Meta Beats Earnings Estimates And Announces First Ever Dividend: Is It Time To Buy?

Image: Bigstock

Investors walked away from this busy investment week with a lot of news to digest, including Meta Platforms (META - Free Report) announcing its first-ever dividend after comfortably surpassing Q4 top and bottom-line expectations on Thursday.

Although the Fed shrugged off the plausibility of rate cuts in March and didn’t blow the cap off a potential broader rally, Meta’s stock soared during Friday's trading session.

Q4 Showdown & Price Performance

Meta’s Q4 report capped off a week that was already highlighted by big tech, with Magnificent Seven peers Apple (AAPL - Free Report) and Amazon (AMZN - Free Report) also reporting their quarterly results. All were able to surpass their quarterly expectations, but it was Meta who stole the show.

Accompanying its strong results, Meta declared its first cash dividend of $0.50 per share, payable on March 26, 2024 to stockholders on record. Going forward, Meta intends to pay its dividend on a quarterly basis, as it is subject to market conditions and approval by its board of directors.

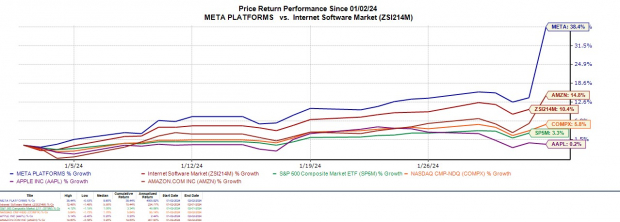

This fueled Meta’s stock in Friday’s trading session, as it was seen spiking over +20%, with Amazon's shares up +8% and Apple's shares virtually flat after an early morning dip. Notably, Meta’s stock has an “A” Zacks Style Scores grade for Momentum, and it has soared +38% over the last month.

Image Source: Zacks Investment Research

Meta’s stock has rallied over +150% in the last year, and it has only continued to rally as the company has continued to beat earnings expectations, which it has done so for five consecutive quarters, as defined by the green arrows in the EPS surprise chart below.

Image Source: Zacks Investment Research

Financial Results

Diving into Meta’s Q4 financial results, earnings of $5.33 per share topped the Zacks Consensus by 10% and soared 77% from $3.00 a share in the prior-year quarter. Quarterly sales of $40.11 billion climbed 25% year-over-year and came in 3% better than expected. It’s also noteworthy that Meta has now posted an average earnings surprise of 19.71% in its last four quarterly reports.

Meta currently has an “A” Zacks Style Scores grade for Growth, and it rounded-out its fiscal 2023 with annual earnings increasing 51% to $14.87 per share versus $9.83 a share in 2022. Total sales increased 15% to $134.9 billion compared to $116.6 billion in 2022.

CEO Mark Zuckerberg stated that Meta made a lot of progress in their vision for advancing artificial intelligence and the metaverse. The company expects its growth to be driven by investments in servers, including both AI and non-AI hardware, in FY24 along with its new data center architecture.

Image Source: Zacks Investment Research

Bottom Line

Meta Platforms' stock currently sports a Zacks Rank #2 (Buy) rating, primarily attributed to the trend of positive annual earnings estimate revisions for FY24 over the last 30 days. This looks likely to continue after the company’s Q4 earnings beat, and the initiation of a quarterly dividend does make a stronger argument for investors buying Meta’s stock at the moment.

More By This Author:

Time For Housing ETFs This Spring?

3 Real Estate Development Stocks To Buy As Fundamentals Rebound

4 Non-Ferrous Metal Mining Stocks Countering Industry Headwinds