Nasdaq 100 Outlook: Where Next For Meta Stock Ahead Of Q2 Earnings?

Image Source: Unsplash

Meta Q2 earnings date and time

Meta is scheduled to report second-quarter earnings after US markets close on Wednesday, July 26. A conference call is scheduled on the same day at 1400 PT.

Meta stock: Q2 earnings consensus

Revenue is expected to rise 7.7% year-on-year in the second quarter to $31.1 billion and adjusted EPS is forecast to increase 18.5% to $2.91.

Meta stock: Q2 earnings preview

Meta has been the second best performer in the Nasdaq 100 in 2023, having more than doubled in value since the start of the year. Meta’s valuation sank to as low as 8.2x forward earnings in late 2022 as it succumbed to the slowdown in the advertising market and the broader selloff in tech stocks. That is a figure that would appeal to a value investor, let alone those hungry for tech-fuelled growth, and those that recognised that have been handsomely rewarded. But that multiple has since shot back up to 19.7x, returning above its five-year average, following this year’s recovery.

This recovery will be tested this earnings season and Meta will need to impress if it wants to keep up the momentum. Fortunately, this has the potential to be a big quarter. Earnings are forecast to grow for the first time in 18 months, its new Threads platform is taking off, and there is a chance Meta could stir up some excitement about its AI prospects.

Revenue is expected to rise 7.7% in the second quarter to $31.1 billion as it starts to come up against easier comparatives. Meta has done well to keep engagement going, with average impressions growth seen rising 17.8%, but is still suffering from lower prices as fewer businesses splash out on advertising, with average prices forecast to be down over 11% from last year. Prices have now been under pressure for well over a year and markets don’t see them rebounding until 2024 at the earliest. Any signs that the ad market is making a comeback sooner would be very bullish for the stock.

Meta was the first to start making job cuts last year and was one of the most aggressive when it came to cost cutting, having become bloated during the pandemic. That is now starting to pay off as costs are expected to grow at a slower pace than sales for the first time in two years! As a result, adjusted EPS is forecast to increase 18.5% to $2.91.

(Source: Estimates from Bloomberg)

The outlook for the second half is rosy, with Wall Street anticipating a significant rebound in earnings as it comes up against easier comparatives. In fact, the second half is expected to see such a surge in earnings that analysts believe annual earnings will hit their second highest figure on record, trailing only the peak we saw when demand for tech exploded in 2021.

The outlook will therefore be critical. Wall Street is looking for Meta to target third quarter revenue of $31.2 billion, which would be up around 12.5% from the year before.

Still, the prolonged recovery in the advertising market remains vulnerable and that could pose a risk to Meta’s estimates. The economy continues to cool – although not falter – as interest rates continue to rise and the risk of a downturn is increasing. Meta may be able to keep eyes on screens but is less able to influence the impact of the wider macro conditions on its customers, which lean toward small and medium-sized businesses.

Its metaverse ambitions continue to be a drag as Meta continues to spend big on its plans, having refused to pullback despite the pressure on earnings over the past two years. Its Reality Labs arm that homes these activities is forecast to report an operating loss of $3.7 billion this quarter. That will be higher than last year but Meta is past the peak spending we saw last year.

Meta stock: Will Threads be a catalyst?

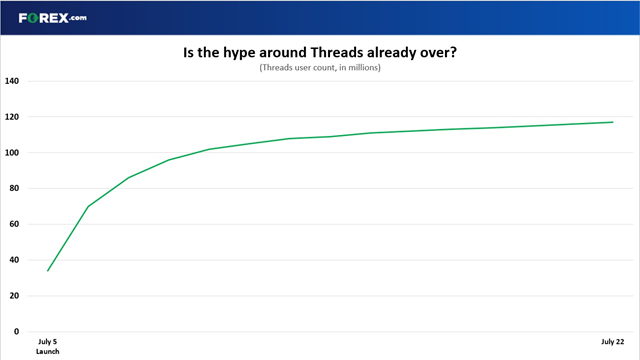

We are also likely to get some more insight into its new social media platform Threads, which has already secured over 100 million users.

It is the fastest-growing app of all time, although this was helped by the fact Meta leveraged the existing user base on the already established Instagram. It took only two weeks to get 100 million signups, but data suggests that growth has since slowed with the platform thought to have 117 million as of July 22, according to a tracker from Quiver Quantitative.

(Source: Quiver Quantitative)

Threads has been designed to compete directly with Twitter, or should I say ‘X’ following this week’s rebrand, but it has some way to go before it can claim to be the biggest platform for public discussion, with Elon Musk’s platform thought to have around 450 million users at present.

Threads is certainly on the right path as users numbers continue to grow. However, it is important to note that users cannot delete their Threads accounts without also saying goodbye to their Instagram accounts, which may prove a crucial rule that prevents users numbers falling even if users decide Threads isn’t for them. Demonstrating engagement will therefore be key, and user numbers should be taken with a pinch of salt.

AI stocks: Meta

Meta could invigorate some excitement around its AI prospects amid reports it is preparing to launch a commercial version of its own AI model that can create text, imagery and code. This could see Meta catch up with its rivals that are currently have a lead in the race for AI supremacy.

AI’s appetite can only been fuelled by two things – computing power and data. Meta certainly has access to huge swathes of data collected from users across its social media platforms and that can feed AI models. And, for the computing power, Meta has turned to the one of the companies to have carved out an early lead in AI – Microsoft.

Microsoft and Meta recently launched the LlaMA 2 suite of large language models on both Azure and Windows, which are designed to help businesses build their own generative AI tools. Meta is keen to thrust the tools in front of as many businesses as possible.

AI has helped Meta rebound this year but markets have not assigned much, if any, value to Meta’s AI potential and this earnings season gives it a chance to show it has what it takes to be a big player in this breakthrough space.

Where next for META stock?

Meta shares have pulled back since hitting 17-month highs earlier this month. However, that has seen the RSI also drop firmly back out of overbought territory while staying within the rising channel that has been in play all year.

We can see the stock flirted with the 78.6% retracement before facing some resistance. A recovery back above the psychological level of $300 is needed before it can try to break above $320 and set fresh highs. Any success here could potentially open the door to a much large move toward $350.

On the downside, the stock has slipped into the lower-end of the channel and risks testing the supportive trendline, which is aligning with the 50-day moving average, if it comes under pressure. Investors will hope the 61.8% retracement can provide some support if we see a reversal. There is some hope that earlier support around $288 could emerge beforehand.

Nasdaq 100 analysis: Where next?

Meta is the fifth largest constituent of the Nasdaq 100 with a weighting of 3.5%, meaning its results will influence how the index performs.

The index has followed a similar pattern to Meta this year. The index pulled back last week as we got the first earnings out from the tech sector. We could see the mid-way of the channel provide some support considering it has largely managed to remain above here for the past two months. We could see it slip back toward the 78.6% retracement at 15,300 if it remains under pressure. Any severe drop risks seeing it fall back into the bottom-half of the channel, which is currently lining-up with the 50-day moving average.

On the upside, the Nasdaq 100 needs to close back above the recent-high of 15,888 before eyeing a move above the psychological level of 16,000.

More By This Author:

Nasdaq 100 Forecast: How Will Alphabet Stock Perform Ahead Of Earnings?

Nasdaq 100 Outlook: Where Next For Microsoft Stock Ahead Of Earnings?

Earnings This Week: Big Tech, UK Banks And Oil Giants

Disclosure: For our complete disclosure and risk warning, please click here.