Nasdaq 100 Forecast: Are Investors Apprehensive About Big-Tech?

NASDAQ 100 STOCK FORECAST: RISING TRENDLINE AIMS TO KEEP INDEX AFLOAT

The Nasdaq 100 fell under pressure alongside the Dow Jones and S&P 500 early this week as traders reassessed the likelihood of a US-China trade deal. After statements from various officials on both sides suggested a deal is unlikely prior to the 2020 US Presidential election, risk assets suffered. The remarks confirmed what was suspected by many – that reported progress far exceeded actual agreement. Now, market participants are left to discern the appropriate valuation for stocks with the trade war primed to continue for the foreseeable future.

While the Dow Jones and S&P 500 have their own concerns to grapple with, the Nasdaq 100 may find itself particularly exposed. Leaning heavily towards technology stocks, the Nasdaq 100 will suffer if semiconductors like Micron, Texas Instruments, and Nvidia fall further – a prospect that becomes more plausible as the trade war continues. That being said, it is unclear how much trade optimism was accounted for in their quarterly forecasts, but the market will soon find out when Micron reports earnings in just two weeks.

(Click on image to enlarge)

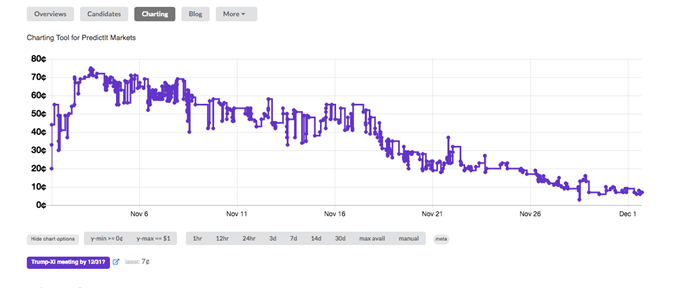

Odds that President Trump and President Xi meet by December 31 according to PredictIt

In the meantime, the Nasdaq could be subjected to further volatility. After months of back-and-forth, it seems as though the market has finally come to accept the talks are producing very little, while the US-China relationship continues to deteriorate in other areas. Therefore, the trade optimism cited by media outlets may be short-lived, and the Nasdaq 100 could threaten further losses.

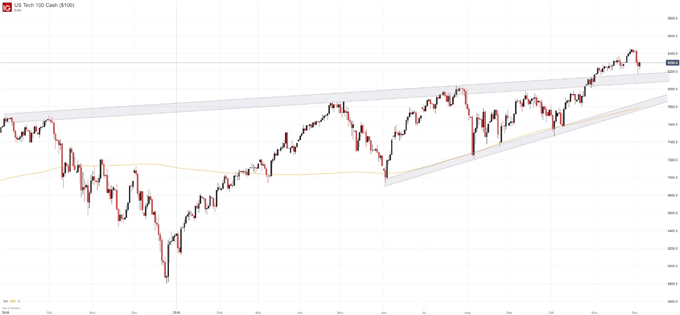

NASDAQ 100 PRICE CHART: DAILY TIME FRAME (JANUARY 2018 – DECEMBER 2019)

(Click on image to enlarge)

If bearishness does continue, the ascending trendline that coincides with prior all-time highs could look to be an early area of support. Helping to buoy price on Tuesday, the 8,200 area could look to do so again in the coming days before the psychologically significant 8,000 mark comes into focus. It is also important to note the upcoming holiday conditions and their potential impact on stocks.