Meta Platforms Is Attractively Valued But Multiple Risks Need To Be Monitored

Image Source: Pixabay

Evolving social media market, the rapid growth of TikTok, and the rise of short-form video content are intensifying the competition among leading social media companies such as Facebook parent Meta Platforms Inc. (FB), YouTube, and Pinterest. Unlike its competitors, Meta had a rough start to 2022 and recently suffered its biggest one-day market value wipeout after reporting a drop in daily active users (DAUs). Historically, the company has demonstrated an ability to rebound after negative news breaks or controversies that questioned the company’s value. Investors have always believed in the company's ability to scale due to its massive userbase and global market domination. But this time, investors’ confidence seems to be dwindling as the company loses its users to TikTok and other social media platforms that are growing faster than Facebook and Instagram. The earnings disappointment wiped out more than $300 billion of its market value and pushed Meta Platforms out of the top 10 largest global companies by market value. Amid sluggish growth of users, legal challenges, and controversies, Meta announced the launch of Reels globally last Tuesday, which marks a bright spot among many negative developments for the company. The global rollout of Reels is likely to improve user growth and create new opportunities for the company to monetize its global userbase in the coming years.

Reels will open new growth opportunities

TikTok, a social networking platform owned by ByteDance Ltd., is posing a major threat to the business of Meta Platforms as the younger generation is increasingly finding TikTok to be a better alternative to Facebook and Instagram. TikTok is a short-form-video-focused social media network that grew in popularity during the pandemic and now has over 1 billion monthly active members globally. In 2021, it surpassed Instagram in terms of popularity and became the most downloaded app globally. One possible reason behind this astronomical growth of TikTok is that Meta Platforms launched Reels with similar features in 2020 but only in select regions, leaving TikTok as the only social media platform specializing in short-form video content. Meta Platforms is finally on a mission to change this competitive environment, and the company is now focused on aggressively launching Reels (the short-form video content feature developed by Meta Platforms) on both Facebook and Instagram to cater to the growing demands of the younger generation.

