Matinas Biopharma Is Highly Undervalued

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

After speaking directly with Matinas Biopharma CEO, Jerome Jabbour, to get the facts on MTNB, I've determined the company is a very interesting biotech with a few aspects to it. Most notably is its main program which is a next-generation omega-3 prescription drug (MAT9001) being developed to treat patients with severe hypertriglyceridemia (patients with triglyceride levels that at ≥ 500 mg/dL) as an initial indication and the potential to also treat patients with elevated triglycerides, which would increase the addressable patient population to approximately 70 million patients in the US alone.

MAT9001 has already demonstrated a superior profile vs. a competing drug known as Vascepa® developed and sold by Amarin Pharmaceuticals (AMRN). While this biotech has MAT9001 as its main clinical product, it does have another distinct and interesting pipeline that is capitalizing on its proprietary lipid nano-crystal drug delivery platform (learn more here).

In viewing the competitive landscape and products, it seems that MTNB is significantly undervalued at its current low market cap. I find a good opportunity here because despite all the progress it has made to date, it still has a low stock price of $0.69 cents per share and an upcoming twelve to eighteen month period full of value-creating catalysts and opportunities for significant value appreciation.

In reviewing the regulatory and clinical development strategy set forth by the company, it appears that MAT9001 has a clear path to FDA approval in severe hypertriglyceridemia and that the opportunity for label expansion beyond that is very promising and real. In particular, it has a 505(b)(2) pathway toward marketing approval in the United States for severe hypertriglyceridemia (≥500 mg/dL). It can utilize this streamlined pathway and still receive the benefit of five years of NCE exclusivity, which is an important value proposition. No outcomes study is required for this indication and its entirely possible that no outcomes study of MAT9001 will be required for label expansion either, following the release of Vascepa’s outcomes data over the past year. That data, and data from another ongoing outcomes study of an omega-3 drug called Epanova by AstraZeneca, are setting this up to be a potential new class of drugs to prevent and treat cardiovascular disease, much like the statin market.MAT9001 was specifically developed to treat these cardiovascular risks, including hypertriglyceridemia and dyslipidemia.

MAT9001 has several key advantages over other existing omega-3 type drugs for this indication. Consider that MAT9001 is an EPA + DPA formulation. The DPA found in Matinas’ drug gives it an advantage with higher potency and a unique mechanism of action. This is important in order to differentiate itself compared to the other drugs of the same class. Vascepa is just EPA. Lovaza and Epanova are other omega-3 drugs that are a mix of EPA and DHA. This is a lot to take in but the bottom line here is that DHA mixed into these Omega-3’s is not good. That’s because DHA is associated with an increase in bad cholesterol (LDL-C).

MAT9001 holds one more important advantage over these other omega-3 drugs. It’s molecular form is that of a free fatty acid, which makes this drug much more bioavailable than Amarin’s Vacepa. In the head to head study of MAT9001 vs. Vascepa, MAT9001 was able to achieve 5x the blood levels of EPA as did Vascepa in the exact same patients. This is very important when you consider the data from Vascepa’s outcomes trial. It bodes very well for MAT9001’s prospects in those same types of patients. In other words, the absorption with MAT9001 is superior over the other Omega-3s. How this drug compares to the others depends on data and the data that has been generated to date highlights that MAT9001 is positioned to be the best-in-class omega-3. I’m pleased to see that Matinas has been making significant progress in the clinic and positioning MAT9001 for some compelling data releases in 2020.

Thus far, it has completed a 28-day comparative bridging toxicology study using MAT9001. The next step from here is to begin a comparative clinical bridging bioavailability study in Q4 of 2019. This study is expected to be completed in Q1 of 2020. This will be the second study necessary to schedule an end-of-phase 2 meeting with the FDA, which could happen by Q2 of 2020. This meeting with the FDA will be important for Matinas to design/submit and potentially obtain a Special Protocol Assessment (SPA) to begin phase 3 registration studies for the use of MAT9001 in both severe hypertriglyceridemia and in patients with elevated triglyceride levels, respectively. There is a good opportunity here and I believe the pathway for FDA approval is laid out appropriately. It also appears that Matinas and MAT9001 are working with some of the world’s leading experts on their program; experts who have been a part of the development of all of the other competing omega-3s and see the differentiated profile and potential for MAT9001 to be a better overall drug than any of its competitors.

