Marqeta: Excellent Numbers And Cheap Valuation

Marqeta (MQ) delivered an excellent quarter in Q1 2021, with all the most relevant metrics exceeding expectations and even showing an acceleration in growth. At one point, the stock was rising more than 18% after the report last week. However, the market environment remains exceptionally challenging for growth stocks, and the stock price is now near all-time lows again.

This is what creates opportunities for long-term investors: An excellent quarter that is not reflected on stock prices because the market is concerned about macroeconomic risk and geopolitical factors. Sooner or later, the external environment is going to change, and the fundamentals remain.

Marqeta makes more than 60% of revenue from Block (SQ) - formerly known as Square. This is an important risk factor that cannot be ignored and has to be considered when analyzing the stock and its risks. Nevertheless, Marqeta is growing at full speed and the stock is attractively cheap at current price levels.

The Quarter

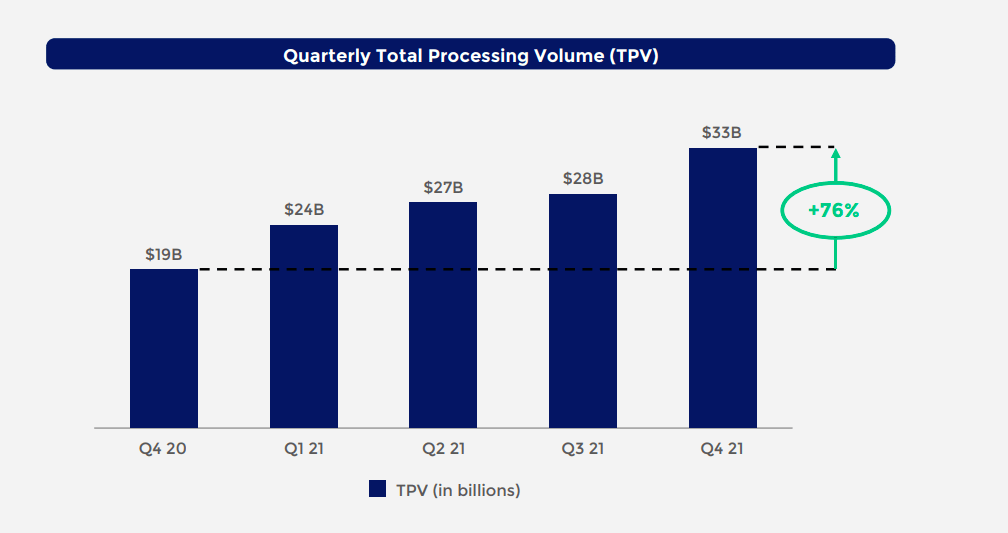

Total processing volume (TPV) was $33 billion for the fourth quarter of 2021, with net revenue reaching $155 million. Both metrics increased 76% from the same quarter of 2020. As a reference, revenue growth was 56% year-over-year in Q3, so the company delivered an acceleration in performance.

(Click on image to enlarge)

Marqeta

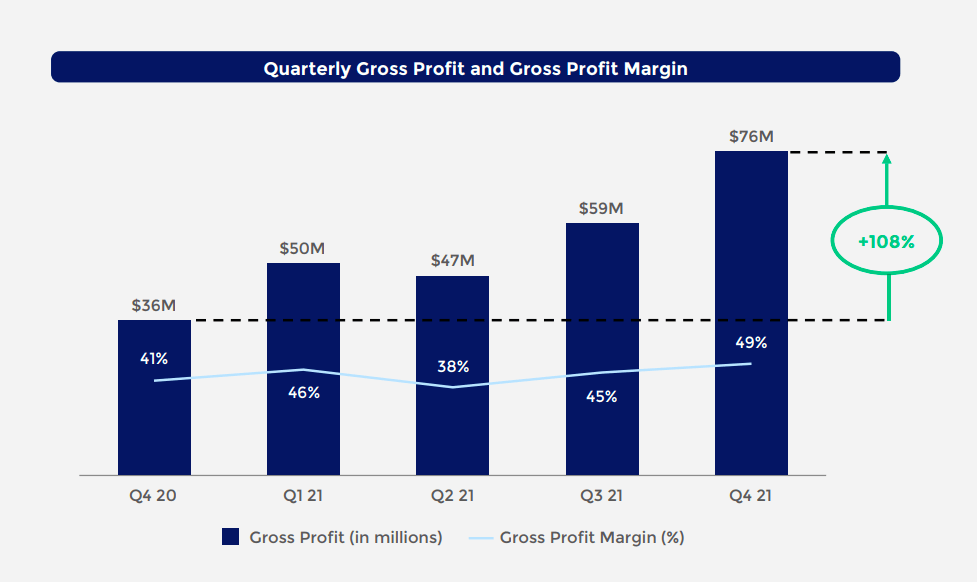

Gross margin expanded to 49% of revenue, and Marqeta made positive cash flows during the period. On the other hand, accounting earnings will probably remain under pressure for several years at least, so we can't expect big profitability metrics from Marqeta anytime soon.

