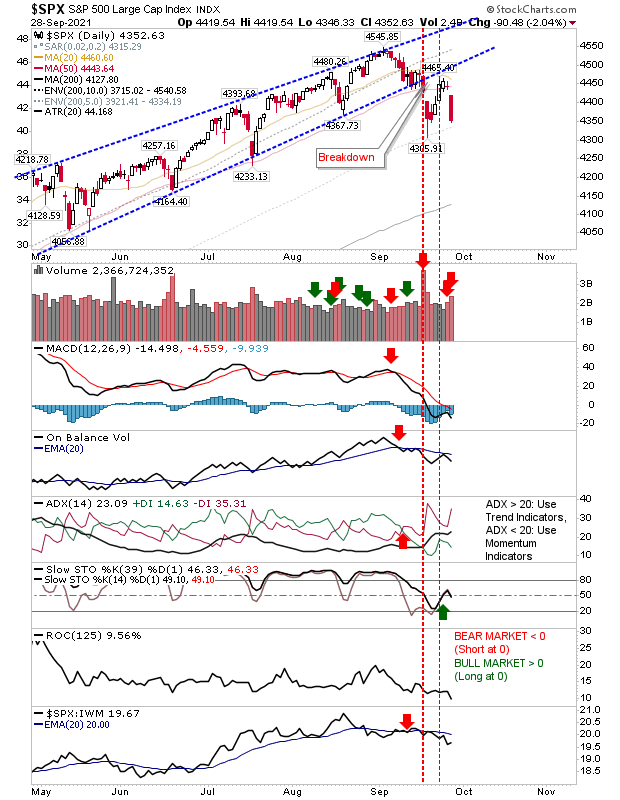

Nasdaq Breakdown Follows That Of S&P

The Nasdaq finally gave in to the selling experienced by the S&P with breakthrough support defined by the July and August swing lows. It came with a 'sell' trigger in On-Balance-Volume and an acceleration in the relative loss to the Russell 2000. The next support level is the 200-day MA - a moving average that last saw a test in early 2020 when Covid first hit the headlines. It's hard to see buyers stepping in until we reach this moving average as there isn't a whole lot of alternative support to work with.

The S&P effectively confirmed the breakdown with the bearish continuation pattern. I would be looking for a measured move down to 4,425 but like the S&P I would be looking for a test of the 200-day MA.

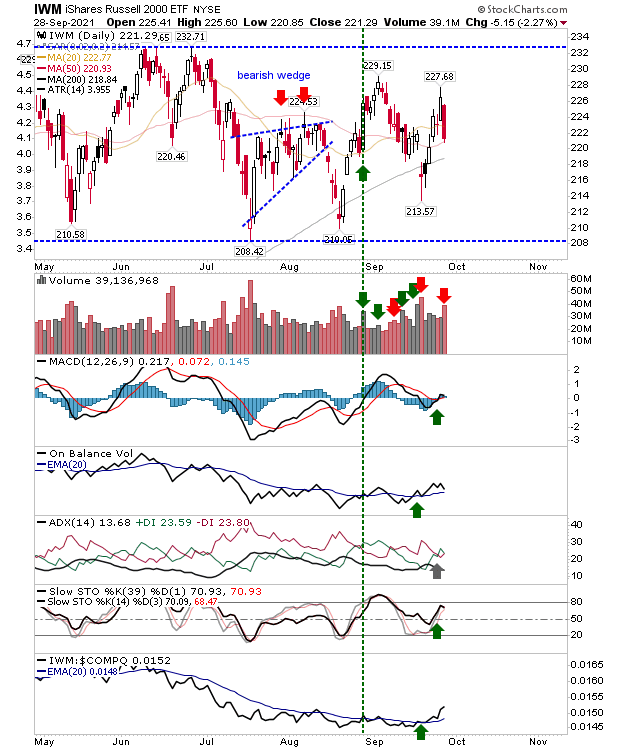

The index which continues to ignore these ebbs and flows is the Russell 2000. Just as recent gains did little to change the dynamics of its trading range, today's losses likewise did little either. Technicals are net bullish, which offers bulls an opportunity to continue the rally to resistance.

Indices are playing out a larger decline but nothing too damaging - not while indices trade well above their 200-day MAs.The Russell 2000 holds the key as it continues to trade sideways.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more