My Picks For A 5-Punch-Card Portfolio

Background

I always tell students in business school they’d be better off when they got out of business school to have a punch card with 20 punches on it. And every time they made an investment decision, they used up one of their punches, because they aren’t going to get 20 great ideas in their lifetime. They’re going to get five or three or seven, and you can get rich off five or three or seven. But what you can’t get rich doing is trying to get one every day.

- Warren Buffett

This so-called "20-Slot Rule" helps lead to the following consequences:

- You become extremely careful when making any investment decision;

- You invest a lot of your money into your investment idea so that the portfolio gets concentrated;

- You think long-term as your investment idea is going to play out for the rest of your whole life;

- You trade so inactively that much less bad decisions are made and much less trading cost is incurred;

- You are able to carve out more time researching each investment that you made or each potential investment that you plan on.

Although their investing flagship, Berkshire Hathaway, is already too large to practice the portfolio concentration, Warren Buffett and his long-time partner Charlie Munger are the strong opponents of diversification, which they claim to be "the protection against ignorance." Additionally, both of the greatest investors demonstrate ultra patience with very little motion in the market.

My 5-Punch-Card Portfolio

To achieve a market-beating performance, I strongly agree that the concentrated portfolio approach is a prerequisite and that "returns decrease as motion increases." As indicated in my portfolio reviews, one of my critical immediate missions is to significantly decrease the number of holdings while keeping the trading cost low on an annual basis.

I also notice that my yearly top 13 stock picks as a whole has outperformed my real-money portfolio of 40-50 stocks (which has outperformed the benchmark though) every year since inception. For new readers who are curious about my top 13 picks based on the proprietary factor-based model, see 13 Stocks That Top My Factor-Based Value Investing Ranking Model; Performance Review: Stocks That Topped My Factor-Based Quality Ranking Model; Updated Lists Of Stocks Topping Our Ranking Model

Hence, while working towards a more concentrated real-money portfolio, I am intrigued in testing out a hypothetical portfolio by adopting Warren Buffett's philosophy and bringing this exercise a bit to the extreme - only 5 holes on the punch card!

Stock Picking Strategy

So here is what I would do if I am only allowed to buy 5 stocks through the rest of my life:

- Select from the top-quality stocks from my factor-based ranking model;

- Focus on the country/region with regulations to protect investors' interests and a shareholder-friendly culture: the answer here is the United States;

- Look for businesses that possess durable competitive advantages and growth potentials for the long run;

- Bet on industries that will remain stable, face little disruption and, hopefully, enjoy tailwinds from macro trends.

Please note that valuation is not a big concern here, as, over the long term, the fundamental factors play a much bigger role in determining investing returns. The time horizon for consideration is 30+ years for this portfolio.

Based on the strategy above, I am listing my picks for this 5-punch-card portfolio, along with reasons (of inclusion) as well as risks:

Berkshire Hathaway (BRK-A) (BRK-B)

Berkshire Hathaway is the multinational conglomerate holding company, known for its control and leadership by Warren Buffet and Charlie Munger.

The reason: Owning stakes in more than 80 operating subsidiaries and publicly/privately-held businesses, ranging from insurance to retailer, to energy and utilities, the stock appears to be a diversification bet in a concentrated portfolio. But the real reason for my inclusion is regarding the unique culture, including its acquisition/investing approach, reputation, and entrepreneurial spirit, at Berkshire, which imposes a moat around the business.

The risk: After Warren/Charlie left the company, the company culture might be impacted by new management teams down the road. But the cultural factor is generally rooted deep in people's mindset and value system, and hence, I do not see this coming in the near- or mid-term future.

Rollins (ROL)

Rollins is the global leader in providing pest control services and protection against termite damage, rodents, and insects.

The reason: The stock is the top American name in my stock quality ranking last year and the year before. The business enjoys both upside opportunities from emerging markets and downside protection due to the recession-proof-ness in the developed world. It is also an extremely rare case that has been growing revenue and earnings every year for nearly two decades. The company's product and service will be in stable demand in the foreseeable future as well as pests "accompany" us in many corners of our life, such as restaurant, house.

The risk: The market may be saturated too soon, or international expansion may not be executed properly. Another mild factor is the current hefty pricing of the stock, which again should not be a major concern for ultra-long-term buy-and-hold investors.

Clorox (CLX)

As a leading multinational manufacturer and marketer of consumer and professional products, Clorox markets some of the most trusted and recognized consumer brand names, including its namesake bleach and cleaning products.

