MicroMarvel: MacroGenics Confuses Wall Street

Image Source: Pexels

MicroMarvel is a series of articles highlighting undercovered stocks with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

- 100% technical buy signals.

- 15 new highs and up 66.53% last month.

- 280.00+ Weighted Alpha

Today's MicroMarvel is the biopharmaceutical company MacroGenics (MGNX). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 10/30 the stock gained 214.73%.

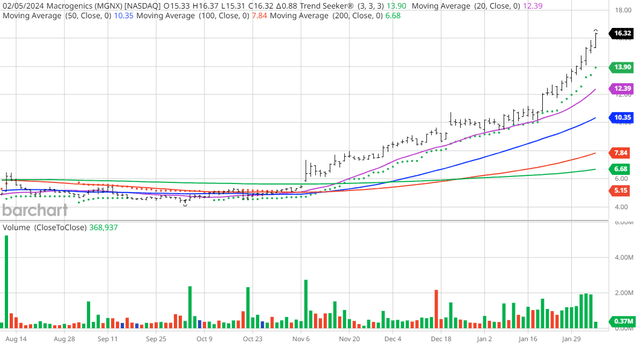

MGNX Price vs Daily Moving Averages (Barchart)

MacroGenics, Inc., a biopharmaceutical company, develops and commercializes antibody-based therapeutics to treat cancer in the United States. Its approved product is MARGENZA (margetuximab-cmkb), a human epidermal growth factor receptor 2 (HER2) receptor antagonist indicated, in combination with chemotherapy, for the treatment of adult patients with metastatic HER2-positive breast cancer who have received two or more prior anti-HER2 regimens. The company's pipeline of immuno-oncology product candidates includes MGC018, an antibody-drug conjugate (ADC), which targets solid tumors expressing B7-H3; Enoblituzumab, a monoclonal antibody that targets B7-H3; and MGD024, an investigational bispecific CD123 × CD3 DART molecule to minimize cytokine-release syndrome for patients with hematologic malignancies. In addition, it develops Lorigerlimab, a monoclonal antibody that targets the immune checkpoints PD-1 and cytotoxic T-lymphocyte-associated protein 4; Tebotelimab, an investigational tetravalent DART molecule for PD-1 and lymphocyte-activation gene 3; Retifanlimab, a monoclonal antibody used for cancer therapeutics; and IMGC936, an ADC that targets ADAM9, a cell surface protein over-expressed in various solid tumor types. Further, the company develops MGD014 and MGD020, a DART molecule to target the envelope protein of human immunodeficiency virus-infected cells and CD3 on T cells; Teplizumab for the treatment of type 1 diabetes; and PRV-3279, a CD32B × CD79B DART molecule for the treatment of autoimmune indications. It has collaborations with Incyte Corporation; Zai Lab Limited; I-Mab Biopharma; and Janssen Biotech, Inc. The company was incorporated in 2000 and is headquartered in Rockville, Maryland.

Barchart Technical Indicators:

- 100% technical buy signals

- 280.00+ Weighted Alpha

- 191.06% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 15 new highs and up 66.53% in the last month

- Relative Strength Index 87.04%

- Technical support level at $14.95

- Recently traded at $16.33 with a 50-day moving average of $10.35

Fundamental Factors:

- Market Cap $958 million

- Wall Street analysts are projecting Revenue to be down 47.30% this year and down again by another 5.70% next year

- Earnings are estimated to increase 119.50% this year, but down 592.10% next year and continue to shrink by an annual rate of 283.60% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks just because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- In spite of those gloomy projections Wall Street analysts issued 5 strong buy, 4 buy and 2 hold recommendation this month

- Their price targets are $11 to $20 with a consensus of 14.56 for 10.65% loss - Why would you recommend buying a stock that you project losses in both Revenue and Earnings and a drop in price --- Wall Street is conflicted on this one

- Value Line rates the stock an above average 2

- CFRAs MarketScope rates the stock a buy

- 6,530 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: TransDigm - Plane Parts

Chart Of The Day: Cadre - Protection For First Responders

Tarsus Pharmaceuticals - Mixed Projections

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.