Monthly Dividend Stock In Focus: Peyto Exploration & Development Corp.

Energy stocks oftentimes offer highly attractive income yields, since they are not spending a lot on growth. Instead, many energy stocks keep their production more or less stable while returning a large portion of their cash flows to their investors.

This is why many retirees and other income investors like to invest in energy stocks and their above-average dividend yields. Most energy stocks make quarterly dividend payments, but there are outliers. Peyto Exploration & Development Corp. (PEYUF) is one such outlier, as it makes monthly dividend payments.

Peyto Exploration & Development offers a dividend yield of 10.5% at current prices. This is a very high yield, which, in combination with the monthly dividend payments, provides for a huge and very smooth income stream.

These dividend properties make Peyto Exploration & Development look attractive to income investors. This article will discuss the investment prospects of Peyto Exploration & Development in detail.

Business Overview

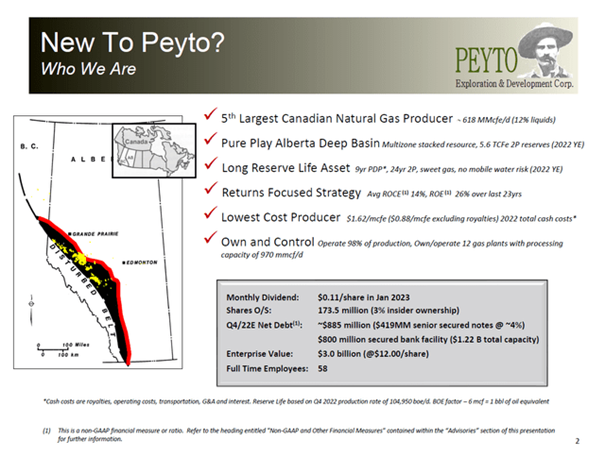

Peyto Exploration & Development, which was once known as Peyto Energy Trust, is a Canada-based upstream energy company. Peyto engages in the exploration, development, and production of both oil and natural gas. The company was founded in 1998 and is headquartered in Calgary, Canada.

Today, its market capitalization is US$1.5 billion, meaning it is not among the largest oil companies in Canada or the world. Still, at least in the natural gas space, Peyto is among the top five producers by production volumes.

Source: Investor Presentation

Peyto is focused on the Alberta Deep Basin region, where it holds a sizeable asset base with vast proven reserves. These reserves give Peyto a long reserve life, meaning the company could produce from its existing assets for a long period of time. But since Peyto adds to its reserves constantly via new exploration, it can be expected that its reserve life will continue to climb.

Importantly, Peyto is the lowest-cost producer in the region it is active in. This means that Peyto will generate above-average margins in all market environments, and it might still be profitable in a commodity price environment where many of its peers are not profitable any longer.

The low break-even costs help avoid losses in bad times and make Peyto a less risky investment, relative to higher-cost producers that will more easily be forced to generate net losses during bad times.

Growth Prospects

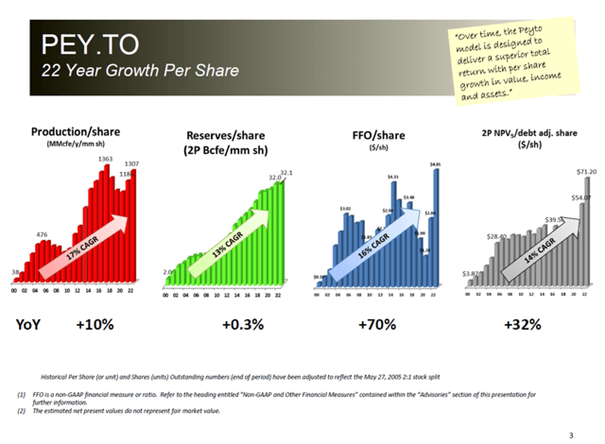

While many energy companies do not invest a lot for growth, Peyto has a pretty strong growth track record. In part, this was made possible by the fact that Peyto was still a pretty small company in the past, which made it easier to maintain a strong relative growth rate for a longer period of time.

Source: Investor Presentation

Over the last 22 years, Peyto managed to grow its production per share, its reserves per share, its FFO-per-share, and its net present value per share at a double-digit pace. While there are temporary ups and downs in all of these metrics, depending on prices for oil and natural gas during every single year, the long-term trend is clearly upwards and to the right.

Some of Peyto’s past growth has been driven by acquisitions, such as the 2021 PrivateCo acquisition, which added 20 wells to Peyto’s portfolio, while the Property acquisition, which was made in 2022, added 12 wells to Peyto’s business. Peyto has also been investing in organic growth, however. It is likely that the company will pursue a combination of organic and inorganic growth in the future, too.

We believe that increased regulation by governments and regulatory bodies will make growth harder to achieve, while the larger production and earnings base will also make it harder to maintain a high relative growth rate. Future business growth and earnings growth will thus likely be lower compared to the double-digit pace we have seen in the past, but Peyto should be able to maintain meaningful growth going forward.

Dividend Analysis

Like many other energy stocks, Peyto is seen as an income investment by many individual investors. And rightfully so, since the company offers a very attractive dividend yield of 10.5%, based on a monthly dividend payout of CAD$0.11 and a current exchange rate of CAD$1.37 per USD, with Peyto trading at US$9.20 right now.

Based on the earnings-per-share of CAD$1.89 that Peyto is forecasted to earn in 2023, the payout ratio is 70%. This is not an ultra-low dividend payout ratio, but not an overly high payout ratio, either. We believe that the dividend should be sustainable at current levels, unless profits fall considerably, which could be the case in an oil price crash, for example.

Peyto has a history of returning a large portion of its profits to shareholders over time, thereby proving its shareholder-friendliness. Peyto has generated profits of CAD$3.1 billion in the past (cumulative), and CAD$2.6 billion of that was paid out to investors via dividends. Since Peyto hedges a large portion of its production, its profits do not swing up and down too much during most years, which makes for relatively reliable dividend payments.

Peyto has a very solid balance sheet, with debt totaling a little less than CAD$900 million, while Peyto is expected to earn CAD$330 million in net profit this year alone. Peyto plans to reduce its debt balance this year while paying a huge dividend yield and investing in its operations at the same time. As the company reduces its debt levels, dividend cut risks will decline further.

Final Thoughts

Peyto Exploration & Development Corp. is not very well known, but the company has a highly successful track record. That holds true when it comes to production and earnings growth, but also when it comes to returning cash to the company’s owners via dividends.

Peyto trades with a very high 10.5% dividend yield today, and that dividend looks well-covered based on the forecasted earnings for the current year. Since Peyto makes monthly dividend payments, investors get almost 1% of their principal per month at current prices, which is very intriguing for retirees and other income investors that live off their dividends.

Peyto trades at less than 7 times this year’s expected net profit, which is a pretty inexpensive valuation. It would not be surprising to see Peyto’s valuation expand over the coming years, which should add to Peyto’s total return outlook.

Between the very high dividend yield, some business and earnings growth potential, and some multiple expansion tailwinds, Peyto could deliver highly compelling total returns going forward, we believe.

Of course, investors should remember that Peyto is still an E&P company and is thus exposed to commodity price movements. While its low break-even costs make it more resilient than most peers, Peyto is still influenced by oil and natural gas price movements, thus Peyto can’t be described as an ultra-safe investment.

More By This Author:

Monthly Dividend Stock In Focus: Freehold Royalties

3 Small-Cap Dividend Stocks To Buy Now

Monthly Dividend Stock in Focus: ChemTrade Logistics Income Fund

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more