Morgan Stanley Reports Record Earnings, Stock Slides On Surprising $911MM Archegos Loss

Bank earnings season concluded as usual with Morgan Stanley reporting record earnings that smashed on the top and bottom line, but as with other banks the stock dropped for two reasons: i) MS was, naturally, priced to perfection and ii) it reported an unexpected $911 million loss tied to the collapse of Archegos which marred an otherwise pristine quarter.

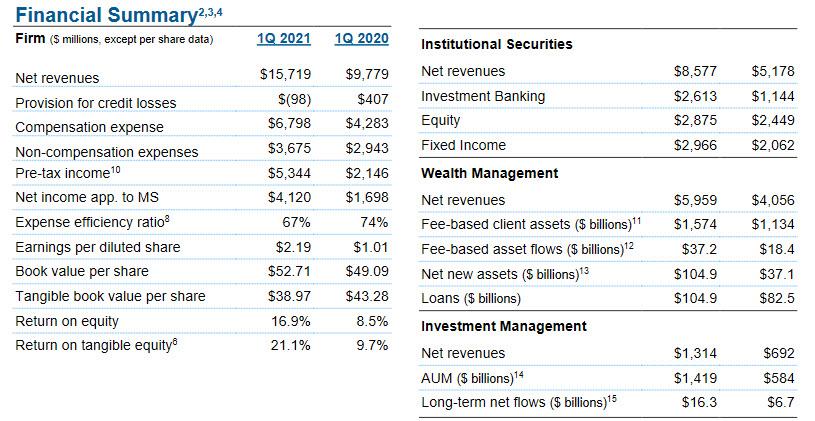

First, the big picture:

- Q1 EPS $2.19, Exp. 1.70 and up from 1.01; tax rate was 22% up from 17.1% a year ago.

- Q1 Revenue 15.7BN, above the exp. 14.09BN.

- Investment Banking Revenue: 2.61bln (exp. 2.01bln)

- Wealth Management Revenue: 5.96bln (exp. 5.72bln) "brought in flows of 10bln"

- Net Interest Income (NII): 2.03bln (exp. 1.51bln)

- CET1 Ratio: 16.8% (exp. 17.48%)

The bank also reminded investors that it had resumed its share buyback program in 1Q of 2021, and repurchased $2.1BN outstanding stock.

As with Goldman and JPM, equities revenue reflected “notable strength in derivatives, driven by continued client engagement and elevated volumes,” the bank said, but also included a “loss of $644 million related to a credit event for a single prime brokerage client, and $267 million of subsequent trading losses through the end of the quarter related to the same event.”

Archegos aside, the company beat every expectation:

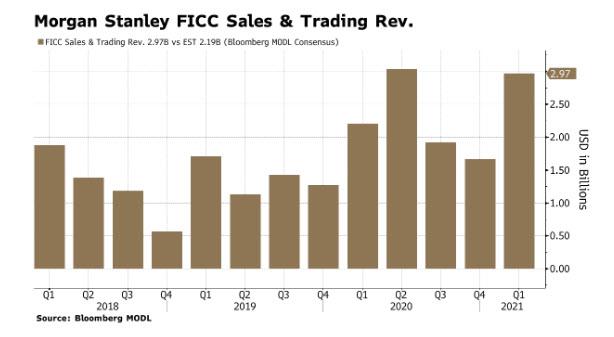

FICC revenue of $2.97 billion rose 44% and smashed an estimate of $2.19 billion.

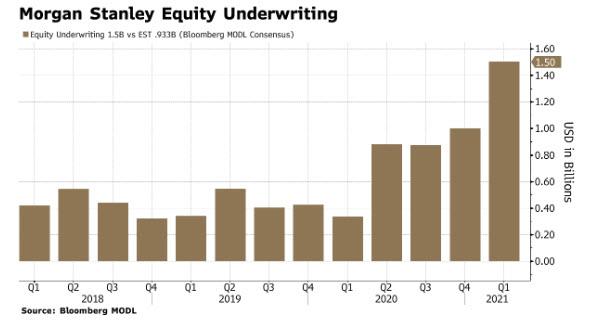

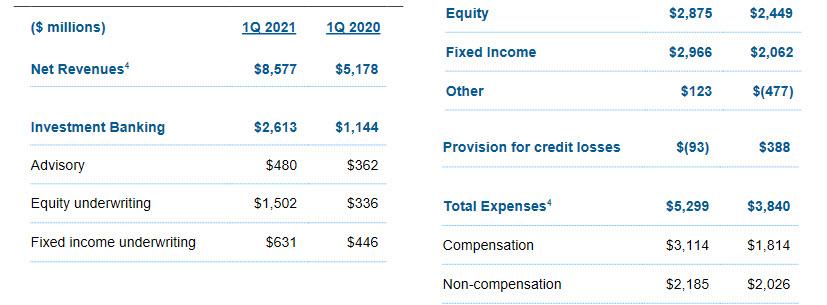

Investment banking revenue of $2.61 billion in fees also beats a forecast of $2.01 billion and wealth management revenue of $5.96 billion exceeded an estimate of $5.71 billion. Digging into investment banking, the bank reported equity underwriting revenue of $1.502BN, far higher than the $933 million analysts were expecting, and again reflects the unprecedented SPAC issuance craze.

The bank's debt underwriters also topped estimates -- bringing in revenue of $631 million in the quarter, and that’s better than the $496 million analysts in a Bloomberg survey were expecting. The firm’s revenues were helped by higher non-investment-grade bond and loan issuances. The bank also says market conditions were “favorable” due to improved credit spreads.

The firm’s stock traders also did better than expected, bringing in $2.875 billion, which is above the $2.597 billion analysts in a Bloomberg survey were calling for.

One potential sour spot for Morgan Stanley was M&A., with the firm’s revenue from advising corporations on deals rising to $480 million, but that’s actually less than the $580 million consensus estimate.

Meanwhile, wealth management’s $6 billion revenue was way up from $4.1 billion a year ago. According to MS, asset management revenues were up, “reflecting higher asset levels and record fee-based flows,” while transactional revenues were up 40% (“excluding the impact of mark-to-market gains on investments” from deferred-comp plans.) The results also reflect “incremental revenues” from E*Trade “and strong client activity.” The pre-tax income of $1.6 billion “resulted in a reported pre-tax margin of 26.9%” Morgan Stanley said that the comparison of the new results to earlier periods is “impacted by the acquisition of E*Trade.”

Commenting on the results, CEO James Gorman said that “the Firm delivered record results. The integrated Investment Bank continues to thrive. We closed the acquisition of Eaton Vance which takes Investment Management to over $1.4 trillion of assets. Wealth Management brought in record flows of $105 billion. The Firm is very well positioned for growth in the years ahead.”

And while the rest of the results were virtually pristine, the Archegos disclosure left Morgan Stanley as the only major US bank to be nursing losses from the implosion of Bill Hwang’s family office. Morgan Stanley was one of the early backers of Archegos despite the legal taint tied to Hwang and served as underwriter of the ViacomCBS $3.1BN stock offering in late March that started the crash.

MS stock initially dipped following news of the Archegos hit but has since rebounded modestly from the lows.

Morgan Stanley’s shares climbed 18% this year through Thursday. The stock fell 1% at 7:45 a.m. in early trading in New York.

As Bloomberg reminds us, in January, Morgan Stanley CEO James Gorman surpassed Jamie Dimon as the best-paid CEO of a major U.S. bank, after being awarded $33 million for the firm’s performance in 2020 while running a firm that’s a third the size of JPMorgan.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more