Microsoft Poised For Gains: Elliott Wave Analysis Signals The Next Leg Up

Image Source: Unsplash

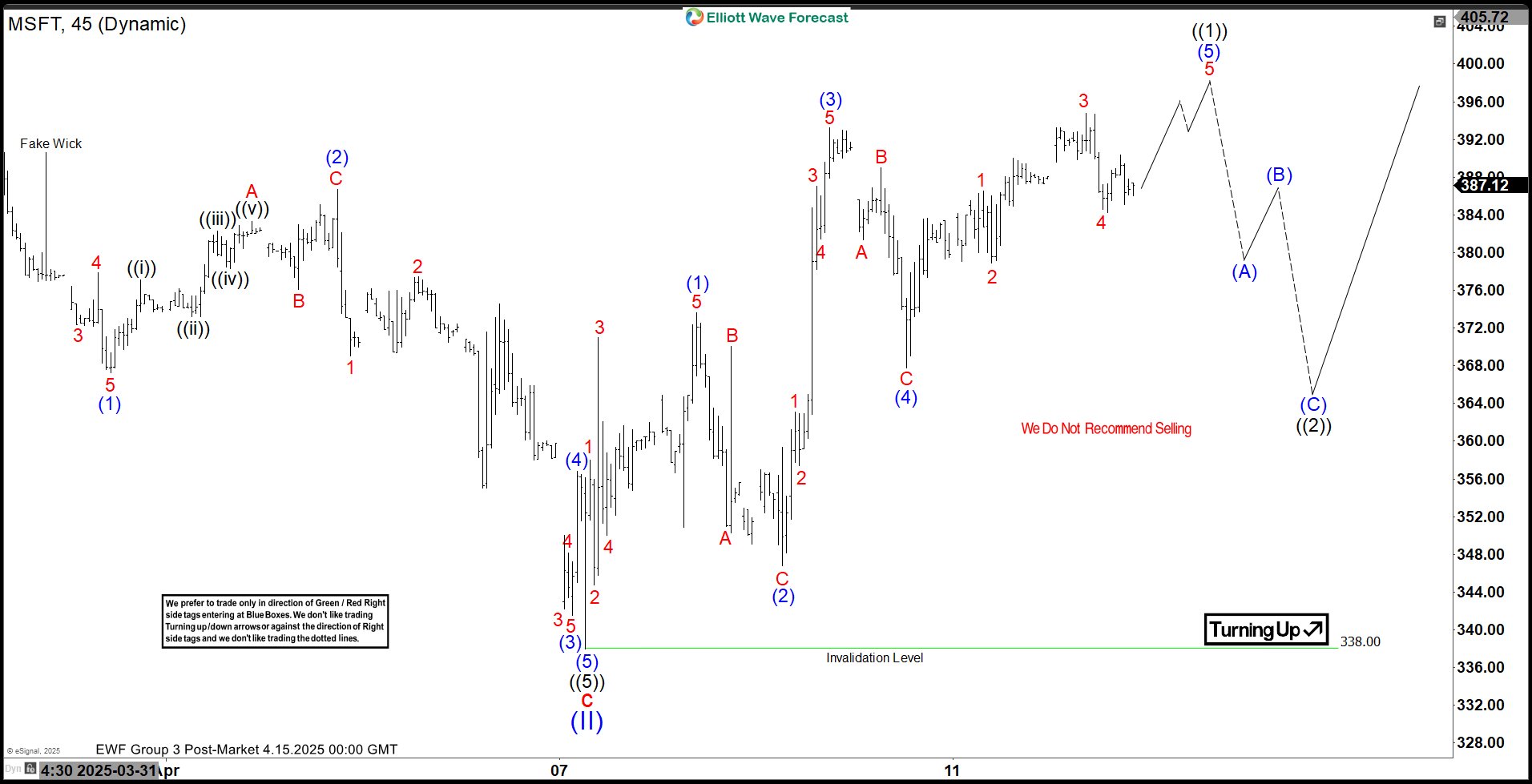

The short-term Elliott Wave outlook for Microsoft (MSFT) paints a bullish picture, suggesting the stock has room to climb after a key low at $338 on April 7, 2025. This level marked the end of a corrective phase, known as wave (II), following a decline that began on July 5, 2024. That selloff unfolded in a three-wave pattern, a hallmark of a correction rather than a bearish trend. Notably, the final leg of this decline, starting from the December 12, 2024 high, didn’t reach a typical Fibonacci extension (1.618), reinforcing the idea that the market remains bullish on Microsoft.

Since hitting the $338 low, Microsoft has rallied in a five-swing pattern, a structure called a motive sequence, signaling potential for further gains. The rally’s first leg, wave (1), peaked at $373.65, followed by a dip to $346.75 in wave (2). The stock then surged to $393.23 in wave (3), with a brief pullback to $367.80 in wave (4). Now, Microsoft is likely nearing the end of wave (5), completing a larger wave ((1)).

Looking ahead, a wave ((2)) pullback is expected to correct the rally from April 7, but as long as the $338 low holds, any dips should find support in a three-, seven-, or eleven-swing pattern, setting the stage for more upside. This suggests short-term pauses but a continued upward trend for Microsoft, making it a stock to watch for bullish opportunities.

Microsoft (MSFT) 45 Minute Elliott Wave Chart

MSFT Video

Video Length: 00:05:49

More By This Author:

QQQ ETF: Forecasting The RallyElliott Wave Outlook: Silver Might Have Launched Into The Following Leg Higher

Elliott Wave Indicates Bearish Sequence For GBPJPY, Favoring A Downward Trajectory

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more