Mastercard Inc.: DCF Valuation: Is The Stock Undervalued?

Image Source: Unsplash

As part of our ongoing series, each week we conduct a DCF analysis on a notable company. This week, we take a look at Mastercard Inc. (MA).

Profile

Mastercard is a global leader in payment processing, providing transaction services to banks, merchants, and consumers. The company operates in over 210 countries, facilitating credit, debit, and prepaid card transactions. Mastercard generates revenue through transaction fees, cross-border fees, and data analytics services. With a focus on digital payments and financial inclusion, the company continues to expand its footprint in fintech and AI-driven fraud detection.

Recent Performance

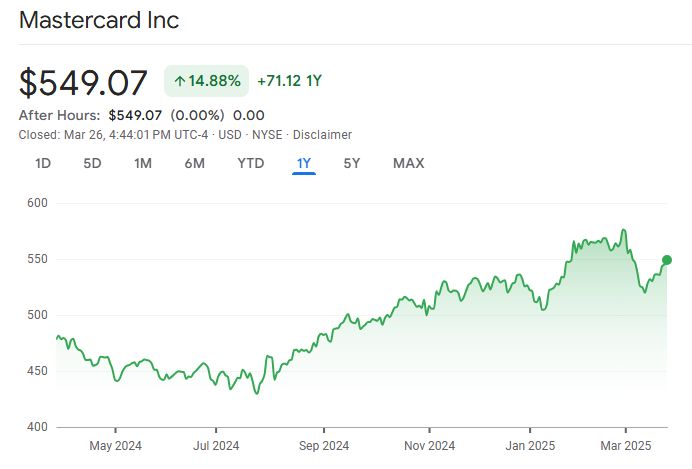

Over the past twelve months, Mastercard’s share price is up 14.88%.

Source: Google Finance

Inputs

- Discount Rate: 9%

- Terminal Growth Rate: 2%

- WACC: 9%

Forecasted Free Cash Flows (FCFs) in billions

| Year | FCF ($B) | Present Value ($B) |

|---|---|---|

| 2025 | 10.5 | 9.63 |

| 2026 | 11.6 | 9.78 |

| 2027 | 13.0 | 10.02 |

| 2028 | 14.6 | 10.28 |

| 2029 | 16.3 | 10.46 |

Total Present Value of FCFs = 50.17 billion

Terminal Value Calculation

Using the perpetuity growth model:

Terminal Value = (FCF_2029 × (1 + g)) / (r – g)

= (16.3 × 1.02) / (0.09 – 0.02)

= 237.71 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5

= 237.71 / (1.09)^5

= 154.75 billion

Enterprise Value Calculation

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value

= 50.17 + 154.75

= 204.92 billion

Net Debt Calculation

Net Debt = Total Debt – Total Cash

= 18.23 – 8.78

= 9.45 billion

Equity Value Calculation

Equity Value = Enterprise Value – Net Debt + Equity

= 204.92 – 9.45 + 6.48

= 201.95 billion

Per-Share DCF Value

Shares Outstanding = 904.89 million = 0.90489 billion

Per-Share DCF Value = Equity Value / Shares Outstanding

= 201.95 / 0.90489

= 223.08

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $223.08 | $549.07 | -59.38% |

Based on the DCF valuation, Mastercard appears significantly overvalued. The estimated intrinsic value of $223.08 per share is far lower than the current market price of $549.07, resulting in a -59.38% Margin of Safety.

This suggests that Mastercard is trading at a substantial premium compared to its fundamental valuation based on our discounted cash flow analysis.

More By This Author:

10 Worst Performing Large-Caps Last 12 Months

XOM: One Stock Superinvestors Are Dumping: Is It Time to Sell?

SLB - One Stock Superinvestors Are Loading Up On