Meta & Alphabet Earnings: Ad Revenue In Focus

Big tech earnings are on the schedule for next week, undoubtedly exciting investors. After their sideways action over the last three months, market participants are curious if Q3 results can help spark a rally to last into year-end.

Two mega-cap names on the docket include Meta Platforms (META) and Alphabet (GOOGL). But how do expectations stack up for each respective company? Let’s take a closer look while also focusing on advertising revenue.

Meta Platforms

Analysts have shown positivity for the quarter to be released, with the $3.57 Zacks Consensus EPS Estimate up 6% since July. The expected figure reflects a sizable 120% jump year-over-year.

Image Source: Zacks Investment Research

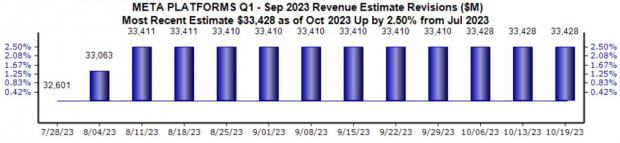

Top line expectations have also increased, with the $33.4 billion quarterly estimate up 2.5% over the same period and reflecting an improvement of 20% from the year-ago period.

Image Source: Zacks Investment Research

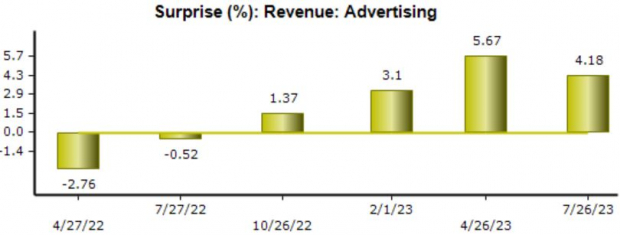

Advertising revenue is critical for the company, reflecting a significant chunk of total sales. For the upcoming release, the Zacks Consensus Estimate for Advertising Revenue stands at $32.9 billion, reflecting a notable 20% increase year-over-year.

The expected growth is particularly notable considering fears of an economic downturn, as ad spending is typically one of the first items to get cut among businesses. As we can see below, META has consistently exceeded consensus ad revenue expectations as of late, with the most recent beat totaling 4.2%.

Image Source: Zacks Investment Research

In addition, the company’s valuation appears sound given its projected growth, with earnings forecasted to climb 36% on 12% higher revenues in its current year. Shares presently trade at a 23.4X forward earnings multiple (F1), in line with the 23.1X five-year median.

Alphabet

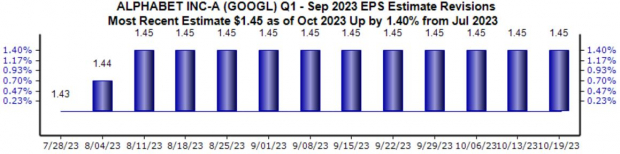

Analysts have shown similar positivity for Alphabet’s upcoming release, with the $1.45 Zacks Consensus EPS Estimate 1.4% higher since July. The expected figure represents a solid 36% boost from the year-ago quarter.

Image Source: Zacks Investment Research

And regarding the top line, expectations have modestly moved higher, with the $63.1 billion quarterly revenue estimate up a fractional 0.5% since July and reflecting an improvement of 10% from year-ago sales of $57.3 billion.

Image Source: Zacks Investment Research

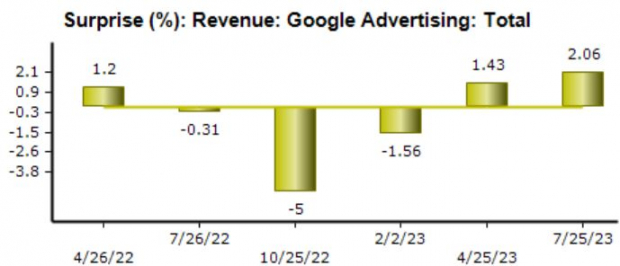

Alphabet’s advertising business also makes up much of its total revenue. For the quarter, the Zacks Consensus Estimate for advertising revenue stands at $58.9 billion, reflecting an 8% change year-over-year.

The company has consistently positively surprised on this metric as of late, as shown below. Again, these expectations and recent results don’t particularly reflect a meaningful slowdown in ad spending.

Image Source: Zacks Investment Research

Bottom Line

With big tech earnings looming next week, investors will surely be in for a hectic period.

And, of course, many eyes will be fixated on Alphabet’s and Meta Platforms’ quarterly results, with both companies forecasted to post sizable earnings growth on improved revenues.

The overall tech sector’s profitability has improved recently, reflecting successful cost-cutting measures following a challenging environment in 2022. These developments are further reflected by the forecasted earnings growth rates both companies are expected to post.

More By This Author:

3 Invesco Mutual Funds To Enhance Your ReturnsBull Of The Day: JP Morgan Chase & Co.

Bull of the Day - Uber Technologies

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more