Morgan Stanley’s New CEO Inherits Rich Pickings

Ted Pick’s appointment as chief executive of Morgan Stanley is Wall Street finance’s equivalent of a chart-topping band working on a difficult second album. He inherits a firm that’s generously valued by investors, amply profitable, and has only just fully digested two large acquisitions. When it comes to future deals, Pick has a tough act to follow. He also, though, has time.

Outgoing chief James Gorman has given plenty of clues that Morgan Stanley’s future purchases will focus on the wealth and asset management business he spent the last decade building up. While Pick himself comes from the firm’s dealmaking and trading division, his predecessor groomed and helped to select him and is sticking around for a while as chairman, so there’s no reason to expect a change of direction.

Gorman likes private banking, scalable businesses, and so-called alternative investments. He dislikes bank branches, payments, credit cards, and fringe markets.

A good place to start is outside Morgan Stanley’s home market. Its business advising clients on how to manage their money is huge, but almost entirely U.S.-based. Indeed, Gorman sold the firm’s European wealth business to Credit Suisse in 2013. Yet the case for servicing the non-American elite remains strong. Western European millionaires are on course to add $1.8 trillion in personal financial wealth between 2022 and 2025, according to McKinsey. In Asia-Pacific, excluding Japan, it’s over $4 trillion.

Should Pick want to go hunting, he would find plenty of assets that look cheap. Valuations of fund managers like Germany’s DWS, Britain’s Schroders, and hedge fund Man Group have slid over the past couple of years. The $120 billion Morgan Stanley’s shares trade at 11 times forecast earnings for the next year, according to LSEG data, a significant premium to many European asset and wealth managers.

There are two catches. One is that European wealth management is pretty local, and it’s no accident that big cross-border deals are rare. Regulation, also local, can prove unfriendly: look at St James’s Place, the UK wealth manager recently forced to cut fees by the watchdog.

Politics might create an obstacle, too. Amundi, Europe’s closest counterpart to U.S. fund giant BlackRock, is big in investing on environmental, social, and governance guidelines and has ventures in emerging wealth hubs in India and China.

The other snag is that Gorman has set the bar high. Morgan Stanley’s two last big acquisitions were chunky, at a combined $20 billion, but also filled niches. E*Trade, an online brokerage, brought millions of households and company employees that Morgan Stanley hadn’t previously served. Eaton Vance, a U.S. asset manager, peddles investment products that Morgan Stanley now funnels through sales teams in far-flung markets. Buying a traditional asset manager in slow-growing Europe might seem like a poor follow-up.

Smaller deals could present themselves. Morgan Stanley has identified alternative assets as a huge growth market, but they currently account for around $230 billion of its total $1.4 trillion investment management business. Infrastructure, real estate, and private credit would all be logical additions, though those rapidly-growing asset classes don’t easily present big takeover targets.

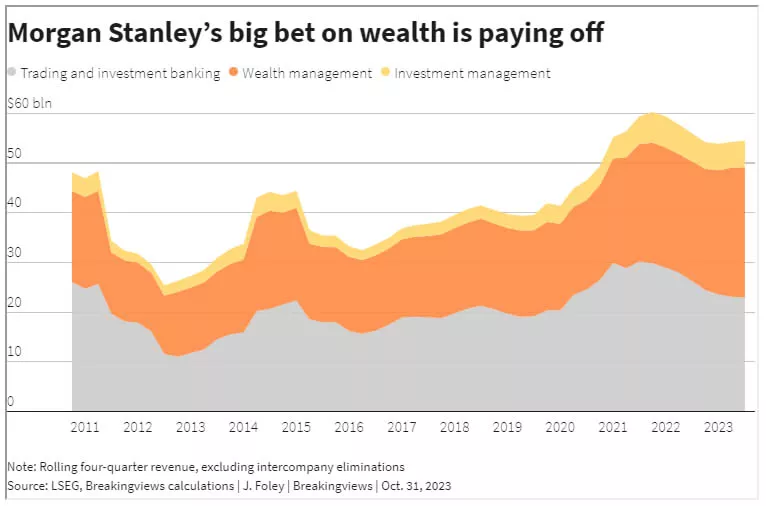

Pick has scope to create value without rushing to do a deal at all, provided he can hit the big numbers that Gorman has already sketched out. If Morgan Stanley’s assets under management reach Gorman’s touted $10 trillion, which the outgoing chief believes is achievable in five years, the wealth division should double its revenue to $50 billion, assuming fees stay steady, taking the whole firm’s top line up by around 50%. And that’s the case even if the institutional securities business Pick previously ran doesn’t grow at all. Gorman has even cheekily suggested assets could then double again.

Not all banks are in the happy position of being able to bandy around such large numbers – and that might be where Pick’s greatest opportunities lie. Gorman’s signature deal was buying Smith Barney from Citi, which was struggling to keep advisers from fleeing as it wrestled with its own problems.

Buying a chunk of a bank that’s already rigorously vetted by U.S. watchdogs also reduces the risk of finding unpleasant surprises under the hood – a factor that rules out many smaller targets in Asia or Switzerland.

Citi’s private bank, for example, has been growing rapidly and gives an owner access to super-rich clients in both hemispheres. Around a quarter of the world’s billionaires already bank with the U.S. lender, which has offices in 20 countries.

CEO Jane Fraser shows no inclination to sell private banking, which for now sits within the group’s $756 billion global wealth management bucket. Then again, her company’s shares have been down 40% since she took over in March 2021, which means it’s hard to be sure what Citi’s strategy might be two years from now.

It’s not even unthinkable that other off-limits targets could creep onto the agenda. HSBC is in turnaround mode and has put wealth at the core of CEO Noel Quinn’s strategy. But not long ago Europe’s largest bank was fighting calls from investor Ping An to break itself up. Even UBS, the Swiss giant now chaired by former Morgan Stanley executive Colm Kelleher, could suit Pick’s ambitions should it ever split its enormous wealth business off from the core Swiss bank.

Those might be pipe dreams. For now, the race by global banks to tout wealth management growth means there are few sellers. Still, Pick has time on his side, and the industry’s rush into wealth may have reached its peak.

And with Morgan Stanley as one of the few mega-sized firms that isn’t either struggling to turn itself around, on probation with its regulators, or already too big to consider big transformative deals, he can consider his options a while longer.

More By This Author:

S&P 500 Earnings Dashboard 23Q3 - Friday, Nov. 3

U.S. Weekly FundFlows: Equity ETFs Attract $7.8 Billion In Inflows

S&P 500 Earnings Dashboard 23Q3 - Thursday, Nov. 2

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more