Momentum Begets Momentum: Why This Rally Has Room To Run

Image Source: Unsplash

Newton’s First Law of Motion states that an object in motion stays in motion unless acted upon by an outside force.

Watching the market’s momentum lately reminds me just how right both Newton and Bill were.

Today, I’m going to teach you exactly how to make money in this type of market — using the lessons I learned from these men.

Resist the Urge to Run Away

(Click on image to enlarge)

Take a look at the S&P 500.

The index is trading comfortably above both its 50-day and 200-day moving averages, showing both short-term and long-term upward momentum. This healthy technical picture comes as investors grow increasingly optimistic about Republican leadership in Washington, anticipating a more business-friendly environment with fewer regulatory hurdles and pro-growth policies.

When markets surge like this, it’s tempting to take profits off the table.

Trust me, I get that urge too!

But I’ve learned the hard way that getting too cute with timing can leave you watching from the sidelines as stocks continue marching higher.

Sure, there are always challenges in the economy (show me a time when there weren’t!). But right now, the market is trading higher as investors anticipate growth ahead. The technical picture remains strong, and money continues flowing into stocks.

Here’s my approach: Until we see those challenges actually show up in the market – dragging the S&P 500 below the 50-day moving average (my short-term trend barometer) or the 200-day moving average (my long-term trend barometer) – we’re better off staying invested in positions that are working.

That doesn’t mean throwing caution completely to the wind.

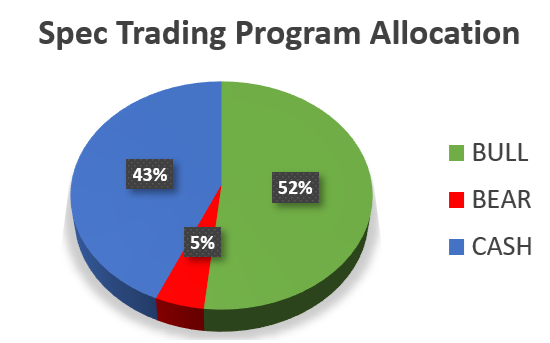

In my own trading account, I maintain some bearish positions as “insurance contracts” against unexpected events. But the majority of my capital is invested in bullish opportunities. And I’m actively looking for chances to put more cash to work.

How I’m Positioning My Own Money in This Market

Take a look at my current portfolio allocation. As you can see, I’m positioning myself to benefit from continued upward momentum while maintaining some defensive positions as hedges.

Newton understood that momentum is a powerful force. In markets, that force is amplified by human psychology and institutional capital flows. As prices rise, more investors are drawn in, creating a self-reinforcing cycle that can persist longer than many expect.

For now, the path of least resistance is higher. Until the technical picture changes or new fundamental challenges emerge, I’m staying positioned for continued upward momentum – while keeping those insurance positions in place, just in case.

More By This Author:

Trump’s Energy Policy Shift Will Push These Stocks Higher

Three Travel Stocks To Pay For Your Next Trip

Mind The Dots