MyoKardia Brings Hope To Hypertrophic Cardiomyopathy Patients

Written by Dan Cohen and Scott Matusow

Currently, we are in the midst of a dramatic shift in the field of biotechnology and the Stock Market is beginning to take notice, as evidenced by the recent surge in the iShares Nasdaq Biotechnology (IBB ) and SPDR S&P Biotech ETF’s (XBI).

Significant improvements in computational and genomic tools have enabled a deeper understanding of the underlying bio-markering of new drugs to treat and potentially cure a wide-array of disease. Under the leadership of Dr. Scott Gottlieb, the U.S. Food and Drug Administration (FDA) has been setting a tone which better accommodates the technological and drug development shifts that are occurring across the sector. This builds upon the precedent set by the 21st Century Cures act which provides the FDA the tools necessary to accomplish this transformation.

Also, the FDA has been guiding for a more expedited and beneficial pathway for therapeutics which molecularly target the underlying root of disease, using a risk/reward based assessment model that should benefit patients, doctors, and investors now and in the future.

The primary focus for Gottlieb will be in assisting and reforming developmental pathways for new personalized therapeutic modalities which target specific genetic variations. Within six months, Gottlieb plans to issue guidance to help expedite possible break-through therapies to market.

At a recent senate hearing Gottlieb stated;

“this new policy will address the issue of targeted drugs, and how we simplify the development of drugs targeted to rare disorders that are driven by genetic variations, and where diseases all have a similar genetic fingerprint, even if they have a slightly different clinical expressions.”

In a more recent blog post entitled “How FDA Plans to Help Consumers Capitalize on Advances in Science,” Gottlieb adds additional commentary on how he intends to achieve this goal. He particularly focuses on the idea of ‘in-silico’ drug development, which means the use of advanced modeling software to generate and evaluate potential drug and device candidates. In the post, he guides that additional guidance will be issued in order to better inform how aspects of these tools can be incorporated into the various aspects of biotechnology development.

Given this context, our first instinct is to look at novel approaches arising in targeted oncology therapy that should significantly benefit as the FDA modernizes and adjusts to this new drug development paradigm. Many of the latest tools are being put to use in this field of development by top-notch management teams in well-financed developmental biotech companies, while others are quickly becoming “me-toos” in an increasingly crowded space.

At Stockmatusow, we constantly scan for companies that are taking the correct approach in the clinic which possess highly differentiated and novel platforms; companies we believe have the potential to be ‘multi baggers’, generating significant alpha in both the near and long term.

Late last year, we began a 3 part write-up series on Calithera Biosciences (Nasdaq: CALA), and more recently a feature article on GlycoMimetics, Inc. (Nasdaq: GLYC). Both of these companies to date have seen success in early data, with platform confirmation in part via big pharma partnerships and significant collaborations. Additionally, both of these companies have seen their stock prices increase 3 to 7 times from when we began to write on them. These developmental companies are particularly focused on defining bio-markers and other prognostic indicators to better define patient populations. We believe both of these companies will ultimately prove successful which we think will result in even larger stock price gains in the future.

Our new feature pick that meets our criteria pivots away from Oncology to a much less covered but arguably equally as an important therapeutic target, cardiomyopathy. Myokardia (Nasdaq: MYOK) is a relatively young company which is taking advantage of the computational tools we have referenced here to achieve a deeper understanding of the structural variations in heart tissue. The company’s lead asset MYK-461 is designed to target symptomatic hypertrophic cardiomyopathy (HCM), a disease marked by hyperdynamic contractility of the heart.

HCM is estimated to impact one in every 500 individuals and is the most common heritable cardiac disease. However, a recent study suggests estimates these numbers may be too low. As a result of this disease, the heart muscle undergoes asymmetric thickening of the left ventricular walls, reducing both the cavity size and stroke volume. This impairs the ability for the heart to deliver oxygen-rich blood to the body.

As a result, the heart will attempt to compensate for the stress signals by pumping harder, leading to a viscous cycle of disease progression and a dramatic decrease in functional capacity over time. In short, patients with symptomatic HCM suffer from a diminished quality of life, often times being unable to perform tasks many of us take for granted – playing with our children, even simply walking up a flight of stairs. Sadly, in many of these patients life expectancy is greatly reduced.

There are no effective treatments approved for this debilitating disease. Physicians will often prescribe beta blockers or calcium channel inhibitors as part of the current standard of care, yet neither of these modalities have been validated to treat HCM in a randomized trial – no meaningful clinical benefit.

