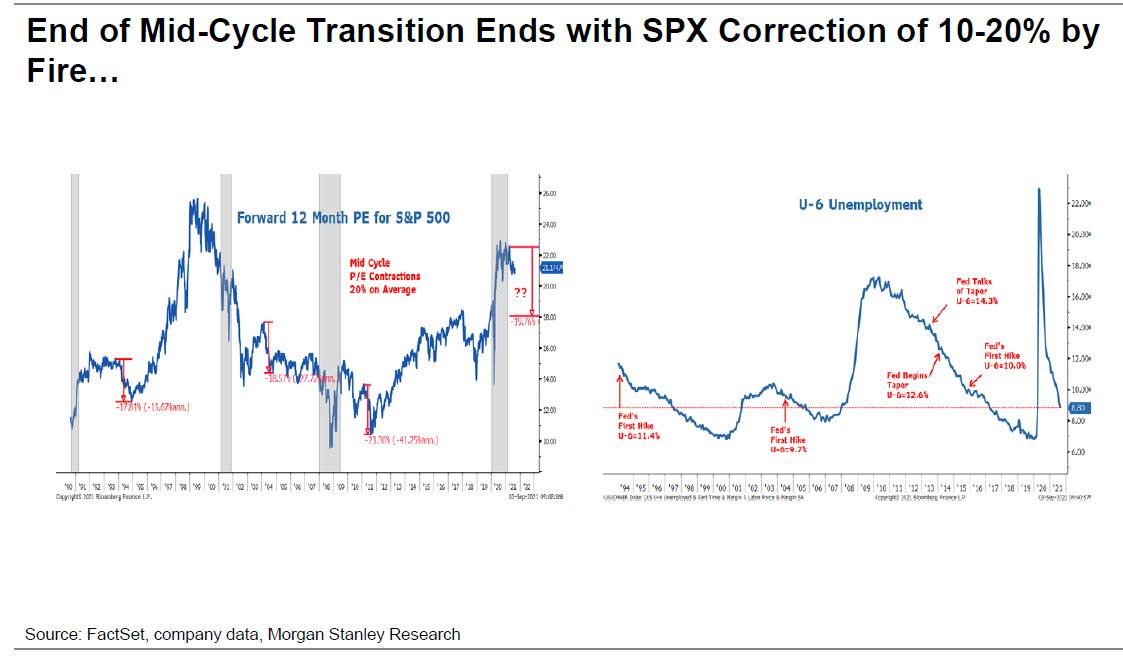

Morgan Stanley Doubles Down On Doom: Calls For "Fire And Ice" Correction

Three weeks ago, when the markets were gripped by a brief but sharp sell-off over fears of Evergrande default contagion (which certainly remains on the table), Morgan Stanley's Mike Wilson took the opportunity to pour some fuel on the fire, or rather "ice", and warned that odds of a "destructive" 20% correction are rising.

As a reminder, for much of the summer, Wilson had been predicting that the current market melt-up would end either in "fire", i.e. a sharp market correction...

(Click on image to enlarge)

