Nasdaq 100: Summer Surge Setting Up Again?

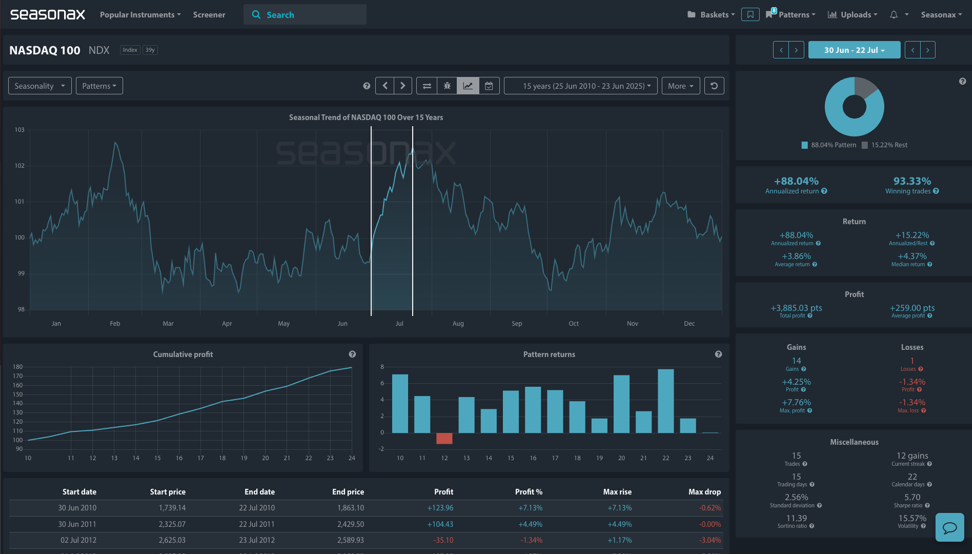

- Instrument: Nasdaq 100 (NDX)

- Timeframe: June 30 – July 22

- Average Pattern Move: +3.86%

- Winning Percentage: 93.33%

You may not realize that the Nasdaq 100 enters one of its most statistically bullish stretches at the end of June. Over the past 15 years, this large-cap tech-heavy index has delivered consistent gains between June 30 and July 22, boasting a 93.33% win rate and an annualized return of +88.04% during this short three-week window.

Let’s break down what makes this seasonal setup so compelling right now.

(Click on image to enlarge)

A Pattern of Precision: 14 Wins in 15 Years

The data behind this window is remarkably clean:

- 14 out of 15 trades closed in profit

- Average return: +3.86%

- Median return: +4.37%

- Maximum gain: +7.76%

- Sortino ratio: 11.39 (exceptional risk-adjusted return)

Even more impressive is the cumulative profit curve, which shows a steady climb year after year — with a current 12-year winning streak still intact.

This bullish burst often coincides with a strong Q2 earnings season for tech, lower summer volume, and front-running of institutional flows before broader market rotations kick in post-July.

Why It Matters This Year

With AI names still dominating headlines, and Fed policy expectations tilting more dovish into Q3, the Nasdaq’s leading growth names may once again attract early-summer capital. This short window offers traders a chance to tactically participate in high-probability directional bias without needing to overextend risk.

If historical performance repeats, we could see another clean upward leg before volatility returns in August.

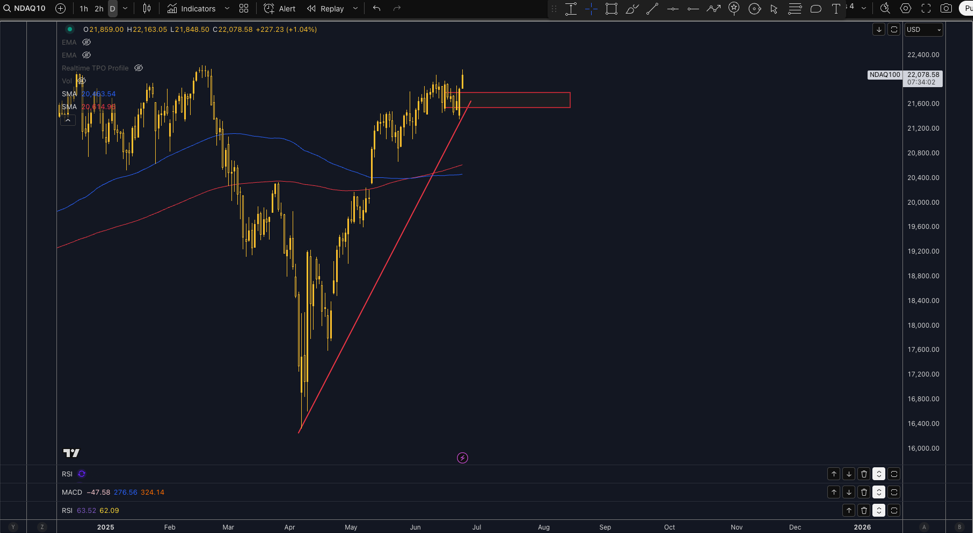

Technical take

The Nasdaq is currently respecting the 21,600 area and that can offer key support on the daily chart should price test that level again. Near term stops could be placed underneath the last swing in anticipation of a potential seasonal upside again.

(Click on image to enlarge)

Trade Risks

A negative shock from key earnings names (Apple, Nvidia, Microsoft) could trigger broad Nasdaq weakness. Any surprise from the Federal Reserve (e.g., hawkish tone or delayed rate cuts) could sour risk appetite. Geopolitical risk or sudden bond market dislocations might distort this otherwise clean seasonal edge.

Video Length: 00:02:38

More By This Author:

Can Amgen Advance On Anti-Obesity Drugs?How The S&P 500 Quietly Delivers A 100 Percent Win Rate

Crude Oil Climbs As Geopolitical Risks Tighten Supply Outlook

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more