My Kingdom For An Acronym

It sure was easy in 2017 when all we had to do is buy any stock that was a member of a group with a great acronym. Remember the FANG stocks? Or FAANG? Or FAANGM?

I am not going to spell them out because any reader of this missive knows we are talking about the sexy techs that led the way. But looking at them now begs the question, “Are they even a thing anymore.”

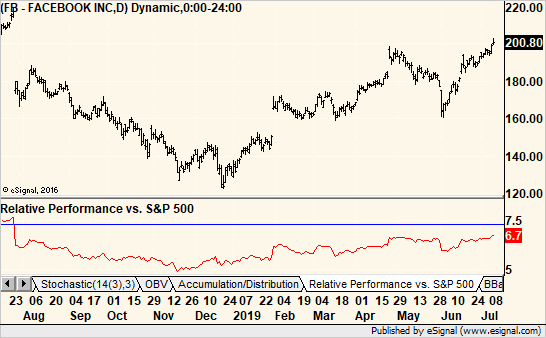

Facebook, Amazon, Apple and Netflix, the latter even with the loss of “Friends”, pretty much paced the broad market over the past year. Sure, there were ups and downs but look at this chart of Facebook with its relative performance plot below. Despite a few months of really lagging and a few months of really leading, your return was just slightly less than it was for the S&P 500.

(Click on image to enlarge)

So much for BTFD on the leaders.

How about the others? Google (I still cannot call it Alphabet) seriously lagged the market for the entire 12-months. Only Microsoft showed some serious FANG-worthy leadership for that period.

The king is dead, long live the king!

Wait, a minute, what king? Oh yeah, the Chinese FANGs called the BAIT stocks. Here, I will have to list them all – Baidu, Alibaba, IQIYI and Tencent. Not surprisingly, we can call them the Amazon, Google or whatever of China. The businesses are very similar.

So, we have a new king acronym. Get your buy orders ready. That is if you like stocks that underperformed the S&P 500 all year. Their charts are particularly ugly, too.

It looks like its atheist time because the Church of What’s Working Now is out of session.

Where, oh where are the PIIGS? You remember them, the five European countries that looked like they were ready to go bankrupt. They were Portugal, Italy, Ireland, Greece, and Spain. I’m not sure how the Emerald Isle got in there, especially since all of our American businesses seemed to be doing deals to move their headquarters there. The rest were all southern European nations that got crushed during the financial crisis. A much better theme.

Well, after years of bumping along the bottom, the PIIGS look like the rest of Europe and the acronym died.

Remember the BRICs? You know, Brazil, Russia, India, and China. They were the next big thing for investors at the start of the century. Some people threw in Indonesia, as well, to make the BRIIC. Acronym makers sure do like double “I” in their offerings, don’t they?

That was your BTFD of choice for a few years. Then it wasn’t. What’s next? Why MINT, of course.

Apparently, the old, new hot economies were to be replaced by the new, new hot economies of Mexico, Indonesia, Nigeria, and Turkey. I guess Indonesia’s rose was still in bloom. Too bad MINT never really caught on. How do I know? No exchange-traded fund (ETF).

I had to dig deep to find CIVITS (China, India, Vietnam, Indonesia, Turkey, and South Africa). With a dopey name like CIVITS, it is no wonder that it never went anywhere. I see you again, Indonesia.

That brings us back to today and the lack of a good acronym for us to blindly love. Some tried MANIA but that was pretty close to FANG with Microsoft, Apple, Netflix, Intel, and Adobe.

What are the latest trends today? Cryptocurrencies? How about BERLS for Bitcoin, Ethereum, Ripple (my favorite Grateful Dead coin), Litecoin and Stellar? Nah, Cryptos are garbage.

How about cannabis? Do any stocks spell out BLUNT or DOOBIE? One can only hope.

The curious lack of acronyms today makes me think that investing and trading is back to being work. What’s up with that?

Disclosure: No positions in anything covered.

Now we have to endure his newest creation....WATCH ack!!!! (wmt azmn tgt cost hd) How can I put Cramer and his damn acronyms on ignore? CNBC is gonna run with this ball forever.

Hey, I like a good acronym.

nothing cramer does should be considered good

BTFD is the only acronym that will outlast them all. It has no expiration date, exists outside the hype, politics, news, cycles, trends, and calendar. I never bought into the whole acronym thing. Plus anything Cramer is a part of (didn't he coin FANG? ) should be ignored. He is the PT Barnum of wall street. The media used FANG as a sound byte to influence the masses. Became over-used and invited sloppy thinking and avoided deeper analysis. You don't really need to dig deep into any of the companies because they began trading together. FANG was like a tiny ETF. And if that doesn't scare you, you should be in CD's.

Did Cramer coin FANG? I always wondering where that came from.

Both are better than crypto's HODL! :)