Mr. Market Does Like Mondays (At Least Lately)

(Today’s theme music, courtesy of the Boomtown Rats, “I Don’t Like Mondays”)

Fifteen weeks in a row is one heck of a streak. NFL teams, which play once a week, have only exceeded that streak 10 times in the league’s history, so it was big news when the San Francisco 49ers 15-game regular season winning streak was broken on Sunday. Just one day later – yesterday – the S&P 500 (SPX) put together a 15-week winning streak of its own. That is one heck of a stealth rally, and it’s not clear why.

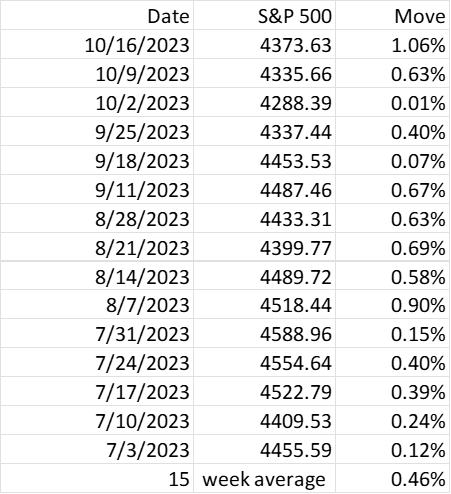

Yes, it’s true. SPX has not been down on a Monday since July 3rd. Granted, that day was a half-day ahead of the July 4th holiday, and we also skipped the first Monday in September for Labor Day. Also, we squeaked by with tiny gains some of those times, but as any coach will tell us, a win is a win. Here are the results over that timeframe:

Source: Interactive Brokers

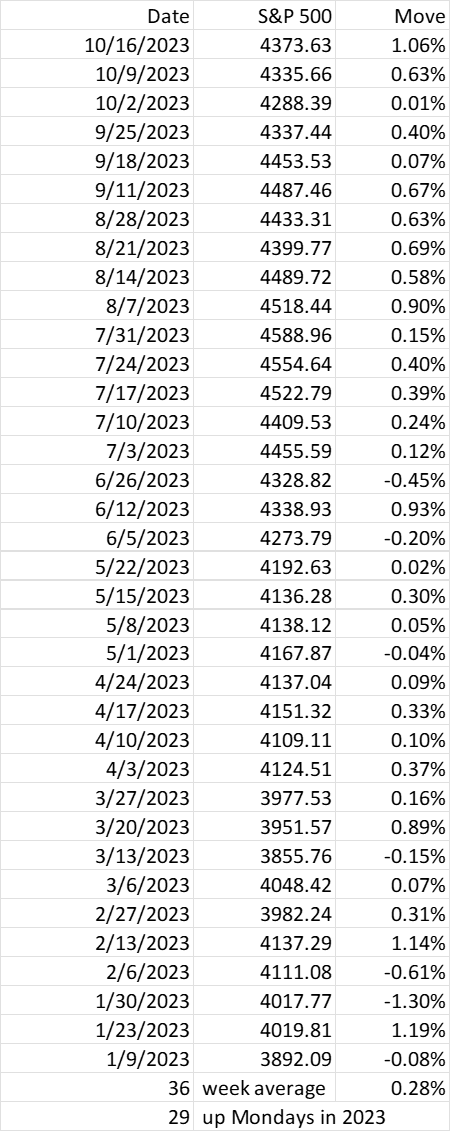

The current streak is quite astounding, but it is clearly part of a larger pattern. So far in 2023, there have been 36 Mondays when the US markets have been open. (This excludes MLK Day, President’s Day, Memorial Day, and Juneteenth in addition to Labor Day.)An astounding 29 of those 36 Mondays have been higher – just over 80%!

Source: Interactive Brokers

We have noted on various occasions that traders love to find tradeable patterns. Quite frankly, if something works 80% of the time, it is quite understandable for that pattern to persist – if for no other reason than that it becomes self-fulfilling. If enough people expect the market to go up on Mondays, then it probably will. The logic is sound, though circular. If there is an imbalance of aggressive buyers, that creates demand, and stocks move higher. The reason is not important. In markets, enough people believe that something will happen – regardless of why – the weight of money can force the outcome.

(By the way, I was careful not to say there are more buyers than sellers. For every buy that gets executed, someone sells – and vice versa. The prices move because one side is more aggressive than the other.)

Although the recent upside moves on Mondays have been quite consistent, this is a relatively recent phenomenon. Over the past 10 years, SPX has risen on about 53% of all trading sessions. Prior to this year that was also the case for Mondays over that period – about 53%.Also, the average daily move over the 10-year period was +0.065%, while Mondays (including this year) average 0.019%.In other words, the recent Monday outperformance is a recent phenomenon.

Frankly, I wish I knew why. I’d love to be able to say that there is something I can point out that makes Mondays a better day than others. Maybe there is something about avoiding major trouble over the weekend that makes traders bullish on Mondays. That was certainly the case yesterday, but it hardly explains the vast majority of weeks this year. At this point, it is more likely either a statistical fluke or a self-fulfilling trading prophecy.

Either way, the market is on a Monday roll. All streaks eventually get broken, but if we can’t offer a great reason for the streak’s occurrence, it is tough to suggest why this one will or won’t continue.

More By This Author:

Taking A Long-Term ViewSize Matters (Banking Edition)

Bring On The Banks

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more