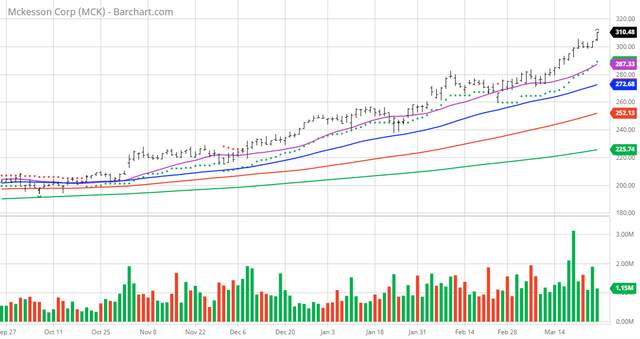

McKesson's Price Keeps Rising

The Chart of the Day belongs to the healthcare company McKesson (MCK) I found the stock by using Barchart's powerful screening function to find the stock with the highest Weighted Alpha and technical buy signals that are closest to their 52 week highs, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 2/25 the stock gained 12.75%.

MCK Price vs Daily Moving Averages

McKesson Corporation provides healthcare supply chain management, retail pharmacy, community oncology and specialty care, and healthcare information solutions in the United States and internationally. It operates through four segments: U.S. Pharmaceutical, International, Medical-Surgical Solutions, and Prescription Technology Solutions (RxTS). The U.S. Pharmaceutical segment distributes branded, generic, specialty, biosimilar, and over-the-counter pharmaceutical drugs and other healthcare-related products. This segment also provides practice management, technology, clinical support, and business solutions to community-based oncology and other specialty practices; and consulting, outsourcing, technological, and other services, as well as sells financial, operational, and clinical solutions to pharmacies. The International segment offers distribution and services to wholesale, institutional, and retail customers in 13 European countries and Canada. The Medical-Surgical Solutions segment provides medical-surgical supply distribution, logistics, and other services to healthcare providers. The RxTS segment offers CoverMyMeds solution to help patients get the medications; RelayHealth, a workflow solution; RxCrossroads solution for therapies and interventions to biopharma manufacturers; and McKesson Prescription Automation, a customized pharmacy automation technology; and Multi-Client Central Fill as a Service, a pharmacy. McKesson Corporation was founded in 1833 and is headquartered in Irving, Texas.

Barchart's Opinion Trading systems are listed below.

Barchart Technical Indicators:

- 100% technical buy signals

- 74.40+ Weighted Alpha

- 62.17% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 12.75% in the last month

- Relative Strength Index 81.54%

- Technical support level at 306.30

- Recently traded at 310.48 with a 50 day moving average of 272.68

Fundamental Factors:

- Market Cap $46.51 billion

- P/E 13.27

- Dividend yield .62%

- Revenue expected to grow 9.80% this year

- Earnings estimated to increase 38.80% this year and continue to compound at an annual rate of 12.75% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 7 strong buy, 4 buy, 3 hold and 1 under perform opinion on the stock

- The consensus price target is 302.31 with some analysts having a price target as high as 340.00

- The individual investors following the stock on Motley Fool voted 652 to 31 for the stock to beat the market with the more experienced investors voting 155 to 3 for the same result

Ratings Summary

| SA Authors | Buy | 4.00 |

|---|---|---|

| Wall Street | Buy | 4.13 |

| Quant | Strong Buy | 4.93 |

Factor Grades

| Now | 3M ago | 6M ago | |

|---|---|---|---|

| Valuation | B+ | B+ | A+ |

| Growth | A | D- | D- |

| Profitability | A+ | A- | B+ |

| Momentum | A+ | A | B+ |

| Revisions | A+ | A | A+ |

Quant Ranking

Sector Health Care

Industry Health Care Distributors

Ranked in Industry 1 out of 9

Ranked in Sector 3 out of 1043

Ranked Overall 48 out of 4253

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more