The reason: According to the company, more than 80 percent of the company’s sales are generated from brands that hold the No. 1 or No. 2 market share positions in their categories. This indicates strong brand equity and explains the business capability of consistently delivering superior returns on capital over the long term. With the mission of "making everyday life better in the world," it is fair to believe that consumer products from Clorox are well positioned to benefit from the improving living standard around the globe.

The risk: the battle between consumer brands and retailers is a long-lasting one. Plus, failing to keep up innovations for new products along with more fierce competition in the space could diminish the company's brand value.

Nike (NKE)

Nike is the world's largest supplier of athletic shoes and apparel and a major manufacturer of sports equipment.

The reason: The company's continuous expansion in the Asia Pacific (especially China) along with a great brand unlocks further growth of its relatively high-margin businesses. Over time, Nike's large investments have been made in sponsorships and athlete endorsements, widening the moat of the business. I believe that the sports goods industry should face limited structural disruptions moving forward, as people would continue (if not increase) their sports activities in aggregate for leisure and better health.

The risk: the market might become saturated sooner than expected and/or brand equity might diminish due to more competition from peers, like Adidas (ADDYY) (ADDDF) worldwide or Anta Sports (ANPDY) (ANPDF) in China.

Domino's Pizza (DPZ)

Domino's Pizza is the seventh-largest fast food restaurant chain by the number of locations in the world.

The reason: Being only 1/10 of McDonald's (MCD) in terms of market value and taking advantage of the trend that millennials favor pizzas over burgers, Domino's should still have great growth ahead. However, the story does not end with pizzas. Domino's actually acts as the ecosystem of restaurant businesses (although just mainly pizza for now), combining standardization of production, efficient operations (from indigent supplies to meal making, to deliveries), the driving force of technology, and the franchise model. This model should be able to apply to some other food verticals in case consumer tastes drift again in the future. In terms of growth, global expansion and further digitization should be the main drivers. Overall, people often have the need of enjoying foods in a convenient way.

The risk: Domino's may fail to keep up with new technological developments and/or changing consumer tastes in the distant future. Additionally, international expansion may not be well executed, especially in light of adapting to local business environments.

Summary

Now for the 5-punch-card portfolio, we have one conglomerate, one consumer/commercial service, and three consumer brands (of food, staples, and sports goods respectively). In almost any case, after all, it should be out of the question that our society is on the way for people to enjoy better food the better way, improve living standards, and continue to conduct sports for leisure and better health.

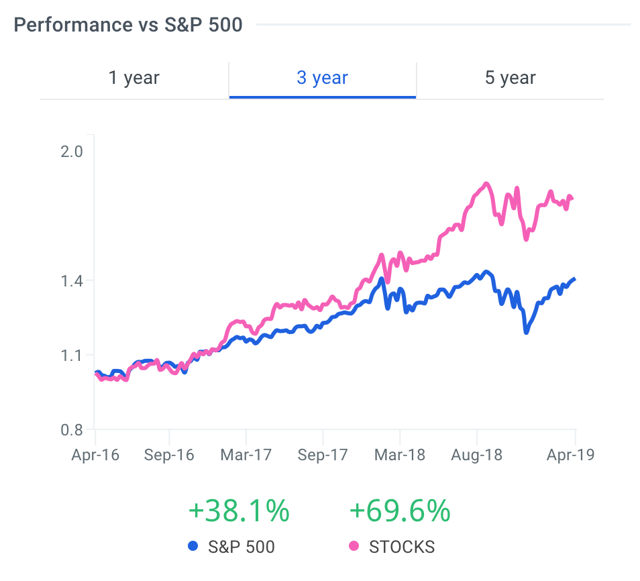

Although this is backward looking and by no means indicates future performances, I am just curious about this 5-punch-card portfolio (assuming an equal weight of each position) compared to the S&P 500 over 1-year, 3-year, and 5-year time horizons. Finbox.io shows me the dramatic deviations from the underlying benchmark below:

Source: Finbox.io; data as of 4/4/2019.

Source: Finbox.io; data as of 4/4/2019.

Source: Finbox.io; data as of 4/4/2019.

I will definitely keep everyone posted on future performances!

So do you buy into the x-Slot Rule for your own investments? And what are your picks for a 5-punch-card portfolio? Feel free to comment at the end.

Any updates?

This is the annual performance review -https://www.gurufocus.com/news/1103844