Nasdaq 100 ETF Affirms Bullish Outlook With Five Wave Rally

Image Source: Unsplash

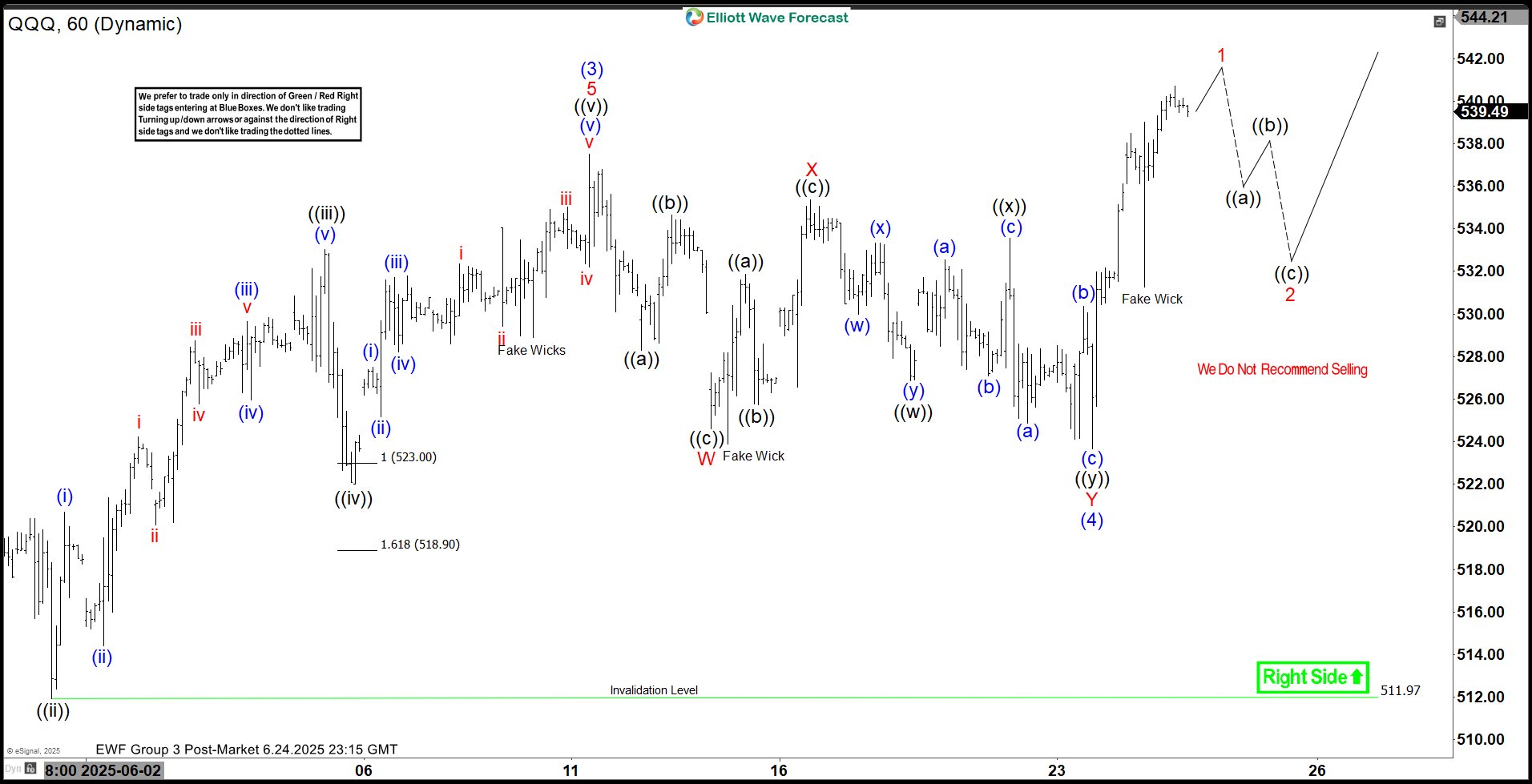

The Nasdaq 100 ETF (QQQ) has continued its upward trajectory, confirming a five-wave Elliott Wave structure originating from the April 7, 2025 low. This development solidifies a bullish market outlook and eliminates the possibility of a double correction scenario. Starting from the April 7 low, wave (1) concluded at 443.14. Wave (2) pullback then followed which ended at 404.44. Subsequently, the ETF surged in wave (3) to 537.5, exhibiting an internal five-wave impulse structure. As depicted in the 1-hour chart, the wave (4) pullback unfolded as a double three Elliott Wave pattern.

From the wave (3) peak, wave W declined to 524.61, and wave X rebounded to 535.37. Last leg wave Y descended to 523.65, completing wave (4) at a higher degree. The ETF has since resumed its ascent in wave (5). From the wave (4) low, wave 1 of (5) is nearing completion, with a forthcoming wave 2 pullback expected to correct the cycle from the June 24, 2025 low before the rally resumes. This pullback should attract buyers at the 3, 7, or 11 swing levels, setting the stage for further upside potential. The bullish structure underscores confidence in continued upward momentum for QQQ.

Nasdaq 100 ETF (QQQ) 60-Minute Elliott Wave Technical Chart

QQQ Elliott Wave Technical Video

Video Length: 00:05:24

More By This Author:

GBPJPY Elliott Wave Outlook: Impulse Pattern Approaching EndTexas Instruments Rallies 45%, Confirms Bullish Sequence

Elliott Wave Analysis: Silver Nears Key Support Zone

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more