Monthly Dividend Stock In Focus: Great Elm Capital

Income investors often see business development companies, or BDCs, as a strong source of income. These companies generally invest in debt and equity instruments of middle-market companies that cannot easily access the public capital markets but generate high levels of returns. BDCs tend to be a bit riskier than other forms of debt investing, but they also tend to pay very high dividend yields.

Great Elm Capital Corporation (GECC) is a BDC that pays an extraordinarily high yield of 24% after the stock lost half of its value due to COVID-19 weakness. Not only does Great Elm offer an extremely high yield, but it pays shareholders on a monthly basis instead of quarterly. This helps investors achieve current income and compound wealth more quickly than less frequent distributions.

Such a yield is obviously quite attractive for income investors, but we do not see it as sustainable. While the company hasn’t cut its payout yet, we see it as inevitable and are therefore cautious on the stock.

This article will analyze the investment prospects of Great Elm Capital Corporation in further detail.

Business Overview

Great Elm is a traditional Business Development Company in that it makes loans and other investments in middle-market companies. These are generally companies with revenues of between $3 million and $75 million annually, and Great Elm typically funds $3 million to $10 million with each position. This is very similar to the business models of other BDCs, so Great Elm isn’t set apart with the way it operates.

Great Elm went public in late-2016, so its operating and distribution history are both quite short. It has less than $300 million in total assets, so the balance sheet is relatively small. It produces about $25 million in annual revenue and trades with a market capitalization of just ~$42 million.

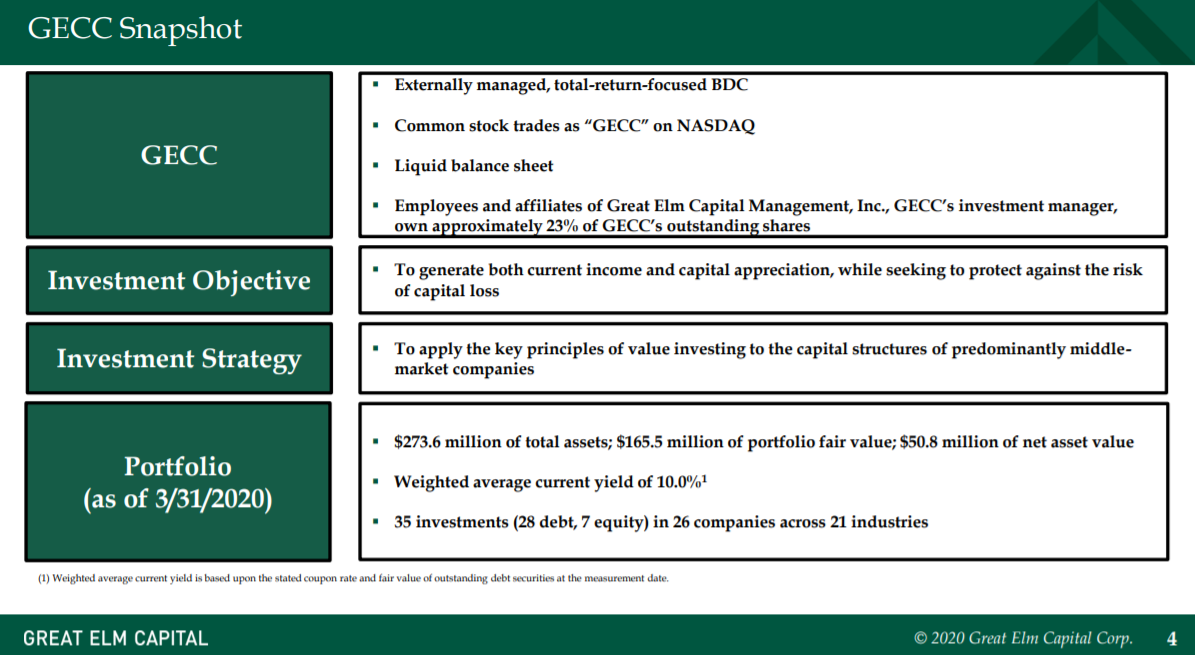

(Click on image to enlarge)

Source: Investor presentation, page 4

Almost a quarter of Great Elm is owned by employees of the company’s investment manager, Great Elm Capital Management, so insider interests are tied very heavily to that of public shareholders.

