Meta Platforms: Tripped Up By Concerns On Spending - But Sentiment Remains Bullish

Image Source: Pexels

Is there anything more meta than the thing that’s supposed to drive a company’s future growth being the exact thing that trips it up? Because that’s exactly what we saw during this week’s results from Meta Platforms Inc. (META), notes Tom Bruni, head of market research at The Daily Rip by Stocktwits.

The stock fell sharply on Thursday despite beating earnings and revenue for the current quarter. That's because its guidance came in below expectations, and AI spending forecasts have investors concerned about near-term results.

Adjusted earnings per share of $4.71 topped the $4.32 expected, as did revenues of $36.46 billion vs. $36.16 billion. Notably, net income benefited from sales and marketing costs falling 16% year-over-year, while revenue growth stayed solid.

Looking ahead, second-quarter revenue guidance had a midpoint of $37.75 billion. While that represents 18% year-over-year growth, it was below the consensus analyst estimate of $38.30 billion.

The sell-off accelerated during the earnings call when CEO Mark Zuckerberg discussed investments in glasses, mixed reality, and other projects that aren’t anticipated to make money for years. He also said investments in Artificial Intelligence (AI) are ramping up, but hedged his statement by saying that once those services reach scale, the company has a strong track record of monetizing them effectively.

Capital expenditure guidance for 2024 was raised from a range of $30 billion to $37 billion to $35 billion to $40 billion, but headcount was down 10% year-over-year to just over 69,000 people.

Overall, Meta’s core businesses continued to fire on all cylinders. But expectations were very high coming into the print, and it’s often increasingly difficult to meet higher and higher expectations. Also, it seems the market is still not fully comfortable with the trajectory of the company’s long-term investments, which remain loss leaders.

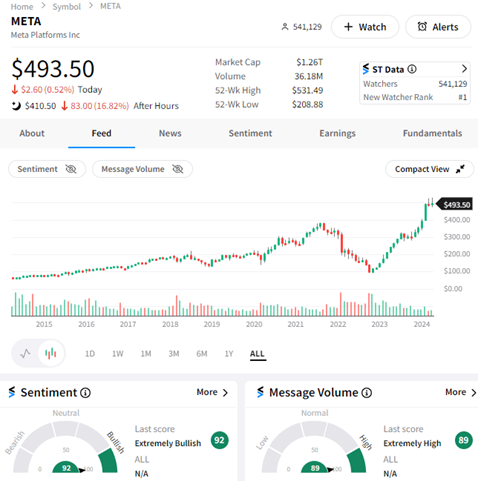

Notably, despite the selloff, Stocktwits community sentiment remained in “extremely bullish” territory this week as investors and traders debated the stock’s future.

Meta's move was in stark contrast to what happened after Tesla Inc. (TSLA) reported results, highlighting the importance of expectations going into an earnings release. Even though Tesla’s numbers were bad across the board while Meta’s were good, one stock mooned, and the other got tuned (up). Just another thing that makes this stock market we all love so difficult to navigate.

About the Author

Tom Bruni is the head of market research at Stocktwits, where he publishes the brand’s flagship market recap newsletter, The Daily Rip, for one million subscribers and oversees the platform’s growing publishing efforts.

Mr. Bruni has been at the intersection of finance and media for the last decade, regularly featured in the Wall Street Journal, Bloomberg, Reuters, Barron’s, and more. He holds both CPA and CMT licenses and graduated with an accounting degree from Molloy University in 2016.

More By This Author:

GS: Profiting By Re-Focusing On Investment, Rather Than Consumer, BankingThe Bizarre Credit Suisse Banking Saga...And The Importance Of Bank Safety

HFMDX: A Growth-Focused Fund That Remains Attractive In A Tougher Market

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.