Another step Matinas is taking to prove that its drug is again superior to Vascepa, is to complete an additional head to head study. Such a study will evaluate the pharmacokinetic (PK) and Pharmacodynamic (PD) markers for MAT9001 and Vascepa in a 28-day crossover study. One important item to note is that this will be in patients with elevated triglyceride levels between 150 - 499 mg/dL. This study is expected to be initiated in Q1 of 2020 and have results readout by Q4 of 2020. Will it be successful? It’s always hard to say with clinical studies of this caliber. However, as I noted above, MAT9001 has already shown superiority over Vascepa in an earlier head to head study. It has been able to show superiority over multiple PD markers such as: triglycerides, total cholesterol, non-HDL-C, VLDL-C, ApoC3 and PCSK9.

Why are these important measures? That’s because these markers are known to cause an increased risk in cardiovascular disease. The greater reductions in all these measures, the better it is for patients with high levels of triglycerides. The importance with this clinical data is not just the efficacy achieved alone. It is the fact that such efficacy was achieved without increasing LDL cholesterol (bad cholesterol). In my opinion, MAT9001 is the most important product and value driver for the company in the short-term. That’s because the Omega-3 market could reach $10 billion dollars and that would be possible with about 70 million patients up for grabs.

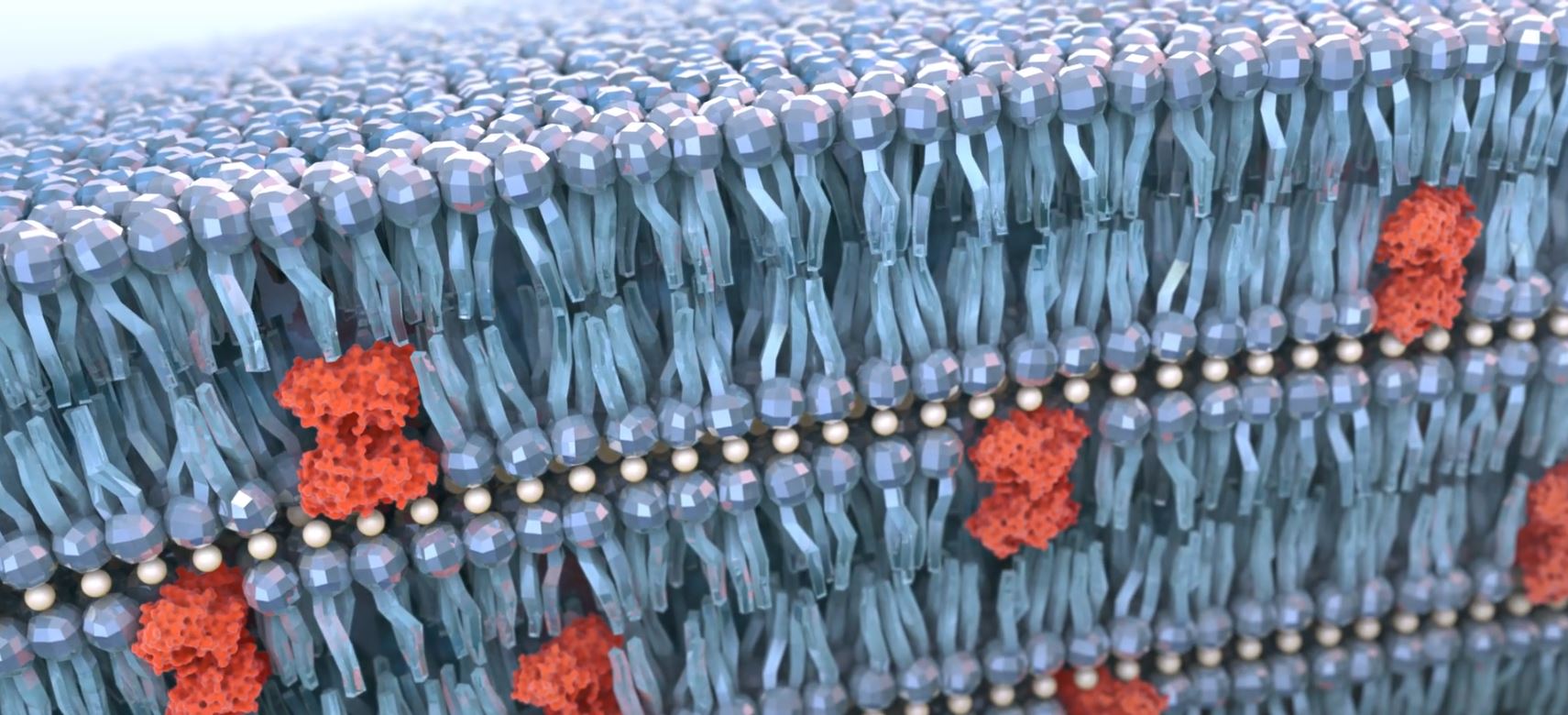

However, the main product of MAT9001 is just the tip of the iceberg when it comes to the potential of Matinas. That’s because it also is developing products based upon a disruptive delivery platform technology that is quite unique and impressive. This delivery tech is known as the lipid nano-crystal (LNC) delivery technology. What makes this technology so great is that it does a better job of protecting drugs as they get to their intended target. Its unique ability allows the delivery of many other different types of drugs such as: proteins, peptides, small molecules, vaccines, gene editing technologies, and many other products. Then it holds other advantages such as being able to convert an IV drug into an oral version if need be as a more convenient form of administration and vice versa. This type of technology has been validated in multiple preclinical and clinical studies as well as being an efficient delivery vehicle. All around it can be used by many other biotechs to deliver their drugs. Especially, since this type of delivery tech has no immunogenicity (no immune response provoked) that occurs and has reduced toxicity as well.