Great Elm’s investment portfolio is built much like other BDCs in that it invests across a number of industries and with various creditors to spread out credit risk. This helps to maximize returns while minimizing credit risk exposure to any particular sector. Great Elm has exposure to 21 different industries with its 35 current investments.

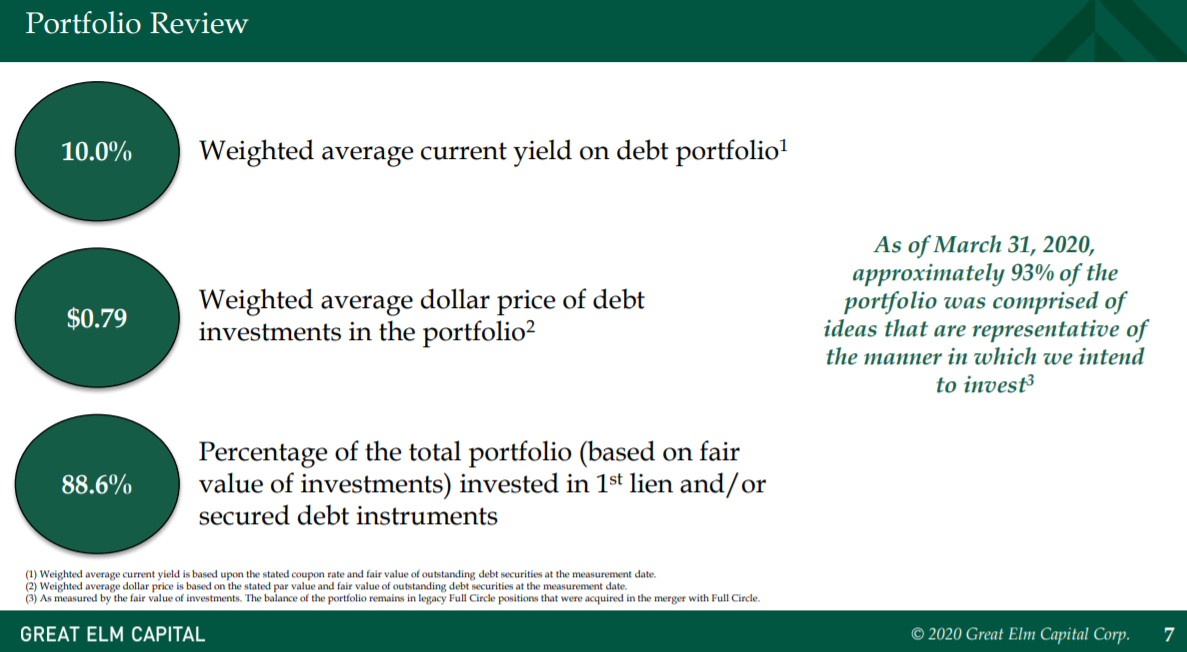

(Click on image to enlarge)

Source: Investor presentation, page 7

Great Elm seeks to buy debt instruments at below par, meaning it has the opportunity not only to achieve interest income but capital appreciation as well. Additionally, this helps Great Elm achieve higher yields on its investments.

Like other BDCs, Great Elm focuses on first-lien and secured debt instruments, because they are safer than unsecured or subordinated debt. In the event of a failure to service the debt from Great Elm’s borrowers, the company would be first in line to get its capital back. This does not ensure Great Elm will never see capital losses, but does minimize the impact of losses should a failure occur.

With a business model that is essentially like every other BDC, Great Elm doesn’t stand out. And given some of the inherent credit risk in a BDC’s portfolio, we are cautious on Great Elm’s prospects, particularly for the distribution.