(Click on image to enlarge)

Marqeta

Non-Block revenue grew 147%, which is a very strong number and above expectations. Afterpay is another significant client for Marqeta, since Afterpay was acquired by Block, Marqeta will be adding Afterpay into its Block business in Q1 2022. Leaving this factor aside, management was expecting a small reduction in customer concentration for Q1 2022. But instead, the reported numbers will show a slight increase in revenue percentage coming from Block next quarter due to Afterpay being recognized as part of Block.

Management highlighted the fact that Marqeta benefits from the success of its customers over time. A pick-and-shovel play is an investment strategy that invests in the underlying technology needed to produce a good or service instead of in the final output, and Marqeta is a leading pick-and-shovel play in fintech.

Leaving aside the temporary acceleration in growth during the pandemic, long-term industry drivers are remarkably compelling going forward. From the conference call:

Our phenomenal fourth quarter is a testament to the outstanding growth Marqeta has demonstrated over the last 3 years as our TPV grew over 400% from 2019 to 2021. Much of this growth was fueled by digital commerce disruptors that grew significantly due to shifts in consumer behavior during the pandemic. Our platform and products helped make much of this growth possible, enabling our customers to offer experiences that have changed commerce in remarkable ways. Our ability to help our customers scale successfully admit this unprecedented growth has earned us valuable trust.

With 2022 under way, we are starting to see some stabilization regarding the pandemic. It is clear that the new commerce experiences, like on-demand delivery and buy now, pay later, are here to stay. And customers' trust in financial services offered by neobanks is increasingly on par with our trust in typical financial institutions. These commerce experiences play to Marqeta's strength.

We have already built trusted relationships with companies that have become household names like Klarna and Cash App that have a track record of expanding on our platform. For the next sets of disruptors looking for a trusted partner who can help them scale, this serves as a proof point. Importantly, we have a foothold into large firms like Marcus by Goldman Sachs, JPMorgan and now Citi that need a technology partner to deliver solutions consumers want.

The Big Picture

Marqeta provides a card issuing platform that offers the infrastructure and tools necessary to offer digital, physical, and tokenized payment options without the need for a traditional bank.

The company's open APIs allow third parties like DoorDash (DASH), Klarna, and Square to rapidly develop and deploy innovative card-based products and payment services without the need to develop the underlying technology.

There are lots of little steps and transactions that need to happen when you pay your Uber (UBER), when you buy something online, or when you transfer money to a friend in a digital wallet. Marqeta provides the tools and technologies to make these transactions work smoothly for all parties involved.

The company has a usage-based model, it derives most of its revenue from interchange fees generated by card transactions through Marqeta's platform. In addition to interchange fees, it also generates revenue from other processing services, including monthly platform access, ATM fees, fraud monitoring, and tokenization services.

Marqeta has an exceptional customer base that includes names such as Block, Visa (V), Mastercard (MA), Google (GOOG) (GOOGL), Affirm (AFRM), JPMorgan (JPM), Goldman Sachs (GS), Uber, DoorDash, Instacart, and Coinbase (COIN), among others. However, more than 60% of revenue comes from Block nowadays, which is a major risk factor.

Marqeta

A position in Marqeta provides exposure to multiple attractive thematics such as the end of cash, digital banking, digital wallets, buy now pay later (BNPL), blockchain and cryptocurrencies, and the gig economy. Just by looking at the company's main customers, it is easy to understand Marqeta as a pick-and-shovel play with an excellent position in fintech.

Marqeta

The market opportunity is enormous and growing exponentially. Based on data for 2020 and estimations by Nilson, Marqeta processed $60.1 billion in volume last year, less than 1% of the annual $6.7 trillion of transaction volume conducted through U.S. issuers in 2020. Growing demand in digital wallets, e-commerce, BNPL, and crypto are powerful tailwinds for the industry.

Marqeta

Payments are not only becoming more digital but are also more deeply integrated into consumer and business applications. Consumers expect elegant payment solutions in all aspects these days. Besides, companies and consumers are gaining confidence in the security aspects of digital transactions.

The market is huge and growing. Importantly, Marqeta is in the right place to benefit from these opportunities. If management keeps executing well, the company should deliver sustained revenue growth in the years ahead.

