Medical Tech M&A Analysis: Neuro, Orthopedic, Aesthetics And Specialty

A deal was announced June 7th, 2016, with Zimmer Biomet (ZBH) agreeing to acquire LDR Holdings (LDRH) for $1, a 65% premium, and paying 4.6X FY17 sales. LDRH specialized in spinal medical technologies and was the best in class name versus peers in terms of FY17 sales growth and gross margins. LDRH also had no long term debt and a healthy cash hoard with 5 years of consistent sales growth.

I expect many more deals in Med-Tech the rest of this year, though the pool of sub $2B market cap companies is relatively small. I want to look across each industry within Med-Tech to find the best M&A candidate looking for growth and above industry-average margins as two keys for being an attractive target.

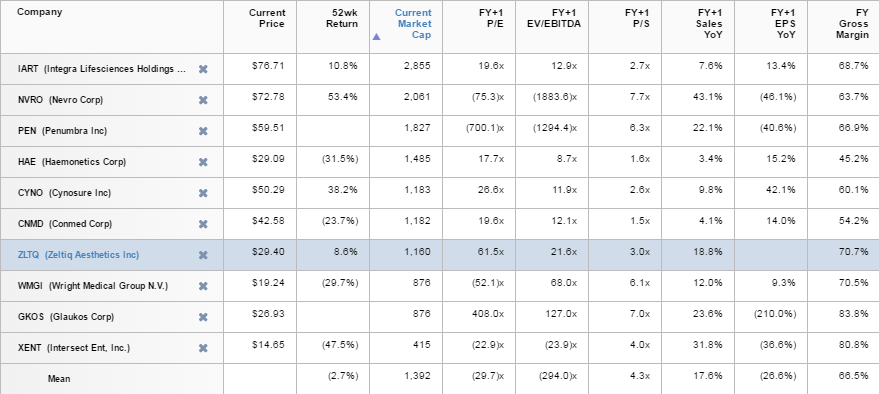

In this next segment I am combining Neuro, Orthopedic, Aesthetics, and Specialty. In Neuro there is Penumbra (PEN) and Nevro (NVRO). In Orthopedic there is CONMED (CNMD), Wright Medical (WMGI), and Integra (IART). In Aesthetics Cynosure (CYNO) and Zeltiq (ZLTQ), and lastly in specialty there is Glaukos (GKOS), Intersect ENT (XENT), and Haemonetics (HAE). The two names that immediately stand out with seeing unusual bullish options activity are Nevro (NVRO) and Wright Medical (WMGI).

The table below shows the comparison of key metrics. Although CONMED (CNMD) and Haemonetics (HAE) are the clear value names at 1.5X and 1.6X FY17 Sales respectively, they also lag industry averages in sales growth as well as being margin laggards. CYNO and IART are both fairly attractive revenue and EPS growth names trading at 2.6X and 2.7X FY17 Sales respectively. NVRO and PEN are the clear sales growth leader plays, but also each are already priced at a major premium valuation. The specialty plays XENT and GKOS are both impressive sales growth names and have 80%+ margins leading in the peer group, trading 4X and 6X FY17 Sales respectively. That leaves WMGI which has above industry average gross margins above 70% and also seeing 12% forward sales growth, but is already trading more than 6X FY17 Sales.

(Click on image to enlarge)

Intersect ENT (XENT) looks to be the most compelling acquisition target in this group, the $415M maker of therapeutic solutions for patients with ear, nose and throat conditions. At 4X FY17 sales shares trade less than the 4.4X peer average yet it is projecting nearly double the industry average sales growth at above 30% and also a gross margin leader above 80%. Furthermore, XENT has no debt and trades just 3.54X cash value. XENT traded above $30 less than a year ago and has sold off to as low as $12 recently, so bargain hunters could swoop in and pick up this name on the cheap. Salesforce turnover/issues has been the major problem for XENT, so being acquired could be the best thing for it, allowing an experienced salesforce to take over and sell its products. XENT is a niche player with limited compeittion, but the risks are with upcoming leading pipeline trials NOVA PROGRESS and RESOLVE II, readout expected in mid-2016 with approval in 2017 for NOVA and RESOLVE II readout late 2016/early 2017 with approval not expected until 2018.

Entellus (ENTL) is a smaller and less liquid Co. with a similiar revenue base as XENT, and trades at a slight discount to XENT, 3.6X FY17 Sales, but less growth and lower margins.

Overall, XENT is the most attractive candidate for a takeout among these names, and any success with its pipeline readouts would make it even more attractive, already trading at depressed valuation levels with sentiment negative after the salesforce issues.

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more