Growth Prospects

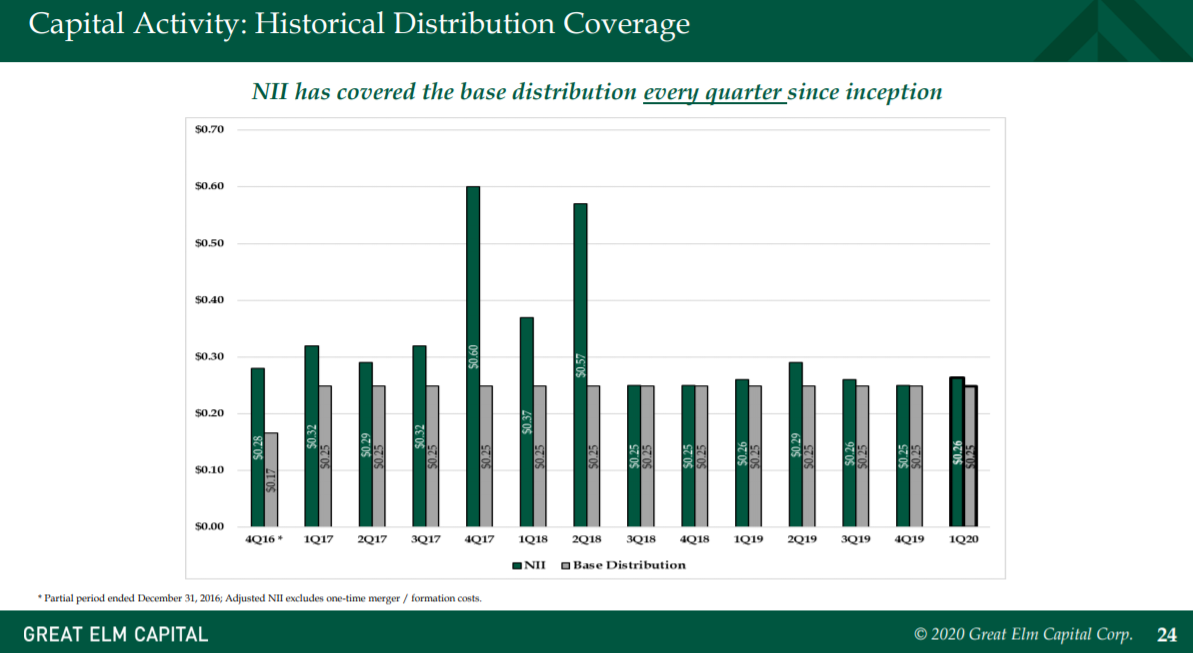

Great Elm has seen its revenue and earnings both fall meaningfully in the years since it went public. However, the company has been able to cover its distribution with net investment income each quarter since inception, which is a strong characteristic. This streak will end for the third quarter of 2020, however, as conditions have deteriorated significantly for Great Elm’s borrowers.