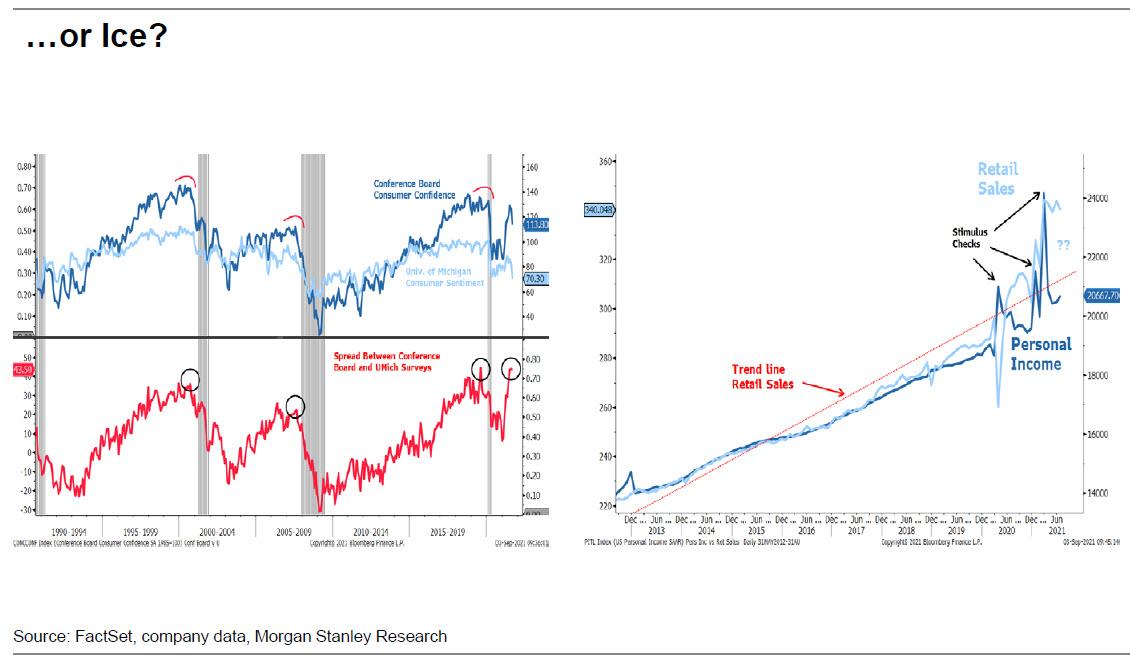

or or "Ice", with consumer spending grinding to a halt...

(Click on image to enlarge)

Pointing to his two gloomy predictions during the "Evergrande Monday" plunge, Wilson wrote that "the ice scenario would be worse for markets and we are leaning in that direction given the fall in consumer confidence and reset lower in PMIs we expect." This is what he said, in the context of his longer running thesis that the "mid-cycle" is about to have a painful correction as we gradually transition into late-cycle:

The typical mid-cycle "fire" outcome would lead to a modest and healthy 10% correction in the S&P 500. However, the "ice" scenario is starting to look more likely, and could result in a more destructive outcome – i.e. a 20%+ correction. As a result, we continue to recommend a barbell of more defensively oriented quality (Healthcare and Staples) to protect from the "ice" scenario while keeping a leg in Financials to participate in the "fire" outcome as higher rates materialize.

And just so it was clear that Wilson stubbornly refused to join the bullish bandwagon, he said that "with our year-end target 10% below current levels, our view is clear: the mid-cycle transition will end with the rolling correction finally hitting the S&P 500."

Fast forward to today when with stocks once again barreling higher, Wilson doubled down on his bearish view and in the latest Morgan Stanley strategy data pack, writes that "we are now calling for Fire AND Ice." Here, he again recaps the two possible mid-cycle correction outcomes he had been envisioning:

- Fire: tightening financial conditions as the Fed signals tapering is coming

- Ice: growth disappointment particularly on the earnings side

And so, in a reversal from what he said last month, Wilson now thinks "it’s increasingly likely these scenarios happen together and we get a >10% correction. The Fed will likely announce its taper plans at its next FOMC meeting just as we expect a disappointment in earnings to materialize."

