MercadoLibre Stock Forms A Bullish Pattern Ahead Of Earnings

Image Source: Unsplash

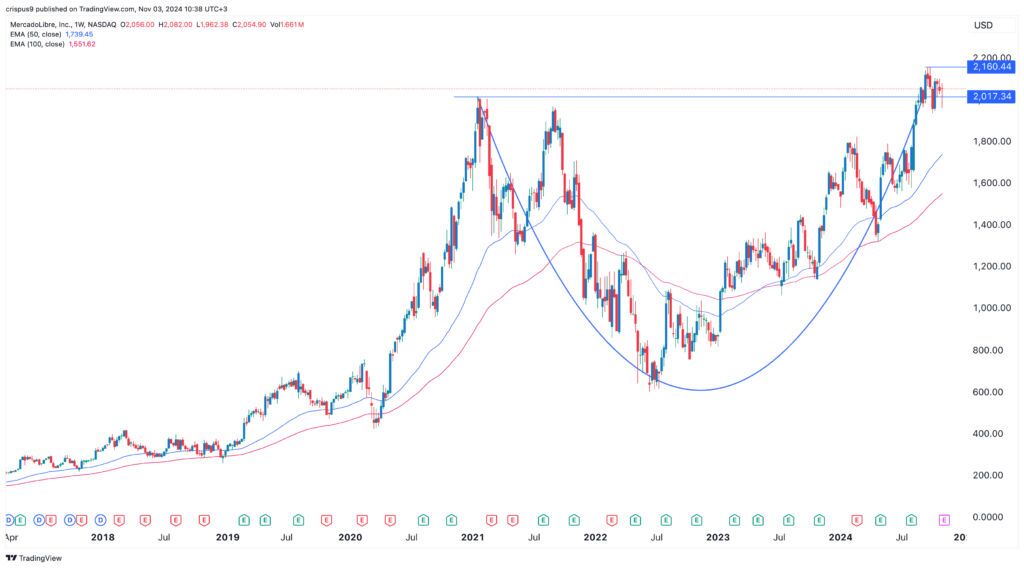

The MercadoLibre (MELI) stock price has moved sideways in the past few weeks as the recent strong rally takes a breather. After peaking at $2,160 on September 26, it has pulled back by about 5% from its highest level this year.

MELI, the biggest e-commerce company in Latin America, has been one of the best-performing companies this year, rising by over 55% from its lowest point this year, and by 240% from its lowest point in June 2022.

MercadoLibre’s business is growing

MercadoLibre has become one of the biggest players in the e-commerce industry with a market cap of over $104 billion.

The company has achieved that by targeting one of the biggest economies globally. Latin America has a population of over 650 million people, almost double that of the United States.

Its GDP has grown in the past few years and is worth over $6.7 trillion. This performance is primarily driven by Brazil, the eleventh-biggest economy in the world. Economists believe that the region will continue doing well in the long term.

Therefore, MercadoLibre stock price has done well because of its dominant position in the region and its growing market share. While there are many e-commerce companies in the region, none of them has the infrastructure that MELI has.

The company has also done well by replicating the success of popular e-commerce companies like Amazon, Alibaba, and Coupang. These firms have grown by expanding its service. It has launched Envios, its logistics business, which offers solutions to countries like Brazil and Colombia.

MercadoLibre also launched Meli Air, which has planes covering countries like Brazil and Mexico.

Additionally, it has become a leading player in the financial services industry, through which it offers solutions like pre-paid cards, merchant and consumer credit, savings and investment solutions, and a cryptocurrency solution. Mercado Credito solution offers loans to millions of customers.

These solutions have made MercadoLibre a fast-growing company whose annual revenue has jumped from $2.29 billion in 2019 to $14.4 billion. This 554% growth is much faster than other companies.

MercadoLibre earnings ahead

The MELI stock price will be in the spotlight this week as it publishes its financial results. The most recent results showed that its Gross Merchandise Value (GMV) rose by 20% to $12.6 billion as it sold 421 items in its platform.

The company’s credit business also continued to do well, with its credit portfolio rising by 51% to $4.9 billion.

As a result, its net revenue rose by 42% in the last quarter to $5.1 billion, while the net income rose to $531 million. Also, its adjusted free cash flow rose by 368% to $678 million.

Analysts expect that MercadoLibre’s business continued doing well in the last quarter. The average revenue estimate is $5.27 billion, much higher than the $3.76 billion it made in the same period in 2023.

For the year, analysts expect that MELI’s revenue will be over $17 billion, a 40% increase from last year. This growth is remarkable for a company that was established over two decades ago.

Analysts are optimistic that MELI has more upside in the longer term. The average estimate is that its stock will rise to $2,365, higher than the current $2,055.

MercadoLibre stock price analysis

(Click on image to enlarge)

MELI chart by TradingView

The weekly chart shows that the MELI share price has been in a strong bull run in the past few months. It has formed a cup and handle pattern, a popular bullish sign in the market. The recent consolidation is part of the handle section.

MercadoLibre stock has remained above the 50-week and 200-week Exponential Moving Averages (EMA), pointing to more upside.

Therefore, the shares will likely have a bullish breakout, with the next point to watch being at $2,200, up by 7.6% from the current level.

More By This Author:

BTC/USD Forex Signal: Bitcoin Price After Hitting Record High

AUD/USD Forex Signal: Aussie Crash To Continue Ahead Of CPI Data

BTC/USD Forex Signal: Bitcoin Rally To Regain Steam

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more