There are two reasons why I see value with respect to the LNC delivery technology platform. One key driver is that there already is a big pharmaceutical interested in preclinical research collaboration. That is both Matinas and ViiV Healthcare have formed a research collaboration utilizing this delivery tech. ViiV Healthcare was formed as an entity in November of 2009 by both GlaxoSmithKline (GSK) and Pfizer (PFE) to develop HIV treatments. Certain antivirals will be developed using Matina’s LNC tech. As I alluded to above, this technology creates a more efficient and safer way to deliver drugs. In this case, antivirals will be delivered using the LNC platform. To make sure everything works at the early stages of testing, these formulations will be tested in in vivo preclinical studies. If it works out well with positive data, it is likely that a lead antiviral product will be advanced towards other studies. The way I see it is that this pre-clinical research holds the potential to advance towards a larger deal. In other words, if the delivery technology is successful with antivirals then I can see a deal incorporating an upfront payment/milestone payments/royalties. The key here is that not only will Matinas be a pharmaceutical company with MAT9001 for the treatment of severe hypertriglyceridemia. In essence, it intends to out-license its delivery technology to any other biotech that may want to use it. This brings in upfront cash and potential milestone payments to be received.

The second reason why I see value with the LNC delivery tech is that proof of concept has been established in pre-clinical testing. On top of that, there is an NIH study funding a phase 1/2EnACT study using MAT2203 to treat HIV-infected patients with cryptococcal meningitis. This open-label study will be initiated in Q4 of 2019. This is an important program because it can provide proof of concept for the LNC drug-delivery tech. Specifically, the LNC tech will deliver the fungicidal drug known as Amphotericin B. Typically, this drug is given through an intravenous infusion. However, with LNC drug delivery it can be given as an oral drug instead. Final data is not expected to be revealed for this study until the first half of 2021. In the meantime, investors will be able to look forward to some data. That’s because Matinas believes progression of cohorts being revealed should be construed as positive catalysts that the dug is working and has been determined safe for continued patient use. The use of MAT2203 as an antifungal is ideal and has the blessing of many agencies. The FDA has already given this drug Qualified Infectious Disease Product (QIDP) designation With Fast Track status for treatment of cryptococcal meningitis. This makes sense because if it is ultimately approved, it would be the only oral drug for the treatment of this disease. It also has three additional QIDP designations for this drug. What is clear is that a safe and oral amphotericin B drug has the potential to meet significant unmet medical need and become the antifungal drug of choice for the treatment of most, if not all, invasive fungal infections. That is an enormous market. As I alluded to before, the NIH is responsible for funding this study. We believe the company will consider partnering on MAT2203 with another pharmaceutical company focused on commercialization once data is revealed.