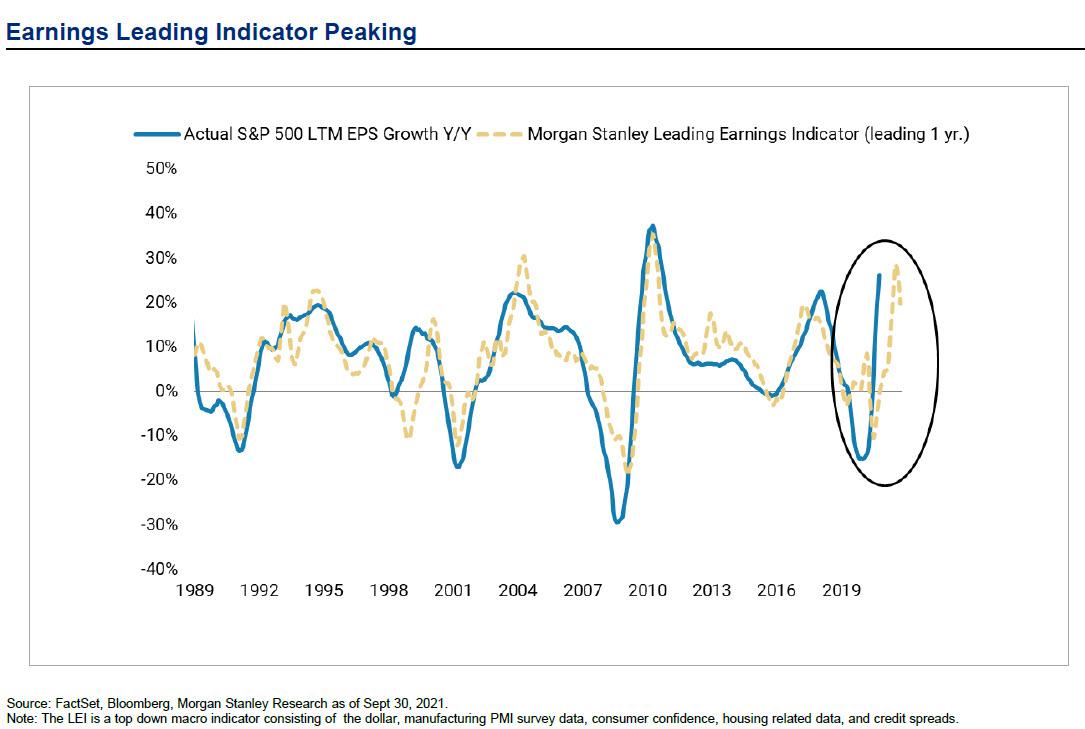

And since much digital ink has been spilled discussing the impact of the coming taper, we will focus on his second warning, namely the coming trouble for corporate earnings, which echoes what we said more than a month ago...

If MS and BofA are right on slumping consumer demand and margin contraction we should start seeing Q3 earnings warnings in the next 2 weeks.

— zerohedge (@zerohedge) August 30, 2021

... and which Wilson distills simply as "Earnings Trouble Ahead."

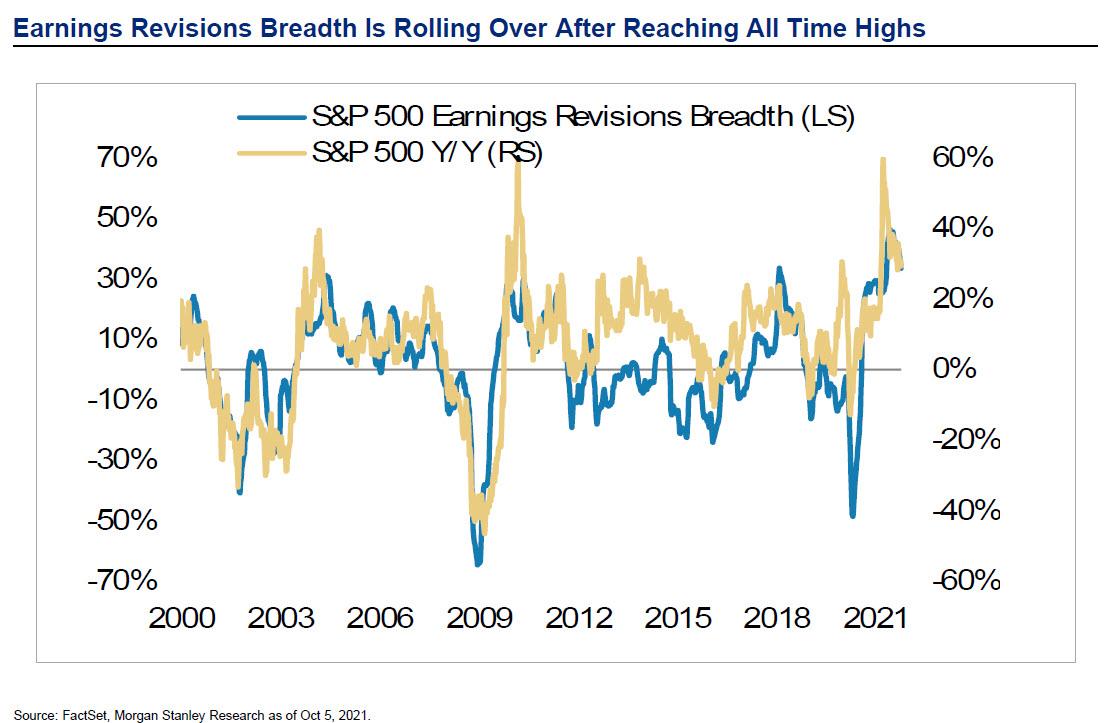

Here, the strategist points to the large number of companies flagging serious supply chain issues in off-cycle earnings reports over the past month and notes that "both forward earnings estimates and price de-rated after many of these reports."

(Click on image to enlarge)

Jumping to the punchline, Wilson thinks this will be a pervasive dynamic during 3Q reporting season and it will "trigger downside in earnings revisions at the index level - a headwind for price."

(Click on image to enlarge)

Finally, looking beyond 3Q, he sees the earnings risk coming more from (1) the inability of companies to pass on pricing (2) margin risk related more to higher wages and (3) a reversion (lower) in goods consumption.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more