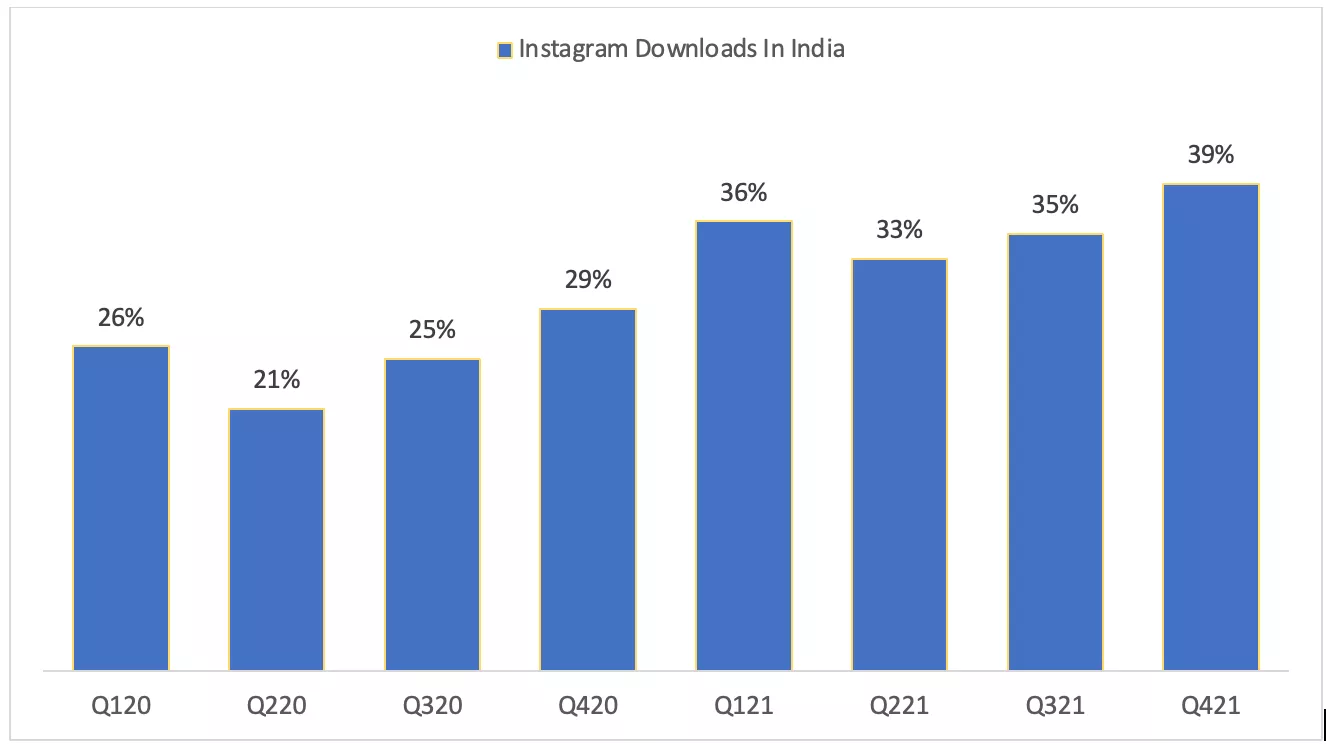

Reels was initially launched only in 50 countries after a 9-month trial period in Brazil. The most opportunistic region at the time was India after the Indian Government banned TikTok owing to border conflict with China. At the time of the ban, TikTok had 200 million Indian users, making it a good place to launch Reels. According to Sensor Tower, Instagram downloads on Android increased 10% year-over-year in Q4 2021, with India accounting for 39% of all downloads in the fourth quarter.

Exhibit 1: Instagram downloads in India

Source: Social Media Today

Instagram's expansion in India opens up new opportunities for Meta, as India is now the world's second-largest smartphone market. Furthermore, the company has a large user base in the Asia-Pacific, implying that the region has a long runway for growth, aided by increased smartphone usage, digitalization efforts, and the adoption of 5G technology. Although the Asia-Pacific region is home to the highest number of active users, this region has the lowest average revenue per user (ARPU), which suggests there is a long runway for growth in this region if the company can successfully monetize this massive userbase in the future. According to CEO Mark Zuckerberg, while more people spend time on Reels, they are spending less time on the feed and stories formats, which earns more ad revenue at the moment.

Exhibit 2: DAUs by region and Asia-Pacific & Rest of the World ARPUs

Source: Meta Earnings Presentation

On February 22, Meta Platforms announced the launch of Reels in over 150 countries, as well as many new advertising tools and features. According to the company, Reels has become the fastest-growing content format, and to keep up with TikTok, Meta is investing in simplifying its video format by combining feed video, IGTV, and Reels under one tab. In addition, the company is developing more creative features and monetization tools for creators. Monetization for Reels and IGTV is currently available only in the U.S, Canada, and Mexico, with plans to roll out testing of the Stars Store monetization feature in a few weeks. The successful rollout of Reels globally could potentially help Meta Platforms monetize its Asia-Pacific userbase better in the future, which is likely to be a major catalyst for growth.

Community messaging trend to fuel Meta’s messaging platforms

Community messaging is another growth area the company is focused on, and Meta Platforms has already made this segment an important investment priority. The company claims that people are gradually sharing more content in messages, including things they would have previously shared on the home feed of Facebook and Instagram. To be a priority platform and take advantage of this trend, Meta is investing in enhancing WhatsApp to enable individuals better organize their group chats and find information for the communities they're a part of. Further, the company is building Community Chats on Facebook and Messenger for real-time conversations.

Business messaging is another crucial area to look for, in addition to community messaging. The company said that every week, more than 1 billion users connect with a business account using its messaging services. Currently, the largest monetization tool is Click to Messaging ads, where a user clicks on an ad in their Facebook or Instagram feed and opens a chat with the business in Messenger, Instagram Direct, or WhatsApp. WhatsApp has already partnered with Uber Technologies Inc (UBER) and JioMart as part of a chat-based business. The partnership allows users to book a ride or order groceries directly from WhatsApp. Every month, more than 150 million users across the world browse a company catalog on WhatsApp, and new features like WhatsApp Collections continue to add to its growth. Supporting small businesses with its messaging apps could open new doors for the company to grow in the future, especially by allowing to monetize the billions of users who use WhatsApp on a daily basis.