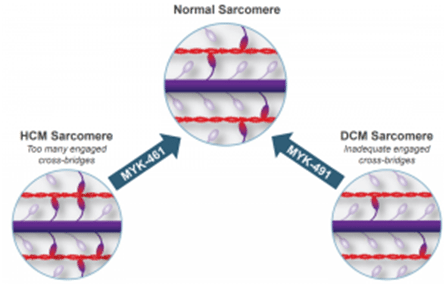

Unlike beta blockers and calcium channel inhibitors, MYK-461 seeks to target the underlying driver of this disease through modulating sarcomere contractility by inhibiting myosin ATPase.Myosin is the force generating protein in the muscle and the mutations here are the driver of the majority of HCM disease cases.

The underlying structural dynamic of the disease has been linked to an abundance of myosin bound to actin in the sarcomere which increases the output force. By blocking myosin ATPase, MYK-461 seeks to stabilize the unbound myosin and keeps it from converting to the strongly bound state. In doing so, this should translate to a reduction of overall force output and reversion to a normal level of contractility.

It remains unclear if MYK-461 will be able to reverse the thickening of the walls in human beings. However, a normalization in contractility should prevent further disease progression – something beta blockers cannot achieve, placing MYK-461 as a potential standard of care (and potentially accelerated approval) in this grossly unmet need patient population.

Myokardia’s first indication for MYK-461 focuses specifically on symptomatic obstructive HCM (oHCM) which is characterized by wall thickening leading to an obstruction of blood flow between the left ventricular outflow tract (LVOT) and the aorta. This obstruction results in a sharp pressure gradient between the ventricle and the aorta that can rapidly progress the symptoms of the disease.

Physicians will generally aim to relieve the obstruction in this patient population because they are most likely to see a clinical benefit. In patients with severe obstructive (≥50 mmHg gradient) disease, the clinical practice is to perform invasive septal reduction surgery in order to alleviate the anatomical obstruction of blood flow. In the near term, this practice can improve LVOT gradient in addition to functional capacity, including peak volume of oxygen (VO2). However, this does not address the molecular rationale for the development of the disease and relief for most is only temporal.

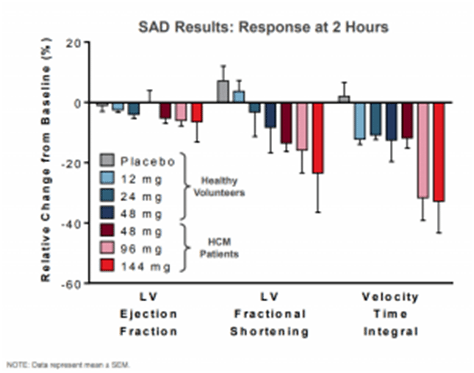

One of the primary reasons for a lack of significant development in therapeutic approaches to clearing obstruction is the lack of animal models of HCM which develop the obstructive physiology. Myokardia has found that felines (house cats) may offer a more relevant model than mice for this subset of patients. Notably, there is a shared molecular mechanism between feline and human HCM, a pair of mutations in the MYBPC3 gene (Myosin binding protein C) and some cats do in fact develop obstruction. In a preclinical model run on 5 cats treated with MYK-461 all showed significant improvements in LVOT gradient and clearance of obstruction in a dose-dependent manner. This has also translated over to a phase 1 trial run on 15 HCM patients where LV ejection fraction, LV fractional shortening, and velocity time integral was reduced in a correlated fashion to dosing as demonstrated in the diagram below.

MyoKardia’s next catalyst upcoming in Q3 centers around its Pioneer-HCM trial; an open label Phase 2 trial examining MYK-461 alone in 10 patients. The primary endpoint of this trial is LVOT gradient, with additional stated objectives of the trial which include functional capacity (Cardio pulmonary exercise test/peak VO2) and clinical symptoms (dyspnea, Kansas City Cardiomyopathy Questionnaire, and New York Heart Association Functional Classification).

More recently, the company has elected to act on the advice of the independent data monitoring committee to add on an additional cohort; MYK-461 + beta blockers in another 10 patients. We feel this decision largely de-risks any potential safety concerns to date, including the possibility of impaired LV function. In other words, safety is strongly tied with efficacy here. By now, we would have known by now if safety has been an issue as we do not think the independent data monitoring committee would allow an additional cohort if there was not a strong safety/efficacy signal.