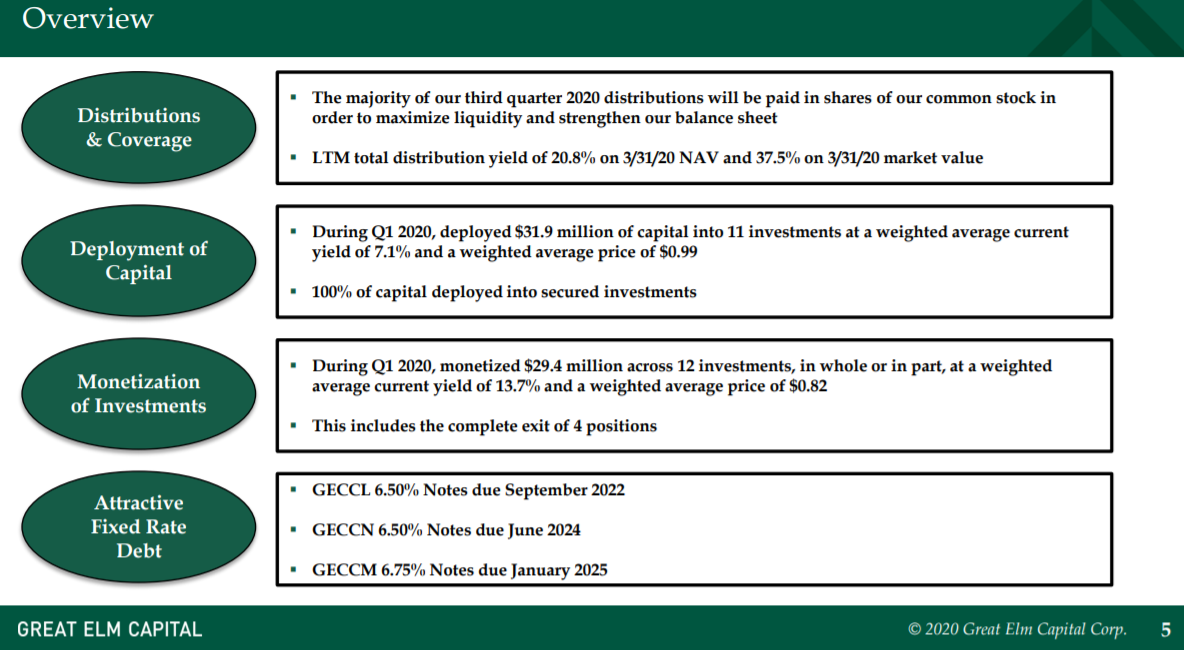

(Click on image to enlarge)

Source: Investor presentation, page 5

Great Elm’s first-quarter results showed a company that was bracing for the worst, given management was well aware of the COVID-19 crisis and its potential impacts on the portfolio. The company monetized $29 million of investments on its balance sheet, selling them for an average of just $0.82 on the dollar, with an average yield of nearly 14%.

Contrast that with new investments that were made at an average price of $0.99 on the dollar and an average yield of 7.1%, and you can see Great Elm was trying to de-risk. In other words, it appears Great Elm was selling riskier positions for unfavorable prices in order to reinvest the proceeds into lower-yielding positions that are likely much safer.

While this should help the company limit the damage in Q2 and Q3 in terms of credit losses, it will also produce lower expected returns in the coming years from a lower portfolio yield.

NII came in at $0.26 in Q1, which covered the distribution of $0.25. However, the company saw a realized loss of $1.12 per share during the quarter and a further $2.47 per-share unrealized loss. Net asset value also plummeted from $8.63 at the end of 2019 to just $5.05 at the end of Q1.

We see Great Elm as struggling to maintain its current level of earnings and therefore forecast a negative growth rate for the foreseeable future. Great Elm’s portfolio is moving down the credit risk ladder, but this also means average yields will fall, and operating leverage will dictate that earnings must fall as well. In short, we think Great Elm will struggle for the balance of 2020 and into 2021.

Dividend Analysis

Great Elm’s distribution hasn’t been cut yet, but given the way the company is paying the distribution today, as well as the negative factors mentioned above, we see the payout as being at high risk of being cut.