Deeply Undervalued

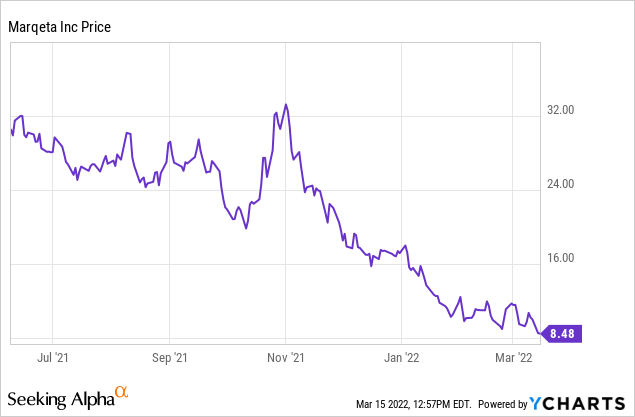

The IPO price for Marqeta in June of last year was $27 per share. Generally speaking, banks tend to price IPOs at convenient valuations so that their big clients get to make a quick profit by buying cheap, and then the stock price pops as it starts trading. That happened with Marqeta too, as it went above 30 in the days after the IPO.

The company delivered excellent numbers since the IPO, but we are facing one of the worst bear markets for growth stocks in history, and Marqeta is at around $8.5 as of the time of this writing.

Data by YCharts

We will see some brokers cutting their price targets for Marqeta in the near term, but only because they are cutting price targets for all growth stocks to reflect the fact that valuations are now much lower. This has nothing to do with the company's fundamentals or with recent execution by management.

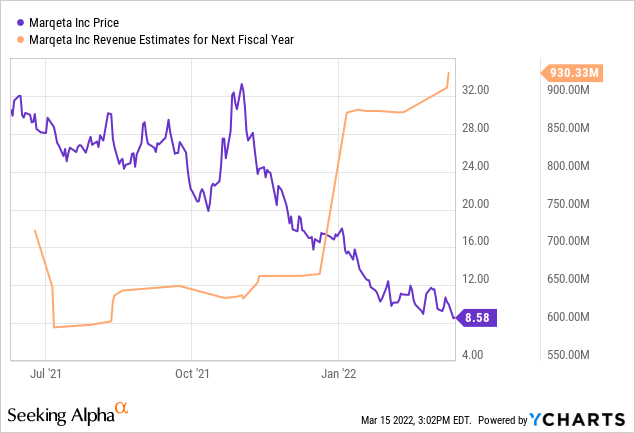

Data by YCharts

These kinds of things happen only during bear markets, and you need a particularly ugly bear market to see something like this. Revenue estimates for Marqeta next year are up from $600 million to $930 million, an increase of 55% in those revenue estimates. At the same time, the stock is down by 77% from its highs.

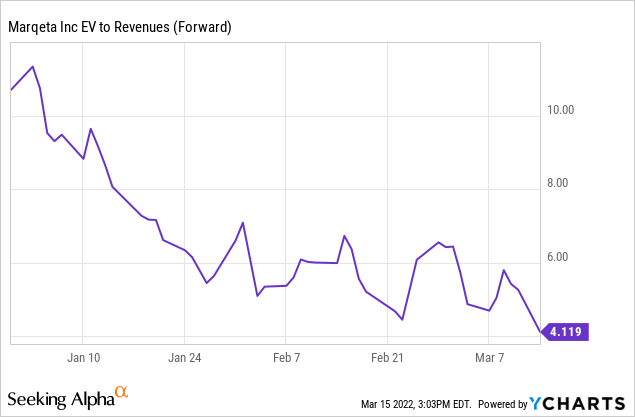

Trading at a forward enterprise value to revenue ratio of around 4, the stock is too cheap in my opinion.

Data by YCharts

Risk And Reward Going Forward

Exposure to Block is obviously the elephant in the room when it comes to risks. If Block decides to squeeze Marqeta's margins or to just change Marqeta for a different solution, the stock would collapse in a second. Besides, with a single customer making 60% of revenue, there is always the chance that this dominant customer may directly or indirectly limit Marqeta's ability to expand with other customers.

The investment thesis in Marqeta depends on the company's ability to diversify its revenue base. If it doesn't deliver on that front, the valuation will remain under pressure, even if it can deliver solid growth via Block.

Importantly, this is already known by the market and acknowledged as a risk. If Marqeta keeps expanding beyond Block, that would drive more revenue opportunities and it could also push the valuation higher by making those revenues of higher quality. Management is doing a sound job in that regard.

In the second place, we would mention competition, and there are some very high-quality players in the fintech space that could deliver competing technologies. This is more like a potential risk to watch going forward, as opposed to a current threat, but it is still worth noting.

Short-term price volatility is not the same as risk. Price volatility can be a source of opportunity if the fundamentals remain healthy while investment risk is the chance that the fundamentals may suffer permanent deterioration. However, it is important to note that Marqeta can be an extremely volatile stock. This is a small and relatively unknown company, which makes the stock price exceptionally volatile in this market environment.

The thesis behind Marqeta is quite simple. The company has enormous potential for growth as a "picks-and-shovels play" in fintech, and management is executing at a high level. But the market has no appetite for small growth stocks these days, and valuation is at record lows. For long-term investors who can tolerate the volatility, this could be an excellent opportunity.

Disclosure: I/we have a beneficial long position in the shares of MQ, SQ, GOOG, COIN either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article ...

more