Myokardia claims this is to better emulate clinical practice, however, the utility of beta blockers in this setting as discussed above isn’t well defined. Rather, we think that this additional cohort is designed to simultaneously demonstrate the usefulness of 461 in the management of oHCM as well as to show the significant inferiority of the current clinical practice (beta blockers). Disproving the validity of the standard of care is a necessary step towards making the case for an accelerated approval pathway. The company has guided for an initial data release from the phase 2 pioneer trial in the third quarter.

Given the heterogeneous nature of the disease progression and variations in myosin mutations in HCM, the FDA’s new approach to targeted therapy is a perfect fit for the indication. In the past studies of mortality benefit were required for a registrational pathway (required for FDA approval) in this indication. However, Myokardia has been guided by the FDA that VO2 can act as a surrogate as it’s a validated quantitative measure of the heart’s functional capacity. It will be up to Myokardia to bridge reductions in LVOT gradient therapeutically with VO2 and there is a reasonable basis to believe this will be the case.

Myokardia is also focusing on improving the diagnosis of HCM which is notoriously poor. Despite the estimated prevalence of at least one in 500 people impacted by this disease, only about 100k patients in the U.S. are diagnosed and are being treated for HCM. Myokardia estimates that of these 100k diagnosed patients, 50-70% have a significant LVOT obstruction, making oHCM a logical first step in establishing a new treatment course.

In order to improve diagnosis and build out a market, the company has partnered with Wavelet Health, a developer of an investigational photo plethysmography (PPG) biosensor that is worn as a wristband. This band shines light onto the skin in order to determine patterns of blood flow and arterial pulses offering a method of improved patient compliance in the diagnosis process.

A person with suspected HCM would be able to wear this device throughout their daily activities with monitoring in real-time. The device is currently being investigated in a sub-study of the pioneer trial in oHCM in addition to an investigator sponsored trial (IST) run by Stanford which is examining the device in step count, heart rate, and heart rhythm. Peak VO2 will also be measured in this IST, presumably to draw a correlation between the PPG sensor and the FDA’s stated registrational endpoint.

Based on the remarks that Gottlieb has made on the pathway forward, we strongly feel that companies like Myokardia that can both utilize these new modeling tools in the development of therapeutics and in diagnostics will be best suited for success in the new FDA direction. In the aforementioned blog post Gottelib particularly remarks;

“An important objective of modelling and simulation is to better evaluate the behaviour of new treatments in rare disease populations that are inherently hard to study.”

There has never been a better time and opportunity for companies such as MyoKardia, given the recent surge in interest and investment in the internet of things (IoT). Advanced diagnostic technologies such as a wearable PPG sensor can both improve patient compliance and afford additional key data outside the clinical setting. The interconnectivity of these devices enables better population scale modelling and important insights in how patients function with the disease in their day-to-day lives. Considering that the primary goal of medicine is to improve the overall quality of life, the collection of data is of utmost importance – this is where IoT advancement comes into play.

On the business leverage end of things, Myokardia has in place an advantageous partnership deal with Sanofi (NYSE: SNY), which possesses one of the strongest sales networks for cardiac diseases in the industry. The deal structure allows Myokardia to retain all domestic rights while paying a small royalty to Sanofi. On the international end it’s the reverse as Sanofi retains full rights while Myokardia would collect royalties.

In addition, Sanofi has taken an 11.7% stake in the company and is actively collaborating in the development of further pipeline candidates designed to target additional subsets of cardiomyopathy, which includes MYK-491 in dilated cardiomyopathy (DCM) – we feel the overall arrangement with Sanofi places MyoKardia in a strong leverage position.

Additionally, with the ongoing advancements in digital health Myokardia is in a strong position to build out a market in a significantly underserved/unmet need patient population. It’s worth noting that this arrangement gives Sanofi a meaningful ‘in’ so-to-speak, as a bridge to a potential acquisition bid on MyoKardia, when and if the time is right.

MyoKardia’s current market cap sits in the low $400M range with the company holding about $150M in cash and cash equivalents (as of March 31st, 2017).If the pending data proves successful we should see an appreciation into the 50-60 range with an upside shot significantly higher into the triple digits if the company can prove that MYK-461 not only halts progression but also reverses wall thickening. However, if a significant patient benefit is not found, we feel that the downside risk would place the stock in the mid high single digits. The downside case is not a scenario that we feel is likely based upon the excellent modelling done to date.

In totality, we think MyoKardia makes for an attractive speculative investment and certainly has binary event ‘run up’ trading value heading into its known catalysts in Q3 of this year.

Disclosure: I am/we are long CALA, GLYC. $MYOK

Disclaimer: This article/video is intended for informational and entertainment use only, and should not be construed as professional ...

more