Meme Stock Mad Libs

Image Source: Unsplash

Are Mad Libs still a thing? My younger colleagues say “yes”, and I’m glad to hear it, because they were endlessly fun when I was a kid.With all the recent discussion about the return of meme stocks, which brings its own sort of nostalgia, it occurred to me that finding the next meme stock fits a Mad Libs type of formula.

<Stock Symbol> has <name recognition | a good story> with <high percentage> of its stock sold short, a price of only <number below $20>, and reasonably active <weekly|monthly> options.

This format came to me earlier this morning, when I was asked what the attributes are that make a good meme stock. I laid out the following four criteria:

- High short interest

- Low price prior to bump

- Good name recognition, preferably with a dose of nostalgia

- Reasonably active options

Let’s look at the names that popped into play this week to see if they fit the first three criteria of the rubric. We’ll get to the options a bit later

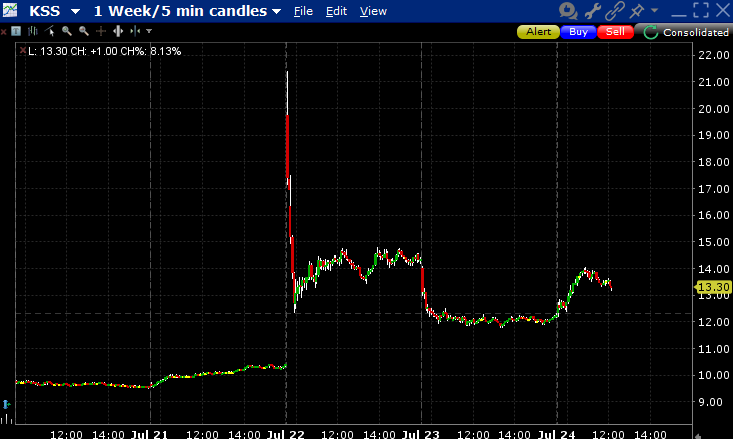

- Kohl’s (KSS)

- 49% of float shorted ✓

- $10 stock price before leap ✓

- stores all around the country ✓

- Krispy Kreme (DNUT)

- 30% of float short ✓

- $3 stock price ✓

- national chain with popular products ✓

- GoPro (GPRO)

- 10% of float X

- $1 stock price ✓

- Popular product[i] ✓

- Opendoor (OPEN)

- 22% of float ✓

- $2 stock price ✓

- Niche product X

- American Eagle Outfitters (AEO)

- 13% of float ~

- $10 stock price ✓

- Sydney Sweeney endorsed product ✓✓✓

That’s hardly an exhaustive list, but we see the theme. All the above have at least 2 of the 3 criteria checked.As Meat Loaf famously told us, Two Out of Three Ain’t Bad. Thinking back to the “OG” meme stocks, those that came to prominence in 2021 – GameStop (GME), AMC, Bed Bath & Beyond, etc. — most fit the same criteria.The current playbook isn’t new.

While it is fun to notice and discuss these situations in hindsight, it would of course be preferable to find them in advance. This is where the options market can offer some clues. We saw big increases in volume and open interest in several options the day before the stocks joined the “meme” classification.For example:

AEO yesterday: Volume in the 10.5 calls expiring Friday soared from 380 to 5838, and the open interest jumped from 780 to 4562. The stock moved from $10.19 to $10.82 yesterday before hitting $12.13 today.

KSS Monday: Volume in the 10, 10.5 and 11 calls expiring Friday jumped to 11664, 13136, and 5910, respectively from 13751, 570, and 289.Open interest in those lines moved to 3653, 5851, and 4091 from 8529, 878, and 700.The relative changes in the open interest indicate that a holder (holders?) rolled their calls from the 10 line to the 10.5 and 11 lines as the stock moved up from $9.58 to $10.42 on Monday and touched $21.39 around Tuesday’s open.

DNUT Tuesday: Volume in the August 5 calls (there were no weekly options) skyrocketed from 618 to 34502, while open interest moved from 6160 to 20367.The stock rose from $3.26 to $4.13 that day and touched $5.73 around yesterday’s open.

GPRO Tuesday: Volume in the August 1.5 calls (weekly options were only listed today) popped from 926 to 22745, and open interest jumped from 1014 to 13948.The stock rose from $0.97 to $1.37, before touching $2.37 around yesterday’s open.

The pattern for the above should be obvious.

- Options volume and open interest increased dramatically on the day prior to the pop

- The peak occurred as the stock opened before a quick fade

OPEN was a bit different, perhaps owing to its lack of status as a household name. This stock had been rallying steadily before its big surge on Monday, and that surge culminated late in the trading day, not around the open. (see charts for all below)

There is no foolproof way to find the next meme, but one could certainly use the TWS tools to scan for big increases in options volume in low-priced household names with relatively high borrowing costs (indicating high short interest). (Unfortunately, I haven’t had a chance to search for those situations myself yet.) And if you are fortunate enough to find one, be quick about taking a profit – the opportunity doesn’t last long!

OPEN, 2-Weeks, 5-Minute Candles

Source: Interactive Brokers

AEO, 1-Week, 5-Minute Candles

Source: Interactive Brokers

KSS, 1-Week, 5-Minute Candles

Source: Interactive Brokers

DNUT, 1-Week, 5-Minute Candles

Source: Interactive Brokers

GPRO, 1-Week, 5-Minute Candles

Source: Interactive Brokers

iOn the nostalgia front, I can’t help remembering my sons’ reaction when GoPro cameras became popular additions to ski helmets. They called the users “Teletubbies” – big round heads (thanks to helmets) with objects sticking up from the top.

More By This Author:

Return Of The MemesAugust 1st Is The New July 9th; Tesla Vigilantes

MOMO And FOMO Power A Wild Q2

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more