The most significant advancement for Matinas will be for the MAT9001 Omega-3 drug, which if it proves to be successful in a few studies can be streamlined for a quick approval pathway for hypertriglyceridemia. Investors won’t have to wait long, because another set of data for this drug will possibly be released by Q1 of 2020. That’s just one of many milestones expected. The other would be the end-of-phase 2 meeting that would take place shortly after such data being revealed. Discussions with the FDA would further confirm the pathway for a SPA for a phase 3 study. Another head to head study, using MAT9001 versus Vascepa, will be another major catalyst in what is setting up to be a transformational year for this under-the-radar biotech. MAT2203 is taken care of with NIH funding, which means the company doesn’t have to spend any money developing it. Its LNC delivery tech has started to be partnered out to potentially generate royalties. Such a delivery technology could be licensed out to many other pharmaceutical companies. An example I can think of would be Arbutus Biopharma (ABUS) which has out-licensed its own delivery RNAi tech platform lipid nanoparticles ((LNP)) delivery technology to a few biotechs. Other pharmaceutical companies that have done this type of out-licensing for delivery tech are Xoma (XOMA) and Ligand Pharmaceuticals (LGND). Having said that, MAT9001 is the main product that is probably going to be receiving all the funding necessary for advancement, along with general corporate purposes.

This is where there is some positive news comes in: The company closed a financing of $30 million with institutional investors several months ago. Matinas is now well-capitalized to fund its operations into 2021. That’s crucial because as I highlighted above there are multiple key milestones expected before then.

With cash concerns put to rest, a solid lead product MAT9001, and a unique LNC delivery tech, I believe the biotech is highly undervalued. It only carries a market cap of $111 million. In comparison, Amarin holds a market cap of $5.6 billion. As you can see, even though MAT9001 has already shown superiority over Vascepa in one head to head study, soon to possibly be in another study, there is massive upside potential. Of course, that is if all studies end up being successful. However, based on the most recently released data comparing MAT9001 versus Vascepa things are looking good in this regard.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

The claims of the benefits of DPA have not been proven.

www.sciencedirect.com/.../S0952327818301285

Additionally how much DPA is in MAT9001? Management does not disclose this. However if you look at the patent, it is mostly EPA with a little DHA and a little DPA.

Research has also found the body can convert EPA to DPA.

Combined I find management’s comments on DPA to be suspect.

Thanks, can you elaborate on the significance of this?

Management claims that DPA gives their drug an advantage. However it has not been proven to.

They must have based that on something though. Companies can't just make sh*t up.

#Matinas looks impressive. Worth taking a deeper dive into this company.

I agree that $MTNB is undervalued. There is a good buying opportunity here.

The article failed to mention how one of the LNCs (MAT2203) did not perform as well as the current treatment for VVC in a phase 2 study.

https://clinicaltrials.gov/ct2/show/NCT02971007

Perhaps the CEO, @[Jerome D. Jabbour](user:106757), can comment on this.

I would say the article is primarily focused on MAT9001.

They don’t have enough cash to fund their developments beyond phase 2. They have no permanent inflow of cash. They will need a lot more cash, time and luck to get their early stage products tested and approved. Phase 3 studies are more expensive and take more time.

There is a cash problem in the long term. They will have to raise more funds.

What's with your dislike of $MTNB? I found the article to be quite impressive.

The article is one sided and a rehash of managements’ talking points just prior to their presentation. I am pointing out there is more to consider.

$MTNB sounds like they have a real advantage over the competition.