Mr. Market Sez: “Don’t Worry, Be Happy”

Image Source: Unsplash

(Today’s musical accompaniment is rather obvious, no?)

The question that I’m most often asked lately involves the rapid rise and fall of the Cboe Volatility Index (VIX) over the past two weeks. I was asked it early this morning (at the 8:25 mark of this audio) and on Friday afternoon (at the 39:25 mark of this video). My answers usually hinge upon the fact that VIX is not designed as a “fear gauge”, but instead measures the “30-day expected volatility of the U.S. stock market.” Considering the events that are due in the coming 30-day period – the “known unknowns”, so to speak – the low VIX tells us more about how sanguine investors are about them.

Please tell me if you think that any of these events might have the ability to meaningfully change the market’s mood or direction:

August 23rd: Fed Chair Powell speaks at Jackson Hole

August 28th: Nvidia (NVDA) earnings

August 30th: Core PCE

September 6th: August Nonfarm Payrolls and Unemployment

September 11th: CPI

September 12th: PPI

And by the way, as of today, this minor event is within 30 days:

September 18th: FOMC Announcement

Throw in the fact that liquidity often suffers around the end of the summer and that September is a seasonally difficult month – the 10-year average return for the S&P 500 (SPX) is -1.19% – and it does seem interesting that volatility assumptions have ebbed substantially. Bearing in mind that the last two Septembers have been treacherous -19.55% (2022) and -11.86% (2023), it seems short-sighted for investors to price SPX index options so that the VIX index that is derived from them is only 14.70 right now.

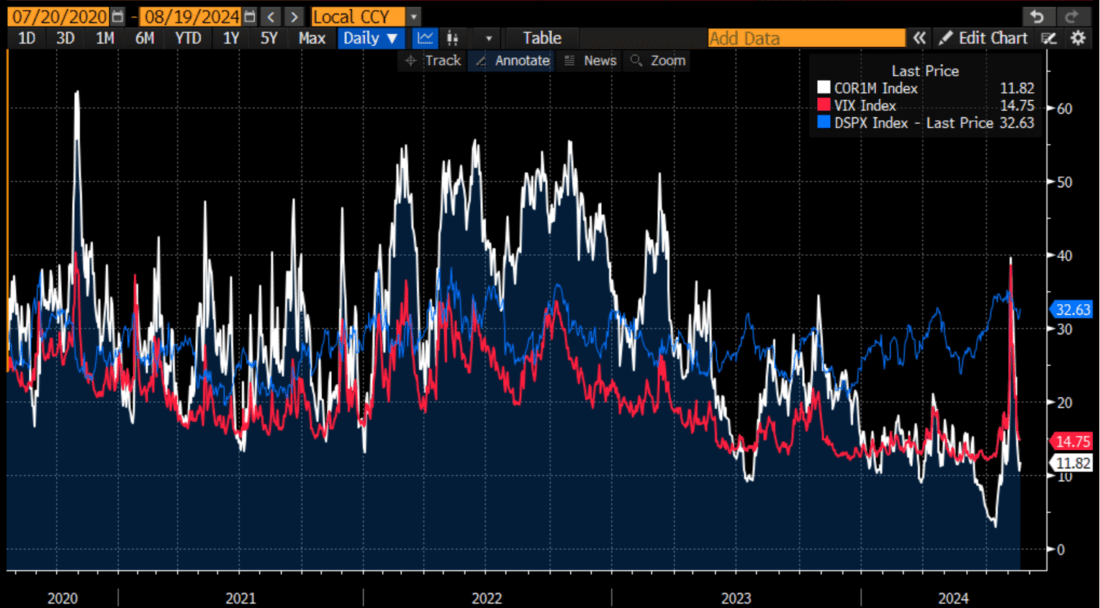

But there is another factor that is pressuring VIX. On July 8th, we pointed out that certain correlation measures were at all-time lows, and that those low correlations along with high dispersion readings were suppressing index volatility overall. Our timing was auspicious, because even though the Cboe 1-Month Correlation Index (COR1M) dropped even further in the following week, VIX didn’t follow, and instead turned higher shortly thereafter. That rise culminated with the events of two weeks ago.

And now…. We’re back. After spiking on the unwinding carry trade madness, correlations have since plunged. They’re not back to early July lows but are indeed back to the low levels that preceded them. Meanwhile, the Cboe Dispersion Index (DSPX) remains near its recent elevated levels.

5-Years, VIX (magenta), COR1M (white), DSPX (blue)

(Click on image to enlarge)

Source: Bloomberg

In short, investors and traders have quickly returned to the playbook that has been working so well for them for the past several months: buy megacap technology stocks, add in some periodic enthusiasm for the rest of SPX and the Russell 2000 (RTY), and don’t bother hedging. (Why hedge when every dip is a short-term buying opportunity, right?)

But I made this comment recently, and I can’t shake the idea that there is more to it than an old adage:

My concern is that [investors have] been rewarded for following the first part of Warren Buffett’s mantra about being greedy when others are fearful but they might not be so much following the second part about being fearful when people are greedy.

Remember, the guy that the quote referenced just sold half of his huge Apple (AAPL) and is carrying a record amount of cash. But don’t worry, be happy – at least for now.

More By This Author:

Will Powell Channel Larry David?

Carried Away, Then Carried Out

Fed, BoJ, Mag7 Jitters Trigger Bearish Reversal

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options ...

more