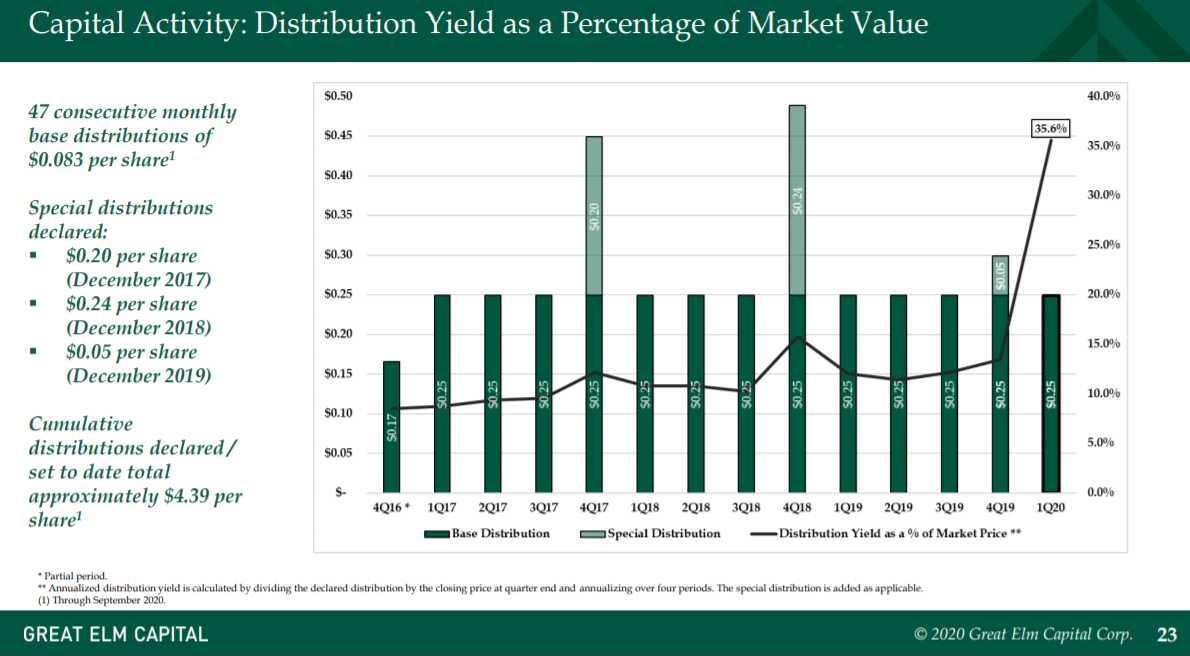

(Click on image to enlarge)

Source: Investor presentation, page 23

Great Elm has paid a monthly distribution of $0.083 per share since the first quarter of 2017 and continues to do so today. However, the current distribution is being paid almost entirely in new common shares, instead of cash, because the company simply cannot afford to pay cash distributions at this level.

This could continue for at least another quarter or two past the already-declared third quarter distribution, which is also almost entirely in common shares instead of cash. This can carry on for some time but the constant dilution is costly as well, so we believe a more prudent course of action would be to cut the payout.

(Click on image to enlarge)

Source: Investor presentation, page 24

Great Elm points out NII continues to cover the dividend, but this streak will likely end when Q2 results are released. In addition, with portfolio losses the size of the market capitalization of the stock, we see NII coverage of the distribution as a moot point.

In total, we believe the distribution of Great Elm is at great risk, and this should not be relied upon by income investors.

Final Thoughts

Great Elm’s reliance on issuing common stock for the distribution is a huge red flag, and investors should be very cautious as a result. The current yield is obviously unsustainable and we believe it will be cut.

With the prospect for earnings growth quite bleak at this point, we rate Great Elm a sell. We see further erosion of NAV, a dividend cut, and sizable dilution from newly-issued shares to pay the distribution. There isn’t a lot to like here, and we recommend income investors look elsewhere for sustainable dividends.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

Thank you for very interesting analysis of the $GECC stock. As one of the shareholders of this stock I naturally come for its defense in few points.

First, I think it is fair to point out that possible vaccine or antibodies for the COVID-19 can be here by the October (at the end of summer there can be the results of three most prominent vaccines so far). This itself can be very significant for the GECC stock. You wrote in the article that they can keep this distribution for two more quarters. That would cover the period of uncertainty quite well making it my opinion quite safe stock.

Second is the declaration of the dividend itself. On the Jun. 29, 2020 the GECC declared its monthly dividend distribution until September (in shares mostly). As you rightly pointed out cut of the dividends is on the table, but I do see an effort of the distribution in shares as better solution than cutting whole dividend down. For me it is good opportunity to accumulate shares of the GECC, because each month my position is increasing and I do not see the need to sold my position as it slowly also average down my price. In addition, it increase my dividend by each passing month. I suspect GECC made shares distribution for the reason that shareholders actually hold the value of its stock. Of course current fall of price is pain 100% agree there.

My third point is that being invested in debt as GECC is, is actually great in current environment. Companies in order to survive will look for more cash. Looking to increase your current debt may actually be beneficial for GECC in the long run. As you also pointed out I also like how they are distributed in so many companies and as they are protecting their investments.

Have a great day everyone and do enjoy the summer a bit if possible.

Thanks for these thoughts on $GECC