Microsoft & Meta Platforms: Spending Like Mad, But Blowing Away Estimates

Image Source: Unsplash

Microsoft Corp. (MSFT) shares soared in recent trading, hitting a new all-time high and topping the $4 trillion market cap mark, after the company posted a beat-and-raise quarter. Meanwhile, Meta Platforms Inc. (META) also hit new all-time highs after it posted a double-beat and raised its forecast, notes Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

Microsoft’s earnings per share of $3.65 and revenues of $76.4 billion respectively topped the $3.37 and $73.8 billion anticipated by analysts. Its implied operating margin of 46.6% topped consensus estimates by 90 basis points despite $30 billion in capital expenditures.

It continues to face data center infrastructure shortages, and it’s throwing money at the problem until the supply-demand balance improves. Its Intelligent Cloud unit revenue rose 26% year-over-year, and management revealed the size of its Azure business in dollars for the first time ever. It’s over $75 billion (and rose 34% year-over-year).

At Meta Platforms, earnings per share of $7.14 on $47.5 billion in revenue respectively topped the $5.92 and $44.8 billion expected. Its third-quarter sales forecast of $47.5 billion to $50.5 billion also topped consensus estimates of $46.1 billion.

Like Microsoft, Meta is investing heavily in expanding its Artificial Intelligence (AI) capacity. It said compensation related to hiring will be the “second-largest driver of growth” and contribute to a 2026 year-over-year expense growth rate that’s higher than 2025’s.

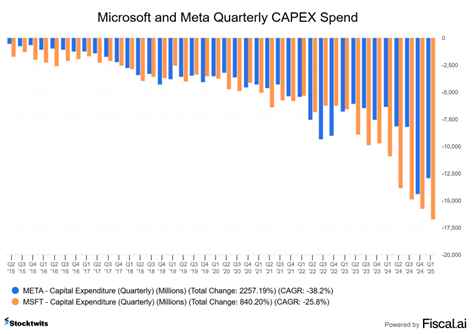

As long as these companies continue to post strong growth – and print cash from their core business – investors are likely to be okay with these capital expenditures. For context, check out the chart above showing their quarterly CAPEX impact on cash flow. That’s a lot of zeros, but Wall Street is loving it.

About the Author

Tom Bruni is editor-in-chief & VP of community at Stocktwits, the largest social network for investors and traders, where he leads the company’s newswire, newsletters, and other publishing efforts. For the last decade, Bruni has been at the intersection of finance and media, regularly featured in The Wall Street Journal, Bloomberg, Reuters, Barron’s, and more. He holds both CPA and CMT licenses and is co-chair of the NYC Chapter of the CMT Association.

More By This Author:

DMLP: A High-Yielding Energy Play Primed To Rally If Oil And Gas Prices RiseBroadcom: A Trend Seeker Buy That's Hitting New Highs

VIX: Does It Make Sense To "Buy Volatility?"

(MoneyShow Editor’s Note: Tom will be speaking at the 2025 MoneyShow Toronto, scheduled for Sept. 12-13. more