The metaverse opportunity

Meta Platforms has pledged to invest billions of dollars to bring the metaverse into life, which is a risky yet potentially rewarding bet that could help the company diversify its revenue streams in the future. Many leading tech companies have unveiled plans to embrace immersive technologies including virtual reality, and Meta Platforms is one of the tech giants that are betting on this new technology aggressively.

Risks to look out for

A limitation on Transatlantic data flows could result in billions of lost revenue

In 2020, the Privacy Shield was established to address the issues of Transatlantic data flows. For months, European Union regulators have been negotiating with the U.S. to replace a Transatlantic data transfer agreement that was struck down in July 2020 by the EU Court of Justice because the EU couldn't be sure if its citizens' data would be safe from the U.S. government surveillance once it was shipped to the United States. Companies were allowed to employ Standard Contractual Clauses (SCC) following the EU Court of Justice's judgment, which allowed data to be moved from the EU to another nation while staying compatible with the EU's landmark data protection legislation, the General Data Protection Regulation (GDPR). Meta said in its recent annual report that it will "likely be unable" to offer services like Facebook and Instagram in the EU if no other legal data transfer option becomes available soon.

The GDPR also allows EU data regulators to impose penalties of up to 4% of a company's annual revenue for the most serious violations. At the end of last year, the Irish watchdog had 30 EU-wide investigations active, including cases against Apple Inc. (AAPL), Alphabet Inc. (GOOG), Twitter Inc. (TWTR), Meta Platforms as well as two investigations against TikTok.In September 2021, the Irish Data Protection Commission (IDPC) imposed a fine of $266 million on WhatsApp for violating transparency obligations under the GDPR act.

With the EU Court trying to avoid international data transfers, it is challenging for Meta Platforms to run its primary businesses such as Facebook, Instagram, and WhatsApp. If the company decides to leave the European market, it will lose over 2 billion daily active users, resulting in significant financial losses. Even if it continues to operate in Europe, the company's ability to sustain active users will be in doubt as advertisers will be unable to target their intended audiences due to a lack of data.

Meta Platforms has always been under the scrutiny of regulators, but the challenges have never been this serious with the company facing an existential threat in Europe. For this reason, investors should ideally monitor new regulatory developments in Europe to identify potential inflection points.

The new privacy features rolled out by Apple & Google are posing a significant threat

The impact of a privacy feature implemented by Apple has harmed digital advertising and was a factor in Meta's disastrous earnings report earlier this month. On top of this, Google announced last week that it would bring a privacy change to Android phones. The move is said to be ad-friendly, unlike Apple's "not to track" function, but this is yet to be confirmed by Meta Platforms executives. Apple has made it easier to opt-out of tracking across various apps by letting consumers know what data the apps are collecting, making it more difficult for advertisers that rely on data to develop new products and understand their target market. Google is also working to limit the sharing of users' data to third parties. The new privacy features were introduced at a time when these companies were being criticized for their data collection practices, and many countries, including India, are keeping big tech under their scrutiny.

On February 16, Meta settled a ten-year class-action lawsuit over the company's usage of "cookies" in 2010 and 2011 that tracked people online even after signing off from Facebook. Meta has agreed to remove all of the data that were "wrongfully collected" during that time from their servers. The proposed settlement is yet to be approved by a judge, however, the company will also pay $90 million to users who filed a claim, after deducting lawyer fees.

Takeaway

Meta Platforms stock has declined 37% this year, and the company has lost the trust of some investors as the business is showing some glimpses of a slowdown. Opportunistic investors, however, are likely to find Meta Platforms attractively valued in the market today at a forward price-to-earnings ratio of just 17, which makes Meta one of the most cheaply valued profitable tech companies in the world. The company has a long runway for growth in the Asia-Pacific region, and the potential monetization of WhatsApp will also add billions of dollars in revenue to the company in the next few years. Investors, however, should keep a close eye on a few challenges that are looming on the horizon to identify the possibility of a permanent deterioration of the company’s earnings power.

Disclosure: The author owned Meta Platforms shares at the time of publication.

Perhaps I'm just too old, but I simply don't understand the appeal of the metaverse, nor why people would pay real money for virtual "stuff" like dressing up an avatar.

It's about the use cases after all. The metaverse is not just about avatars and meetings and having fun. For instance, let's say you want to check out a property thousands of miles away without physically visiting the location - the metaverse has a solution for you! This is just one example - there are many use cases where the metaverse could be used for business purposes.